The global packaging industry is entering a decisive transformation phase, and sugarcane composite tubes are emerging as one of the most compelling bio-based packaging innovations of the next decade. Driven by sustainability mandates, regulatory pressure on plastics, and brand-led commitments to carbon reduction, the sugarcane composite tubes market is positioned for accelerated growth between 2026 and 2036.

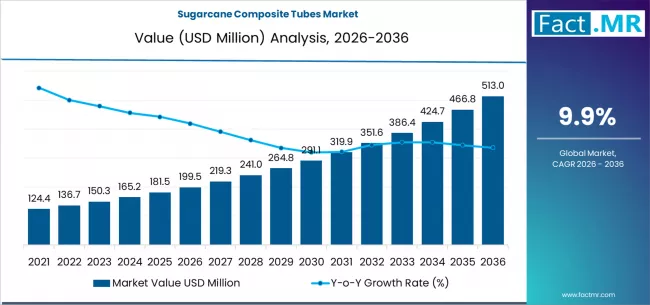

The global sugarcane composite tubes market is projected to grow from approximately US$230–240 million in 2026 to nearly US$590–600 million by 2036, representing a robust compound annual growth rate (CAGR) of about 9.9% over the forecast period. This growth trajectory significantly outpaces the broader tube packaging market, which is expanding at a comparatively moderate CAGR of around 4.7%, underscoring the disruptive potential of bio-based tube solutions.

Market Fundamentals: Why Sugarcane Composite Tubes Are Gaining Traction

Sugarcane composite tubes are typically manufactured using bagasse fiber—a by-product of sugarcane processing—combined with bio-resins or hybrid materials. This structure offers a compelling balance of renewability, mechanical strength, printability, and recyclability, making it suitable for applications traditionally dominated by plastic or aluminum tubes.

From a sustainability perspective, sugarcane-based materials benefit from the wider sugar economy. Cane sugar already accounts for a significant portion of global industrial sugar consumption, ensuring stable raw material availability and cost efficiency in major producing regions such as Brazil, India, China, and Southeast Asia. This linkage between agriculture and packaging creates a structurally resilient supply chain advantage.

Strategic Forecast: Market Evolution from 2026 to 2036

The 2026–2031 period is expected to represent an early-to-mid adoption phase. During this window, market value is forecast to rise steadily as multinational cosmetics and personal care brands scale pilot programs into commercial procurement. Annual market additions are expected to increase from the low US$20 million range to over US$35 million as performance validation and supply reliability improve.

From 2031 to 2036, growth momentum is projected to strengthen further. The market could expand from roughly US$335–370 million to nearly US$600 million in this phase, driven by repeat ordering, standardized tube specifications, and penetration into mass-market FMCG categories. Importantly, this expansion is characterized by volume-driven demand rather than short-term experimentation, signaling long-term structural adoption.

End-Use Dynamics: Cosmetics Lead, FMCG Follows

Data-driven segmentation shows that cosmetics and personal care applications account for approximately 45% of total demand, making them the dominant end-use segment through 2036. Premium skincare, oral care, and beauty brands are using sugarcane composite tubes to reinforce sustainability narratives while maintaining shelf appeal.

Beyond cosmetics, emerging opportunities are accelerating in:

-

Household and cleaning products, where fiber-based packaging aligns with eco-positioned brands

-

Dry food and nutraceutical packaging, leveraging moisture resistance and structural rigidity

-

Pharmaceutical and wellness segments, particularly for secondary or outer tube formats

As manufacturing tolerances improve, these adjacent sectors are expected to contribute a growing share of incremental demand after 2030.

Regional Outlook: Where Growth Will Be Concentrated

Asia-Pacific is expected to remain the fastest-growing regional market, supported by strong sugarcane availability, expanding FMCG consumption, and government-led sustainability initiatives. Countries such as India, China, and Indonesia benefit from vertically integrated sugar and packaging ecosystems.

Latin America, led by Brazil, represents another strategic hotspot. Brazil’s scale in sugarcane production offers cost and supply advantages that are attracting global packaging converters and material innovators.

Meanwhile, North America and Western Europe are projected to drive high-value demand, particularly from premium and multinational brands seeking compliance with tightening packaging waste regulations and ESG reporting standards.

Market Entry Insights: What New Entrants Must Get Right

For manufacturers and investors considering entry into the sugarcane composite tubes market, data points to several critical success factors:

-

Material Consistency & Performance

Brands demand tubes that match plastic equivalents in squeeze performance, barrier properties, and decoration quality. -

Scalable Manufacturing

Growth from pilot volumes to multi-million-unit contracts requires capital-efficient forming and curing technologies. -

Certifications & Compliance

Food-contact approvals, recyclability labeling, and lifecycle assessment data are becoming non-negotiable for global buyers. -

Strategic Partnerships

Collaborations with sugar mills, bio-resin suppliers, and FMCG brands can significantly shorten commercialization timelines.

Competitive Landscape and Strategic Positioning

The competitive environment is evolving as large packaging groups and material innovators expand their bio-based portfolios. While the broader composite tube market grows at 3–4% annually, sugarcane-based composites stand out as a high-growth niche within a mature industry. Early movers are leveraging sustainability differentiation to secure long-term supply agreements with global brands.

Browse Full Report : https://www.factmr.com/report/sugarcane-composite-tubes-market

Outlook: A Decade of Embedded Growth

Between 2026 and 2036, sugarcane composite tubes are expected to transition from an emerging alternative to a mainstream packaging format in select categories. With nearly US$360 million in incremental market value forecast over the decade, the segment represents one of the most attractive growth pockets in sustainable packaging.

Companies that align early with bio-based material innovation, scalable production, and brand-led sustainability demand will be best positioned to capture value in the next generation of tube packaging solutions.