The global rinse aid and drying agents market is poised for sustained growth over the next decade, driven by increasing demand from commercial kitchens, institutional foodservice operations, and urban households prioritizing hygiene, efficiency, and spot-free cleaning performance. By 2036, the market is expected to not only expand in volume but also demonstrate greater product differentiation, advanced pricing strategies, and regional specialization, influenced by water quality, regulatory policies, and appliance penetration.

Market Size Outlook Through 2036

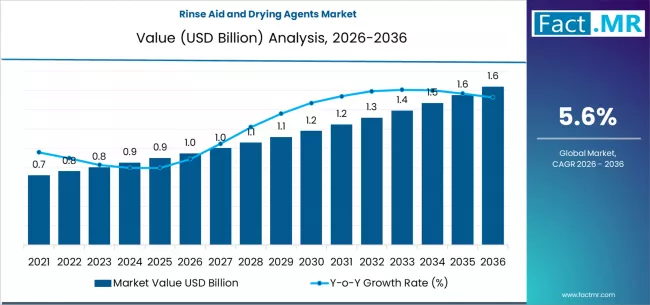

The global rinse aid and drying agents market is projected to grow from approximately USD 952 million in 2026 to USD 1.64 billion by 2036, reflecting a compound annual growth rate (CAGR) of 5.6%. This growth aligns with rising adoption of automatic dishwashing systems and an increased focus on optimizing wash and drying outcomes. The market for adjunct products such as rinse aids is becoming increasingly important as users demand superior performance and spot-free results.

The broader dishwasher detergent ecosystem, which includes rinse aids, has also shown strong expansion, highlighting the strategic significance of these additives. Rising urbanization, the proliferation of modern dishwashing appliances, and a growing emphasis on cleanliness are reinforcing demand across both household and commercial segments.

Strategic Benchmarking: Product and Chemistry Segments

Within the market, low-temperature machine rinse aids are expected to capture nearly a third of total market share by 2036. These products are increasingly preferred in commercial kitchens aiming to reduce energy costs without compromising sanitation standards. Low-temperature formulations enable operators to achieve optimal drying and shine while using less energy, making them a cost-effective and sustainable choice.

From a formulation standpoint, nonionic surfactant systems dominate the market, accounting for more than a third of chemistry-based demand. These systems are valued for their superior sheeting action, low foaming, and compatibility across varying water hardness levels. In hard-water regions, polymer-based wetting agents and acidic neutralizers are commonly integrated to prevent mineral deposits and ensure consistent drying quality.

Manufacturers are benchmarking performance not only on drying speed and shine but also on environmental and sustainability metrics. Biodegradability, phosphate-free formulations, and lower dosages per wash cycle have become key differentiators in procurement decisions for institutional buyers and multinational foodservice chains.

Pricing Trends and Value Chain Dynamics

Pricing trends in the rinse aid and drying agents market reflect a balance between raw material costs and performance-based differentiation. Entry-level commercial rinse aids remain highly competitive, particularly in emerging markets, while premium and branded formulations can command price premiums of 20–35% due to features such as faster drying, glass protection, and eco-certifications.

Brand loyalty and product consistency drive willingness to pay, particularly in developed markets where commercial users prioritize reliability. Bulk packaging, auto-dosing compatibility, and service-linked supply arrangements further influence pricing dynamics, particularly in institutional and hospitality sectors. Raw material fluctuations, especially for surfactants and specialty polymers, are mitigated through long-term sourcing agreements and formulation optimization strategies.

Regional Hotspots Driving Demand

North America continues to be a mature and lucrative market for rinse aids and drying agents. High dishwasher penetration, widespread hard-water conditions, and strong hygiene expectations support consistent demand. Commercial applications, especially in institutional kitchens and hospitality, account for a significant share of total consumption, and overall market growth is expected to remain steady with mid-single-digit annual gains.

Europe follows closely, with demand driven by energy efficiency regulations, low-temperature machine adoption, and environmental labeling requirements. Countries such as Germany, France, and the Nordics are increasingly adopting bio-based and low-toxicity formulations, reflecting both regulatory pressures and consumer preference for sustainable solutions.

Asia-Pacific represents the fastest-growing region, fueled by rising urbanization, increasing disposable income, and accelerating adoption of automatic dishwashers in urban households. While penetration remains lower than in Western markets, growth rates are significantly higher. Emerging markets in China, India, and Southeast Asia are witnessing strong expansion in both household and commercial applications, particularly in premium and convenience-focused product segments.

Competitive Landscape and Long-Term Strategy

The competitive landscape features a mix of global chemical manufacturers, specialized hygiene solution providers, and private-label brands. Strategic priorities through 2036 include expanding auto-dosing compatible portfolios, investing in R&D for water-adaptive formulations, and strengthening regional distribution networks.

As dishwashing systems become increasingly automated, rinse aids and drying agents are evolving from ancillary products to critical performance enablers. Companies that align pricing strategies with demonstrable efficiency gains—such as reduced rewash rates, energy savings, and improved appliance longevity—are expected to outperform the broader market.

Browse Full Report : https://www.factmr.com/report/rinse-aid-and-drying-agents-market

Outlook to 2036

By 2036, the rinse aid and drying agents market will be defined less by volume growth alone and more by value-driven differentiation, regional customization, and sustainability leadership. With a projected market size exceeding USD 1.6 billion and stable mid-single-digit growth, the sector offers attractive opportunities for manufacturers able to benchmark strategically, optimize pricing, and capitalize on regional hotspots while meeting evolving regulatory and customer expectations.

In conclusion, rinse aids and drying agents are moving from supporting roles to central components in dishwashing systems. The combination of technological innovation, sustainable formulations, and regional market specialization will define success in this space over the next decade. Companies that invest strategically in performance-driven products, align with environmental priorities, and adapt to regional consumer behaviors are poised to capture significant share in a steadily expanding global market.