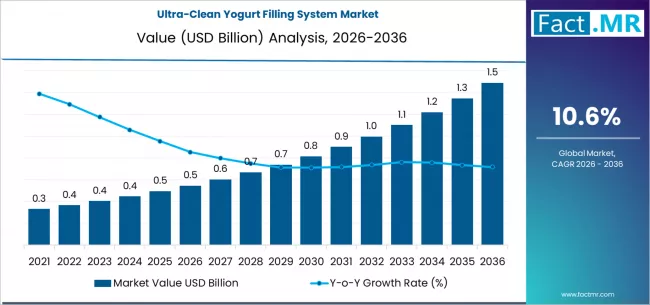

The global ultra‑clean yogurt filling system market is forecast to exhibit robust expansion over the next decade, fueled by dairy industry modernization, heightened consumer expectations for hygiene and extended shelf life, and rising adoption of advanced sterile filling technologies. Global market valuation is projected to grow from approximately USD 0.55 billion in 2026 to nearly USD 1.49 billion by 2036, representing a CAGR of 10.6% over the forecast period.

Market Drivers: Consumer Preferences and Product Quality

The accelerating shift toward premium, preservative‑free yogurt and fermented dairy products is creating significant demand for ultra‑clean filling systems, which play a central role in preserving sensory quality, nutritional value, and microbial integrity during packaging. With consumers increasingly seeking fresh, clean‑label dairy that remains safe without traditional preservatives, manufacturers are investing in technologies that reduce contamination risk and enhance shelf reliability.

Ultra‑clean filling systems are uniquely positioned to meet this demand by creating localized sterile zones at the point of filling — enabling extended shelf life without the complexity and expense of fully aseptic systems. This makes them particularly attractive for live‑culture yogurts, probiotic beverages, and high‑value fermented dairy products, which are both sensitive to contamination and highly competitive in retail environments.

Technology Trends: HEPA‑Filtered and Sterile Air Systems Lead

Among the technological choices in the market, HEPA‑filtered filling combined with sterile air environments represents the dominant approach, commanding around 44% of market share in 2026. These technologies establish an ultra‑clean zone over the open product during the fill process, significantly minimizing airborne contamination — a critical factor for dairy operations targeting longer shelf life and stringent hygiene standards.

Alongside HEPA‑filtered systems, chemical‑free sterilization technologies such as dry sterile air and non‑thermal techniques are gaining traction. These align with clean‑label and sustainability trends, reducing chemical usage while meeting both regulatory and consumer expectations for minimal processing.

Segment Insights: End‑Use and Packaging

Analysis by end‑use shows that yogurt and fermented dairy products account for the largest portion of demand in 2026, with a 42% share. This segment’s leadership reflects both high production volumes and the heightened sensitivity of fermented dairy to post‑processing contamination.

In terms of packaging format, cups, bottles, and pouches combined account for roughly 45% of the market. These formats present both engineering challenges and opportunities due to varying fill requirements and the need to maintain sterile conditions across different container shapes and materials.

Filling system types vary from cup & bottle fillers and rotary ultra‑clean fillers to high‑speed and inline systems. Among these, ultra‑clean cup & bottle fillers are expected to remain dominant, as they cater to a wide range of product formats and are suitable for both traditional and growing drinkable yogurt segments.

Regional Growth Dynamics

Growth is expected to be geographically widespread, though with variations in pace and scale:

-

India is anticipated to register the fastest regional growth, with a projected CAGR of approximately 13.9%, driven by rapid dairy industry modernization and escalating demand for packaged yogurt in both urban and rural markets.

-

China follows closely with an estimated CAGR of 12.6%, underpinned by the expansion of functional dairy consumption and significant investments in state‑of‑the‑art filling solutions.

-

The United States shows stable expansion at about 9.7% CAGR, supported by robust private label and branded yogurt production that requires consistent quality and long distribution reach.

-

Brazil and Germany demonstrate double‑digit growth potential, tied to market competition, export‑oriented dairy sectors, and technical precision demands respectively.

-

Japan, while the slowest among key markets at around 5.9% CAGR, still reflects demand for precision filling systems in premium and specialty yogurt products.

This regional diversification highlights how global consumption patterns and industrial technology adoption are influencing capital allocation across multiple markets simultaneously.

Supply Chain and Risk Considerations

Several supply chain insights and risk factors are influencing the market trajectory:

-

Capital intensity and expertise: Ultra‑clean systems demand significant upfront investment and expertise, which may deter smaller dairy processors from immediate adoption. This can slow deployment in less developed regions or fragmented dairy sectors.

-

Supply chain resilience: Integrating ultra‑clean technology often requires collaboration across machinery suppliers, culture producers, and packaging vendors — underlining the importance of coordinated supply chains and risk mitigation strategies to ensure equipment availability and performance.

-

Regulatory alignment: Compliance with food safety standards across regions is vital, requiring robust validation and documentation — a factor that can both enhance product safety and increase operational complexity.

However, opportunities such as modular retrofit solutions and the growing preference for automation and digital monitoring systems (for real‑time sterile zone validation and predictive maintenance) are reducing barriers to entry for medium‑sized producers and strengthening long‑term resilience.

Competitive Landscape and Key Players

The market is characterized by a mix of global machinery giants and specialized technology providers, including:

-

Tetra Pak – Broad portfolio with integrated processing and filling systems.

-

GEA Group – Strong presence in high‑precision dairy machinery.

-

Newamstar – Cost‑effective and scalable solutions.

-

Nichrome India Ltd. – Regional engineering expertise and localized offerings.

-

KHS GmbH – High-speed and automated systems.

-

Shibuya Corporation – Precision engineering tailored to niche product lines.

In this competitive environment, differentiation is increasingly based on efficiency, reliability, ease of integration, and digital services such as remote monitoring and predictive maintenance. Partnerships across the supply chain — from culture suppliers to packaging makers — are also shaping competitive advantage.

Browse Full Report : https://www.factmr.com/report/ultra-clean-yogurt-filling-system-market

Outlook

With a projected near 3‑fold increase in market value over the next decade, the ultra‑clean yogurt filling system market stands as a crucial enabler of next‑generation dairy production — offering both quality assurance and operational advancements needed to satisfy evolving global consumer demands.