The global beauty industry’s shift toward minimalism, skin-first aesthetics, and precision formulation has propelled J-Beauty sheer finish pigment systems into a fast-growing segment within color cosmetics. Rooted in Japanese beauty philosophies emphasizing translucency, optical harmony, and buildable enhancement, these pigment systems are redefining the approach to color payoff, texture, and layerability. By 2036, this niche is expected to evolve from a regional trend into a globally benchmarked standard for premium and masstige color cosmetics.

Market Size & Growth Outlook to 2036

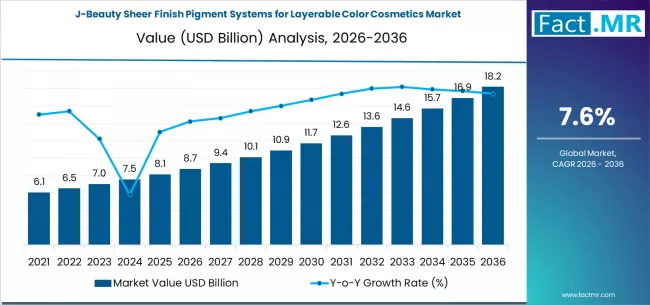

The J-Beauty sheer finish pigment systems market was valued at approximately USD 410 million in 2026 and is projected to reach over USD 1 billion by 2036, representing a compound annual growth rate (CAGR) of around 10%. This growth significantly outpaces the broader cosmetic pigment market, which is expanding at roughly 6–7% annually.

The acceleration reflects changing consumer preferences: color cosmetics buyers increasingly prioritize translucency, layerability, and natural skin enhancement over high-coverage, opaque products. Sheer finish systems are particularly popular in foundation, blush, and highlighter applications, where multiple layers can be applied without masking skin texture or causing caking.

Strategic Benchmarking: Performance Over Pigment Density

Unlike traditional pigments, J-Beauty sheer finish systems are evaluated on optical diffusion, transparency retention, and layer stability, rather than opacity alone. Ultra-transparent mineral pigments dominate demand, enabling repeated application while maintaining a natural finish.

Key competitive differentiators include:

-

Particle size engineering for controlled light scattering

-

Surface-treated minerals that improve adhesion without adding coverage

-

Encapsulation technologies that enhance color consistency across layers

This performance-driven benchmarking aligns with broader trends in the cosmetic pigment industry, where nanotechnology, hybrid organic-inorganic blends, and encapsulation are becoming standard for premium formulations.

Pricing Trends & Value Chain Dynamics

Pricing for J-Beauty sheer finish pigments reflects their premium positioning. These systems generally command a 15–30% price premium compared to conventional pigments, due to more precise particle engineering, higher-quality raw materials, and customized formulations.

Although inorganic pigments still dominate overall cosmetic pigment demand, sheer finish systems increasingly rely on refined mineral grades and hybrid formulations, which tighten supply chains but support higher margins. Production scale-up in Asia-Pacific is expected to moderate costs over the next decade, making these systems more accessible to mid-market brands while retaining premium positioning.

Regional Hotspots: Growth Concentration

Japan remains the epicenter of innovation and consumption, driven by a consumer base that highly values subtle, natural aesthetics. Sheer and translucent foundation systems alone represent a significant share of domestic color cosmetics demand.

High-growth regions outside Japan include:

-

United States: Rapid adoption of Japanese-inspired beauty trends and premium brand expansion is projected to sustain double-digit growth.

-

South Korea: Cross-pollination between J-Beauty and K-Beauty innovation, supported by strong R&D infrastructure, is driving growth.

-

China: Rising demand for precision beauty and advanced cosmetic systems is fueling market expansion.

-

Europe (Germany and France): Luxury cosmetic standards and a preference for optical efficiency in makeup formulations create a strong growth environment.

While North America and Europe account for a significant portion of global color cosmetics revenue, Asia-Pacific remains the fastest-growing hub due to increasing consumer sophistication, premiumization, and localized ingredient production.

Competitive Positioning within the Beauty Economy

J-Beauty sheer finish pigment systems should be viewed within the context of the broader beauty economy, which is projected to expand from around USD 378 billion in 2025 to nearly USD 690 billion by 2035. Color cosmetics remain a core driver, with sheer, buildable formulations becoming a focal point for innovation.

These pigments bridge the gap between makeup and skincare, enabling multiple layers without compromising skin health or natural appearance. As multifunctional products gain popularity, J-Beauty pigment systems offer a competitive advantage for brands targeting skin-conscious consumers.

Browse Full Report : https://www.factmr.com/report/j-beauty-sheer-finish-pigment-systems-for-layerable-color-cosmetics-market

Outlook to 2036: From Niche to Standard

By 2036, J-Beauty sheer finish pigments are expected to evolve from a niche differentiator into a baseline standard for premium and upper-mass color cosmetics. Strategic benchmarking will focus on layer integrity and optical performance, while pricing is expected to stabilize as supply chains mature and production scales.

Asia-Pacific will remain the innovation hub, while North America and Europe will continue to drive value growth through premium adoption. For ingredient suppliers, cosmetic chemists, and beauty brands, the message is clear: transparency, layerability, and performance are the new competitive currency in color cosmetics.