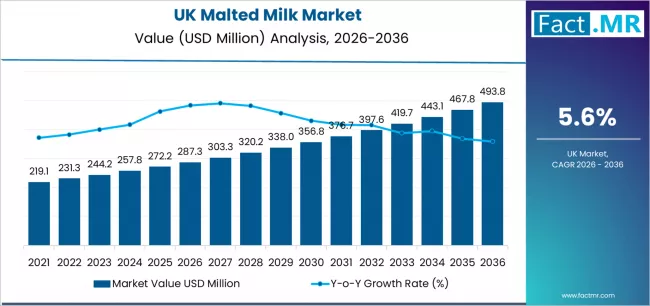

The UK malted milk market is poised for steady and sustained growth over the next decade, supported by rising health consciousness, renewed interest in traditional nutrition, and increasing consumption across children, adults, and aging populations. According to a recent analysis by Fact.MR, demand for malted milk in the UK is projected to expand from USD 287.3 million in 2026 to approximately USD 493.8 million by 2036, registering a compound annual growth rate (CAGR) of 5.6% during the forecast period.

This growth reflects strong consumer preference for nutrient-rich beverages, growing incorporation of malted milk in daily diets, and expanding applications across household, institutional, and foodservice channels.

Browse Full Report: https://www.factmr.com/report/united-kingdom-malted-milk-market

Strategic Market Drivers

Rising Health & Nutrition Awareness

Consumers in the UK are increasingly prioritizing balanced nutrition, digestive health, and immunity, driving demand for fortified and functional food products. Malted milk—rich in vitamins, minerals, calcium, and carbohydrates—is widely recognized as a wholesome nutrition source for all age groups.

The shift toward preventive healthcare and wellness-focused diets is significantly boosting market adoption.

Strong Demand Among Children and Elderly Populations

Malted milk continues to be a staple nutritional supplement for children’s growth and development, while also serving as an easily digestible energy source for elderly consumers. Its mild taste, digestibility, and nutritional profile make it ideal for daily consumption.

Healthcare professionals and caregivers frequently recommend malted milk as part of regular dietary routines.

Growth of Convenient & Ready-to-Consume Beverages

The expanding market for ready-to-mix and instant beverages is accelerating malted milk consumption. Busy lifestyles and demand for quick, nutritious drinks are encouraging households to opt for malted milk powders and flavored variants.

Innovations in low-sugar, fortified, and plant-enhanced malted milk formulations are further widening consumer appeal.

Influence of Traditional Consumption Habits

Malted milk enjoys strong cultural acceptance in the UK, with long-standing consumption patterns across generations. This heritage appeal, combined with modern nutritional positioning, continues to strengthen brand loyalty and repeat purchases.

Market Segmentation Insights

By Product Type

- Plain Malted Milk – Dominant segment due to traditional consumption and versatility

- Flavored Malted Milk – Growing popularity among younger consumers

By Form

- Powdered Malted Milk – Largest share driven by convenience and long shelf life

- Liquid / Ready-to-Drink – Emerging segment with rising on-the-go consumption

By Distribution Channel

- Supermarkets & Hypermarkets – Leading sales channel

- Online Retail – Fastest-growing due to digital grocery adoption

- Pharmacies & Health Stores – Strong presence for nutritional positioning

Regional Outlook: UK Market Growth Drivers

England Leads Consumption

England remains the largest contributor to UK malted milk demand, supported by high urban population density, strong retail networks, and established consumption habits.

Scotland, Wales & Northern Ireland Show Steady Growth

Rising awareness of nutritional beverages and expanding availability across retail outlets are supporting gradual growth in these regions.

Challenges Impacting Market Growth

Sugar Content Concerns

Growing scrutiny over sugar intake has prompted consumers to seek low-sugar or sugar-free alternatives, pushing manufacturers to reformulate products.

Competition from Alternative Health Beverages

The rise of protein shakes, plant-based drinks, and fortified dairy alternatives poses competitive pressure on traditional malted milk products.

Competitive Landscape

The UK malted milk market is moderately competitive, with companies focusing on product innovation, clean-label ingredients, reduced sugar formulations, and enhanced nutritional value.

Key Companies Operating in the Market

- GlaxoSmithKline (Horlicks)

- Nestlé

- Abbott Nutrition

- Mondelēz International

- Local and private-label brands

Manufacturers are increasingly investing in fortification, flavor innovation, and sustainable packaging to strengthen market presence.

Recent Developments

- 2024: Introduction of low-sugar and immunity-boosting malted milk variants

- 2023: Expansion of online retail distribution and direct-to-consumer models

- 2022: Reformulation initiatives to align with UK sugar reduction guidelines

Future Outlook: Sustained Growth Through Nutritional Innovation

The UK malted milk market is set to experience consistent expansion through 2036, driven by:

- Rising focus on daily nutrition and wellness

- Strong demand from children and elderly populations

- Innovation in low-sugar and fortified products

- Growth in convenient beverage consumption

- Continued trust in traditional nutrition brands

As consumers seek nutritious, familiar, and convenient dietary solutions, malted milk is expected to retain its relevance and grow steadily across the UK market.