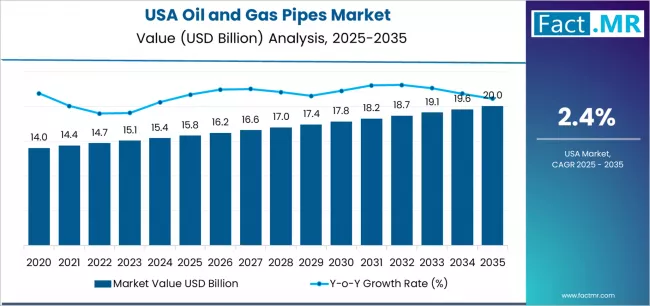

The demand for oil and gas pipes in the United States is poised for robust growth over the next decade, rising from an estimated USD 15.8 billion in 2025 to approximately USD 20.29 billion by 2035. This trajectory — a compound annual growth rate (CAGR) of about 2.4 % — reflects surging investment in upstream drilling, midstream pipeline expansion, and advanced energy infrastructure across key U.S. regions.

Demand Drivers: Why Pipe Infrastructure is Heating Up

• Upstream Exploration Resurgence

A major portion of the demand — about 43.5% — originates from upstream activities such as drilling and resource extraction. As energy companies re‑accelerate exploration and production, especially in regions like the Permian Basin and other shale plays, demand for high-quality welded and seamless pipes continues to climb.

• Midstream & Pipeline Infrastructure Expansion

Pipelines remain the backbone of oil and gas transportation in the U.S. Pipeline infrastructure — including new-build and upgrade projects — captures nearly 44.7% of the midstream market share. The push to build new pipelines, upgrade aging lines, and support increasing volumes of crude oil, natural gas, and LNG transport is a powerful force behind growing pipe demand.

• Welded Pipes Dominate, Fueled by Performance & Reliability

In 2025, welded pipe solutions are projected to account for roughly 62.3% of total demand — emerging as the preferred choice due to their strength, cost-effectiveness, and compatibility with existing pipeline infrastructure. Their widespread adoption underscores industry consensus on reliability and long-term performance.

• Regional Growth Spread from West to South, Northeast, and Midwest

While the entire nation will see growth, the West leads in projected demand with a 2.6% CAGR, supported by increased drilling activity and energy infrastructure investments. Other regions — the South, Northeast, and Midwest — are also expected to contribute significantly, with demand rising steadily across all regions.

Market Outlook: Growth Phases & Investment Opportunities

Based on the forecast, the U.S. oil and gas pipes industry will progress through two distinct growth phases:

-

2025–2030: Demand is expected to grow from USD 15.80 Bn to USD 17.83 Bn — an increase of USD 2.03 Bn, accounting for approximately 45% of the total growth over the decade.

-

2030–2035: Demand is projected to climb from USD 17.83 Bn to USD 20.29 Bn — a further increase of USD 2.46 Bn, representing roughly 55% of the overall growth by 2035.

This steady growth is fuelled by rising upstream drilling, midstream build-out, replacement/upgrade projects, and the adoption of advanced pipeline technology for enhanced efficiency and safety.

In tandem, the broader U.S. pipeline infrastructure market is experiencing significant investment, with major pipeline construction and midstream activities contributing to a rising demand for pipeline services and materials.

What This Means for Industry Stakeholders

-

Manufacturers & Suppliers: The sustained growth presents a stable outlook for welded pipe manufacturers and steel pipe suppliers, ensuring demand for high-grade materials and fabrication services.

-

Energy Companies & Developers: Upstream operators and midstream developers expanding drilling and pipeline networks will benefit from increased supply of pipes, enabling scaling of operations across multiple regions.

-

Investors & Infrastructure Financiers: Predictable growth and a rising total addressable market make the oil & gas pipe segment an attractive long-term investment — offering relatively stable returns compared to more volatile segments.

-

Technology & Service Providers: As older pipelines are replaced and new pipelines built, demand for advanced coatings, corrosion-resistant materials, pipeline monitoring, and maintenance services is likely to rise, opening growth avenues for technology innovators and service firms.

Industry Context: LNG Trends & Domestic Energy Needs

The broader U.S. oil and gas midstream market is undergoing transformation — driven by increased LNG exports, rising natural gas demand for power generation and heating, and expanding industrial use.

Moreover, with aging pipeline infrastructure and regulatory pressure to modernize, many operators are replacing older pipelines or installing new lines, leading to higher demand for welded steel pipes and advanced pipeline materials.

Energy demand catalysts — including growing consumption from data centers, manufacturing hubs, and expanding LNG export capacity — are further accelerating the need for robust pipeline networks and associated pipe infrastructure.

Key Regional & Product Insights

| Segment / Category | Key Facts (2025) |

|---|---|

| Market Size (2025) | USD 15.80 billion |

| Forecast (2035) | USD 20.29 billion |

| Forecast CAGR (2025–2035) | ~ 2.4% |

| Dominant Pipe Type | Welded pipes — 62.3% demand share |

| Top Application | Upstream (drilling, production) — ~43.5% share |

| Fastest‑Growing Region (2025–2035) | Western U.S. — ~2.6% CAGR |

Quotes from Industry Analysts

“The U.S. oil and gas pipes market is entering a phase of stable, structural growth. As upstream production revives and midstream infrastructure expands, demand for welded steel pipes will reliably rise for years to come.” — Lead Analyst, Independent Pipeline Research, 2025.

“With nearly 3 million miles of pipeline infrastructure nationwide and ongoing investments in upgrades and new builds, pipeline-related materials and services are among the most resilient sectors in the energy supply chain.” — Senior Energy Infrastructure Consultant, 2025.

What Lies Ahead: Strategic Opportunities & Challenges

Opportunities

-

Scaling up welded‑pipe manufacturing capacity to address rising demand.

-

Expanding into value‑added segments: corrosion‑resistant coatings, composite pipelines, advanced monitoring and maintenance services.

-

Supplying to midstream and downstream infrastructure upgrade projects, especially in regions with aging pipelines.

Challenges

-

Regulatory scrutiny and environmental compliance for new pipeline construction.

-

Volatility in steel and raw material costs — which may affect pipe manufacturing margins and supply chain stability.

-

Transition pressures from alternative energy sources and evolving energy policy — which could impact long‑term fossil‑fuel infrastructure investments.

Browse Full Report : https://www.factmr.com/report/united-states-oil-and-gas-pipes-market

Conclusion

As the U.S. presses ahead with ambitious upstream drilling and midstream infrastructure expansion, the demand for oil and gas pipes is set to climb steadily over the next decade. From USD 15.8 billion in 2025 to an anticipated USD 20.29 billion by 2035, the market offers stable growth, predictable demand, and numerous opportunities across manufacturing, services, and infrastructure development.

For manufacturers, investors, energy operators, and service providers — the coming years present a compelling window to engage, invest, and expand in the U.S. oil and gas pipe sector.