The U.S. rigid plastic packaging market is entering a decade of steady, innovation-driven growth as consumer demand, regulatory pressure, and sustainability commitments reshape packaging strategies across industries. From food and beverages to pharmaceuticals and personal care, rigid plastic formats remain essential due to their durability, protective qualities, and adaptability. Between 2025 and 2035, this sector is positioned for healthy expansion driven by technological advances, evolving retail dynamics, and rising expectations for high-performance and eco-efficient packaging.

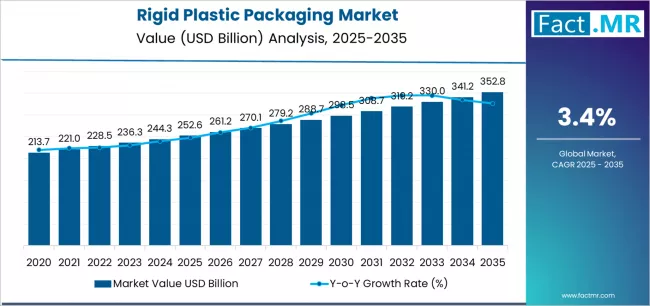

Market Growth Outlook 2025–2035

The U.S. rigid plastic packaging market is valued at approximately $140.9 billion in 2025 and is projected to rise to around $200 billion by 2034, marking a compound annual growth rate near 4%. Extending the trajectory into 2035 places the market in the range of $205–210 billion, assuming stable economic conditions and continued investment in sustainable packaging transformation.

This growth reflects increased reliance on packaging formats that offer physical protection, shelf-life extension, contamination resistance, and brand differentiation. As consumer expectations shift toward convenience, safety, and eco-forward design, rigid plastic packaging continues to meet these diverse performance requirements.

Drivers Behind Market Expansion

1. Strong Demand Across Food, Beverage, and Consumer Goods

Food and beverage producers remain the largest users of rigid plastic packaging, depending on bottles, jars, tubs, clamshells, and rigid containers that offer product preservation, tamper resistance, transportation durability, and clear branding surfaces. As convenience foods, ready-to-eat meals, portion-controlled products, and on-the-go beverages surge in popularity, rigid packaging sees parallel demand.

The rapid growth of direct-to-consumer brands and e-commerce further amplifies the need for protective, shatter-resistant packaging that withstands distribution and last-mile delivery.

2. Pharmaceutical and Personal Care Sector Growth

Pharmaceuticals and personal care products rely heavily on rigid plastic packaging for sterility, regulatory compliance, dosing precision, and consumer safety. As these sectors expand—supported by aging populations, increased healthcare consumption, and growing personal hygiene awareness—the need for high-performance rigid containers, vials, bottles, and closures intensifies.

Tamper-evident features, child-resistant caps, and ergonomic dispensing systems continue to drive innovation within rigid packaging for health-related applications.

3. Sustainability and Recyclability Imperatives

A defining trend shaping the next decade is the industry’s transition toward sustainable rigid plastic solutions. Recycled plastics, bio-based resins, lightweighting strategies, and circular packaging models are becoming central pillars of competitive packaging strategies.

Companies are adopting:

-

Recycled-content packaging (rPET, rHDPE)

-

Mono-material designs that simplify recycling

-

Lightweight rigid containers that use less resin but maintain strength

-

Refillable and reusable systems in select categories

As consumer awareness of plastic waste rises and regulations tighten, sustainability will become an even more powerful driver of innovation and market expansion.

4. Advancements in Molding and Manufacturing Technology

Technologies such as advanced injection molding, blow molding, thermoforming, and hybrid molding processes allow for thinner-wall construction, improved barrier properties, and design customization at scale. These innovations reduce cost, improve sustainability, and make rigid packaging more competitive versus alternative formats.

Automation, smart manufacturing, and AI-integrated quality control systems are expected to further boost production efficiency while maintaining high aesthetic and safety standards.

Challenges Facing the Industry

Despite optimistic growth projections, the U.S. rigid plastic packaging market faces several challenges that could reshape its trajectory.

1. Regulatory Pressure on Plastic Waste

Federal, state, and municipal regulations targeting plastic waste, single-use plastics, and producer responsibility programs could create additional compliance costs or shift demand toward alternative materials. Packaging producers will need to stay ahead of evolving legislation by investing in recycling infrastructure, sustainable resin options, and recyclable design.

2. Competition from Flexible and Alternative Packaging

Lightweight flexible packaging—pouches, films, and wraps—continues to gain traction due to its reduced material usage and efficiency in transportation. While rigid plastic remains essential for protection-focused applications, certain categories could shift toward flexible formats, pressuring rigid plastic market share.

3. Material and Supply Chain Volatility

Price fluctuations in resin materials, limited supply of high-quality recycled plastics, and logistical disruptions can impact production cost and reliability. Ensuring supply chain resilience and building domestic recycling capacity are key priorities for rigid packaging manufacturers over the next decade.

Opportunities Ahead: What Will Shape 2025–2035

• Rise of Circular Packaging Systems

From take-back programs to refillable packaging, circular economy frameworks will become mainstream. Packaging will be designed for multiple life cycles, with durability and reuse potential becoming core value propositions.

• Expansion of Premium Packaging

In personal care, cosmetics, nutraceuticals, and specialty foods, premium rigid packaging—using sleek designs, high-clarity plastics, and tactile finishes—will serve as a differentiation tool for brands seeking higher market positioning.

• E-Commerce Safety-Optimized Designs

As online retail grows, rigid packaging will incorporate impact-resistant geometries, reinforced lids and seals, and tamper-evident enhancements to ensure safe delivery, reducing returns and product loss.

• Growth in Bio-Based and Compostable Rigid Plastics

While still developing, bio-based resins such as PLA and PHA will gain prominence, especially for brands targeting eco-conscious consumers. These materials are expected to become more cost-competitive as scale expands.

Implications for Key Stakeholders

For Brands

Sustainable rigid packaging will not only support environmental commitments but also attract consumers who increasingly value responsible packaging choices. Brands can differentiate through recyclable materials, elegant product presentation, and reassuring safety features—especially in food, beverage, beauty, and health sectors.

For Packaging Manufacturers

Manufacturers that invest early in recycled resin integration, automation, lightweighting, and design-for-recyclability will capture growing market share. Partnerships with brands on custom packaging solutions and sustainable innovation will become essential.

For Policymakers

Balanced regulation that fosters recycling infrastructure, stimulates innovation, and manages environmental impact without compromising food safety or pharmaceutical standards will be vital to shaping a resilient packaging ecosystem.

Browse Full Report : https://www.factmr.com/report/rigid-plastic-packaging-market

Conclusion

The U.S. rigid plastic packaging market is on a strong growth trajectory through 2035, driven by sustainability, technological innovation, and growing consumer-sector demand. While challenges such as regulatory shifts, material volatility, and competition from alternative formats remain, the industry is poised to evolve into a more sustainable, efficient, and design-driven sector.

Rigid plastic packaging will continue to play a central role in protecting products, enabling consumer convenience, and supporting brand value—while increasingly aligning with circular economy principles and eco-conscious design.