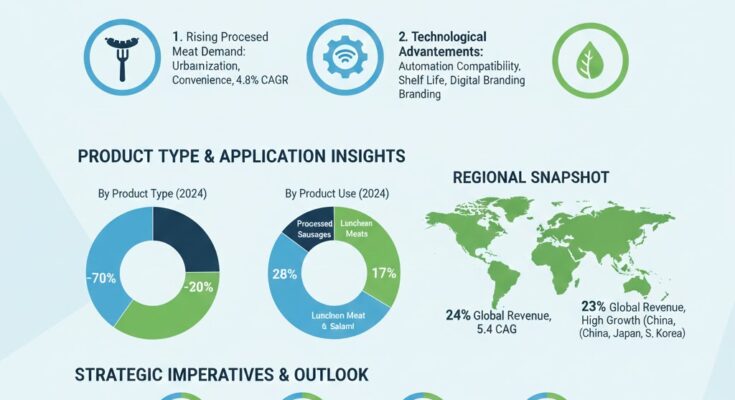

The global fibrous casing market, an essential segment in food packaging and processed meat production, is poised for steady expansion between 2026 and 2036. Driven by growing processed meat consumption, technological innovation, and sustainability trends, the market is projected to reach approximately $6 billion by 2034 from a base of $3.7 billion in 2024, registering a compound annual growth rate (CAGR) of 5%.

This growth trajectory signals significant opportunities for manufacturers, suppliers, and investors seeking to leverage emerging consumer preferences and efficiency-driven innovations in food processing.

Market Overview & Forecast

-

Market Size (2024): $3.7 billion

-

Projected Market Size (2034): $6 billion

-

CAGR (2024–2034): 5%

-

Global Revenue Contribution (North America): 24%

-

Global Revenue Contribution (East Asia): 23%

-

Segment Share – Clear Casings: ~30% of total market

-

Major End-Use Segment – Luncheon Meats: ~$1 billion in 2024, projected ~$1.7 billion by 2034

The market is expected to maintain steady growth through 2036 due to increasing urbanization, convenience-oriented food consumption, and the global proliferation of processed meat products.

Key Growth Drivers

1. Rising Processed Meat Demand

Globally, processed meat consumption is projected to grow at 4.8% CAGR from 2026 to 2036, with North America and East Asia emerging as high-demand regions. Urban households are increasingly prioritizing convenience and ready-to-eat foods, with processed sausages and luncheon meats accounting for nearly 55% of fibrous casing applications.

Retail expansion, online grocery adoption, and food service growth further amplify demand for high-quality, durable fibrous casings capable of automated processing and consistent product presentation.

2. Technological Advancements

Fibrous casing manufacturers are implementing innovations to enhance operational efficiency and product performance:

-

Automation Compatibility: Casings designed for uniform shirred lengths improve throughput by 20–25% on industrial filling lines.

-

Moisture Retention & Shelf Life: Next-generation fibrous casings extend product shelf life by 7–10 days for cooked and processed meats.

-

Digital Branding & Printing: Customizable casings allow branding directly on the product, increasing retail appeal and market differentiation.

Such innovations support both cost-efficiency and premium product positioning, driving adoption across large-scale processors and small-to-medium enterprises.

3. Sustainability & Regulatory Compliance

Environmental concerns are shaping the fibrous casing market. Cellulose-based fibrous casings, representing 65% of global material use, are increasingly preferred due to biodegradability and lower carbon footprint relative to synthetic alternatives.

Companies investing in plant-derived and compostable fibrous casings are seeing early traction in sustainability-conscious markets, especially in Europe and North America, where regulatory compliance and eco-labeling are critical.

Regional Insights

North America

-

Market Size (2024): $400 million

-

Projected Market Size (2034): $677 million

-

CAGR: 5.4%

The region benefits from high demand for frozen and convenience foods, a strong retail network, and early adoption of advanced casing technologies. The U.S. and Canada account for the majority of revenue, with processed sausages and luncheon meats driving the majority of demand.

East Asia & China

-

Regional Share of Global Revenue: 23% by 2034

-

Market Drivers: Rapid modernization of meat processing, growing middle-class population, increasing per capita meat consumption.

China, Japan, and South Korea represent the largest consumption hubs, with processed meats accounting for nearly 60% of fibrous casing utilization. Expansion in export-oriented food processing further boosts market potential.

Product Type & Application Insights

-

Clear Casings: ~30% of total market, preferred for visibility and premium branding

-

Specialty Casings (Colored or Textured): ~15% of total market, used in niche or high-margin products

-

End-Use Segments:

-

Luncheon Meats: $1 billion (2024) → $1.7 billion (2034), ~28% CAGR contribution

-

Processed Sausages & Salami: ~55% of global fibrous casing demand

-

Other Meat Products: ~17%

-

Clear and specialty casings are emerging as high-growth product types due to consumer preference for visible quality and enhanced product differentiation.

Challenges

-

Plant-Based Alternatives: Rising demand for plant-based proteins may temper growth in traditional meat-based applications.

-

Natural Casings Preference: Certain regions continue to favor natural casings, impacting fibrous casing penetration in premium segments.

Despite these challenges, technological innovation, sustainability adoption, and global processed meat consumption growth continue to drive market expansion.

Competitive Landscape

The global market is dominated by a few key players focusing on R&D, supply chain optimization, and product diversification:

-

Leading manufacturers control ~60% of global market share, emphasizing specialty casings, automation-compatible products, and sustainable solutions.

-

Emerging regional players are gaining share through cost-effective solutions and local partnerships with processors and retailers.

The competitive landscape underscores the importance of innovation, regional expansion, and sustainable solutions to secure long-term market leadership.

Browse Full Report : https://www.factmr.com/report/1719/fibrous-casings-market

Strategic Imperatives for 2026–2036

To capitalize on market opportunities, companies should prioritize:

-

R&D and Innovation: Develop clear, specialty, and functional casings that improve shelf life, automation compatibility, and branding.

-

Sustainability: Expand biodegradable and compostable casing solutions to meet regulatory and consumer expectations.

-

Regional Expansion: Focus on high-growth regions such as East Asia and North America.

-

Automation & Digital Solutions: Integrate digital printing and automation-friendly casings to improve efficiency and reduce waste.

By following these strategies, companies can capture high-growth segments, increase revenue, and secure long-term competitive advantage in the global fibrous casing market.