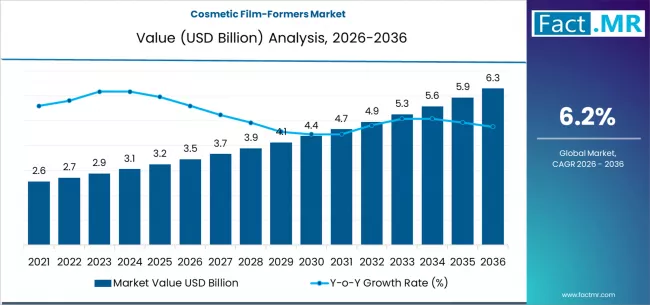

A newly released 2036 Global Cosmetic Film-Formers Market Intelligence Report delivers an in-depth, data-driven analysis of one of the most critical ingredient categories in the modern beauty and personal care industry. The report reveals that the global cosmetic film-formers market, valued at approximately USD 2.4 billion in 2025, is projected to reach USD 4.6–4.9 billion by 2036, expanding at a compound annual growth rate (CAGR) of 6.1–6.4% over the forecast period.

Cosmetic film-formers—polymers that create continuous films on skin, hair, or nails—are essential to product performance, enabling long wear, water resistance, texture enhancement, and sensory appeal. As consumer expectations shift toward high-performance, sustainable, and multifunctional beauty products, film-formers are undergoing a fundamental transformation.

Technology Shifts: From Synthetic Dominance to Bio-Based Innovation

Historically dominated by petrochemical-derived polymers such as PVP, acrylates copolymers, and polyurethanes, the cosmetic film-formers market is now experiencing a decisive pivot toward bio-based, biodegradable, and hybrid polymer technologies.

Synthetic film-formers accounted for nearly 68% of total market revenue in 2024, but this share is expected to decline to below 50% by 2036. In contrast, natural and bio-based film-formers—including cellulose derivatives, starch-based polymers, chitosan, alginates, and plant-derived polyesters—are forecast to grow at a CAGR exceeding 8.5%, outpacing the overall market.

Key technological trends identified include:

-

Enzyme-modified biopolymers that improve film flexibility and adhesion without compromising biodegradability.

-

Hybrid film-formers combining natural backbones with synthetic side chains to balance performance and sustainability.

-

Water-borne and solvent-free systems, now representing over 72% of new product launches, driven by regulatory and environmental pressures.

-

Smart film-formers with humidity-responsive, heat-activated, or pH-adaptive properties, particularly in color cosmetics and hair styling products.

Investment in cosmetic polymer science has increased by an estimated 40% since 2020, with leading ingredient suppliers allocating up to 6–8% of annual revenues to innovation in sustainable film-forming technologies.

Demand Dynamics: Long-Wear, Clean Beauty, and Customization Drive Growth

On the demand side, the report highlights strong growth across color cosmetics, hair styling, and skincare applications, collectively accounting for over 85% of film-former consumption.

-

Color cosmetics remain the largest segment, representing approximately 41% of market demand in 2025, driven by long-wear foundations, transfer-resistant lip products, and waterproof mascaras.

-

Hair care and styling follows closely, with a CAGR of 6.8%, fueled by consumer demand for humidity resistance, curl definition, and lightweight hold.

-

Skincare applications, though smaller in volume, are the fastest growing, projected at 7.5% CAGR, as film-formers are increasingly used for barrier repair, pollution protection, and active ingredient delivery.

Consumer behavior is reshaping formulation priorities. Over 60% of global beauty consumers now actively seek products labeled “clean,” “natural,” or “sustainable,” while nearly half are willing to pay a premium for proven eco-friendly formulations. This has forced brands to reformulate legacy products, accelerating demand for next-generation film-formers that meet both performance and clean-label criteria.

Customization and personalization also play a critical role. AI-driven formulation platforms and on-demand manufacturing models are increasing the need for modular, adaptable film-former systems that perform consistently across diverse skin tones, hair types, and climates.

Regional Insights: Asia-Pacific Leads, North America Innovates

Regionally, Asia-Pacific dominates the global cosmetic film-formers market, accounting for nearly 38% of total revenue in 2025. Rapid urbanization, rising disposable incomes, and strong domestic beauty brands in China, South Korea, Japan, and India are key growth drivers. The region is expected to maintain the highest growth rate at over 7% CAGR through 2036.

North America remains the innovation hub, with the highest concentration of patent filings and specialty ingredient suppliers. Meanwhile, Europe leads in regulatory-driven sustainability, with strict environmental standards accelerating the adoption of biodegradable and microplastic-free film-formers.

Investment Outlook: Strategic Opportunities Across the Value Chain

The report identifies significant investment opportunities across raw materials, formulation technologies, and application-specific solutions. Global investment in cosmetic ingredient startups has grown rapidly, with film-former developers among the top beneficiaries.

Key investment themes include:

-

Bio-refinery integration, enabling scalable production of plant-based polymers at competitive costs.

-

M&A activity, as large chemical companies acquire niche biotech firms to strengthen sustainable portfolios.

-

Private equity interest in specialty ingredient manufacturers with strong profitability.

-

Emerging market capacity expansion, particularly in Southeast Asia and Latin America, where local production can reduce supply chain risk.

By 2036, cumulative capital investment is projected to exceed USD 6.5 billion toward cosmetic film-former innovation, production, and commercialization.

Browse Full Report : https://www.factmr.com/report/cosmetic-film-formers-market

Strategic Implications

The 2036 Global Cosmetic Film-Formers Market Intelligence Report concludes that film-formers are no longer commoditized formulation aids but strategic enablers of brand differentiation, sustainability compliance, and consumer loyalty. Companies that align technology innovation with evolving demand dynamics—and back it with disciplined investment—are expected to outperform the market over the next decade.

As beauty continues to converge with biotechnology, materials science, and sustainability, cosmetic film-formers will remain at the center of the industry’s transformation.