The global laboratory furniture market is entering a transformative decade. Between 2026 and 2036, demand for high-performance, modular, and sustainable laboratory environments is expected to accelerate as governments, life sciences companies, universities, and contract research organizations expand research infrastructure worldwide. Market indicators suggest consistent mid-single-digit growth, driven by investments in R&D, healthcare capacity, and advanced manufacturing.

Market Size Outlook: A Decade of Steady Expansion

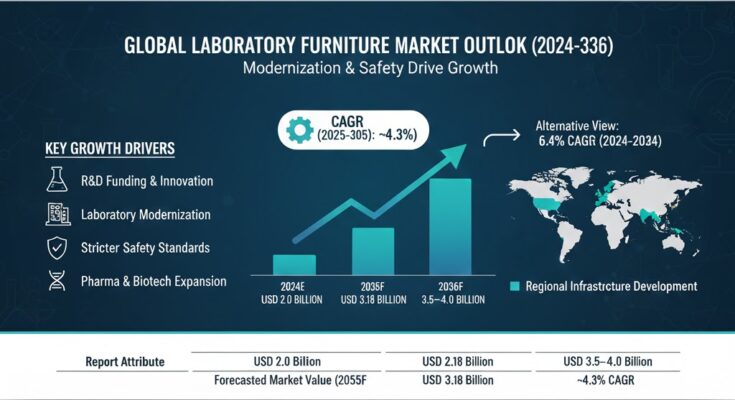

Estimates indicate the global laboratory furniture market was valued at approximately USD 2.0 billion in 2024, with projections to reach about USD 3.18 billion by 2035, representing a CAGR of roughly 4.3% over 2025–2035. Alternative projections suggest the market could grow from USD 1.14 billion in 2024 to USD 2.13 billion by 2034, implying a CAGR of 6.4%. Additional analysis indicates a CAGR of approximately 6.2% during 2026–2035, driven by modernization of laboratories and stricter safety standards. Taken together, these forecasts suggest that by 2036, the global laboratory furniture market could plausibly exceed USD 3.5–4.0 billion, depending on public R&D funding, pharmaceutical pipelines, and regional infrastructure development.

Core Growth Drivers Shaping 2026–2036

1. Expansion of R&D and Life Sciences Infrastructure

Governments and private investors are increasing spending on biotechnology, pharmaceuticals, diagnostics, and materials science. Laboratory furniture is no longer a static cost center but a strategic enabler of productivity, safety, and compliance. Growth in biopharma R&D facilities and academic laboratories is a primary demand driver, particularly in North America, Europe, China, and India.

2. Shift Toward Modular and Flexible Lab Design

Traditional fixed benches are giving way to modular, reconfigurable furniture systems that support evolving workflows. Modular and ergonomic laboratory furniture adoption is rising, enabling faster lab reconfiguration and improved space utilization. This trend is especially relevant for high-throughput and multidisciplinary research environments.

3. Safety, Ergonomics, and Compliance Requirements

Regulatory emphasis on laboratory safety—particularly in chemical, biological, and pharmaceutical labs—is driving demand for specialized furniture such as fume hoods, biological safety cabinets, and chemically resistant work surfaces. Ergonomic designs that reduce operator fatigue and injury are increasingly influencing procurement decisions.

Segment Performance and Opportunity Hotspots

Product Segments

Laboratory tables, storage cabinets, fume hoods, and safety cabinets remain the backbone of market demand. Laboratory desk and storage cabinets are projected to grow from approximately USD 0.5 billion in 2024 to nearly USD 0.8 billion by 2035, reflecting the importance of integrated storage and workflow efficiency.

Materials

Stainless steel is emerging as the fastest-growing material category due to durability, chemical resistance, and ease of cleaning. It is projected to grow from about USD 0.6 billion in 2024 to roughly USD 1.0 billion by 2035. Sustainable materials and low-VOC finishes are also gaining traction as laboratories align with ESG objectives.

End-User Segments

Academic and research institutions remain major buyers, but medical and diagnostic laboratories are showing faster growth, fueled by rising testing volumes, personalized medicine, and aging populations. CROs and private research labs represent a high-margin niche, often demanding customized furniture solutions.

Regional Dynamics: Where Growth Will Concentrate

North America continues to dominate market share, accounting for nearly a quarter of global revenue in 2024, supported by strong pharmaceutical and biotech ecosystems. Workstation and storage furniture sub-segments in this region are expected to reach USD 2.3 billion by 2030, growing at an estimated CAGR of 8.3%, reflecting rapid lab modernization.

Asia-Pacific represents the most compelling long-term growth opportunity. East Asia is projected to approach USD 500 million in market value by 2034, driven by government-backed research initiatives and expanding higher-education capacity. China and India, in particular, are expected to attract new manufacturing and assembly investments.

Market Entry and Competitive Strategy Insights

For new entrants and expanding players, differentiation will be critical during 2026–2036. Successful strategies include:

-

Localization of manufacturing and design to meet regional standards and cost expectations.

-

Customization and project-based selling, particularly for large research campuses and hospital labs.

-

Technology integration, such as height-adjustable benches and embedded power/data systems, aligning furniture with smart-lab concepts.

-

Sustainability positioning, leveraging eco-friendly materials to win institutional and government contracts.

Strategic partnerships with architects, EPC firms, and laboratory planners are also becoming essential, as furniture decisions are increasingly made early in facility design.

Emerging Opportunities Through 2036

Looking ahead, the convergence of digital laboratories, automation, and flexible research spaces will reshape demand patterns. Smart laboratory furniture with IoT-enabled monitoring, rapid reconfiguration capabilities, and lifecycle service models represents a nascent but high-growth opportunity. Additionally, emerging markets in Southeast Asia, the Middle East, and Latin America offer greenfield potential as governments invest in healthcare resilience and scientific self-reliance.

Browse Full Report : https://www.factmr.com/report/laboratory-furniture-market

Conclusion

Between 2026 and 2036, the global laboratory furniture market is poised for sustained, data-supported growth. Companies that align product innovation with safety, flexibility, and sustainability—and that strategically target high-growth regions—will be best positioned to capture value in this evolving, mission-critical industry.