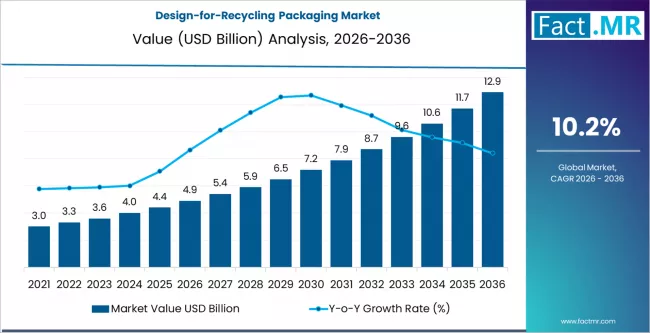

A comprehensive market analysis by Fact.MR reveals that the global Design-for-Recycling (DfR) packaging market is poised for transformative growth, with a projected valuation of USD 12.9 billion by 2036. Currently valued at USD 4.9 billion (2026E), the sector is expected to expand at a compound annual growth rate (CAGR) of 10.2% over the next decade.

This shift marks a critical evolution in the packaging industry, moving away from reactive waste management toward a “”recyclability-by-design”” framework. Driven by stringent global plastic regulations and a massive corporate push for monomaterial structures, DfR is becoming the baseline standard for the FMCG and food and beverage sectors.

Core Market Dynamics: Who, What, and Why

The move toward DfR packaging is led by global brand owners, converters, and regulatory bodies aiming to simplify the end-of-life recovery of materials. Historically, complex multi-layer laminates provided excellent barriers but were nearly impossible to recycle.

The industry is now pivoting toward:

- What: Simplification of packaging structures to ensure compatibility with existing mechanical and chemical recycling streams.

- Who: Key players including Amcor, Mondi, and Smurfit Kappa are investing heavily in R&D to replace traditional multi-material plastics with high-performance mono-structures.

- Where: While North America remains a significant hub with a 9.8% CAGR, the Asia-Pacific region is emerging as a high-growth territory due to rapid industrialization and updated waste management policies.

- Why: Escalating Extended Producer Responsibility (EPR) laws and a 15-20% annual increase in global plastic reduction legislation are compelling manufacturers to adopt circular designs to avoid heavy penalties and meet consumer demand.

Strategic Shifts: Mono-Materials and PE/PP Simplification

According to the report, PE and PP simplification strategies currently dominate the market with a 54% share. By utilizing polyolefin mono-structures, manufacturers can create packaging that is easily sorted and processed without contamination, significantly improving the quality of the resulting recyclate.

Mono-material packs represent 48% of the packaging format segment. This architectural shift is particularly vital for flexible packaging, which has traditionally been the most difficult to recover. High-barrier PE films are now being engineered with EVOH tie layers or plasma coatings that maintain shelf-life while remaining fully compatible with polyolefin recycling streams.

The Role of Technology and Generative Design

Efficiency in this market is no longer just about the material; it is about the engineering. The report highlights a surge in Generative Design Tools, a sub-market projected to grow at 14.6% CAGR. These AI-driven platforms allow engineers to optimize “”recyclability-first”” geometries, reducing material weight by up to 30% while maintaining structural integrity.

Furthermore, technologies such as Digital Watermarking (e.g., HolyGrail 2.0) and QR-code integration are being embedded into designs to facilitate high-speed automated sorting, ensuring that DfR packaging actually reaches the correct recycling bin.

Regional Insights and Sector Relevance

- United States: Poised for steady growth (9.8% CAGR) as federal and state-level mandates regarding recycled content take effect.

- Food & Beverage: This sector remains the primary end-user, accounting for the highest volume of DfR adoption due to the sheer scale of single-use plastic consumption.

- E-commerce: A rapidly growing vertical where “”right-sized”” and “”recycling-ready”” corrugated and flexible mailers are reducing both carbon footprints and shipping costs.

Expert Perspective

Design-for-recycling is no longer a peripheral sustainability goal; it is a fundamental business requirement,”” states a lead analyst at Fact.MR. “”As businesses strive to meet 2030 sustainability targets, the ability to document recyclability through data-backed scores will become a primary competitive differentiator for suppliers.””

About the Report

The Fact.MR report provides a granular analysis of the Design-for-Recycling Packaging market, covering technological outlooks, material strategies (PE, PP, Paperboard), and regional growth trajectories. It serves as a strategic roadmap for investors, brand owners, and packaging engineers navigating the transition to a circular economy.

Key Market Segments Covered:

- By Strategy: PE/PP Simplification, Recyclable Laminates, Polyolefin Mono-structures.

- By Format: Mono-material Packs, Rigid & Flexible, Lightweight Packs.

- By Technology: Barrier Redesign, Design-for-Disassembly, High-speed Conversion.

- By End-Use: FMCG, Food & Beverage, E-commerce, Healthcare.

Browse Full Report : https://www.factmr.com/report/design-for-recycling-packaging-market

Market Data at a Glance:

| Metric | 2026 Estimated Value | 2036 Forecast Value | CAGR (2026–2036) |

| Global Market Size | USD 4.9 Billion | USD 12.9 Billion | 10.2% |

| Leading Segment | PE/PP Simplification | 54% Market Share | — |

| Key Growth Region | North America | 9.8% CAGR | — |

Analysis Table: Growth Factors

| Factor | Impact on Market |

| Regulatory Compliance | High impact; 20% annual increase in global plastic laws. |

| Monomaterial Shift | Reduces sorting contamination; increases recyclate quality. |

| AI Integration | Optimizes material usage and improves sorting accuracy. |

“