Critical Infrastructure: Global Ultra-pure Pipes Market Poised for Strategic Expansion Through 2036

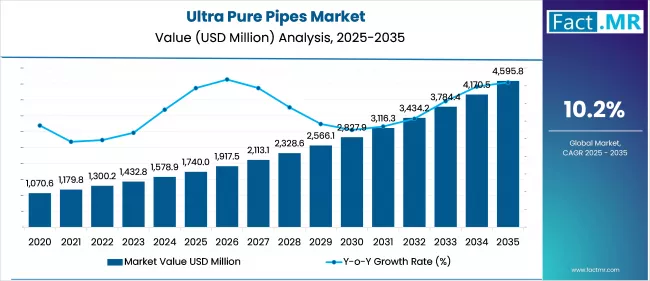

As high-tech manufacturing sectors face increasingly stringent contamination standards, the global Ultra-pure Pipes Market is undergoing a significant transformation. Driven by the aggressive expansion of semiconductor fabrication plants and the rising demand for biologics in the pharmaceutical industry, the market for high-purity piping systems is projected to reach $12.88 billion by 2026, growing at a compound annual growth rate (CAGR) of 11.8%.

Ultra-pure piping systems are specialized fluid-handling infrastructures engineered to transport chemicals, gases, and water without introducing even molecular-level contaminants. This press release outlines the current market trajectory, technical shifts, and the industrial demand fueling this critical sector.

Who, What, When, Where, and Why: The Market at a Glance

- Who: Key industry stakeholders include global manufacturers such as Georg Fischer, Parker Hannifin, Swagelok, AGRU, and Saint-Gobain, serving end-users in the semiconductor, biotechnology, and clean energy sectors.

- What: The market focuses on high-performance materials including PVDF (Polyvinylidene Fluoride), PFA (Perfluoroalkoxy), and 316L VIM/VAR stainless steel, designed for zero-leachate performance.

- When: The 2025–2030 period is identified as a critical “”scaling phase”” for the industry, coinciding with the deployment of 2nm and 3nm chip architectures.

- Where: While the Asia-Pacific region remains the largest market due to manufacturing hubs in Taiwan and South Korea, North America is emerging as the fastest-growing region following federal investments in domestic chip production.

- Why: The move toward smaller, more complex technology nodes means that even trace impurities can lead to catastrophic yield loss in high-value manufacturing.

Sector Insights: Semiconductor and Life Sciences Demand

The primary catalyst for market growth is the global “”fab boom.”” Modern semiconductor fabrication requires massive quantities of Ultrapure Water (UPW) for wafer cleaning and chemical mechanical planarization (CMP). In 2025 alone, over 70 new semiconductor fabs were under construction globally, each requiring miles of contamination-free piping.

“”In the microelectronics industry, the margin for error has vanished,”” says an industry analyst. “”Ultra-pure piping is no longer a utility; it is a critical component of the production tool itself. Without it, the yields required for AI and 5G chips are simply not achievable.””

Parallel to electronics, the biopharmaceutical sector is shifting toward single-use and high-purity thermoplastic systems. These materials prevent biofilm growth and ensure the integrity of volatile organic compounds used in vaccine and drug development.

Technical Trends: Material Innovation and Smart Monitoring

The market is shifting away from traditional materials toward advanced polymers and “”Smart Pipes.”” Key technical trends include:

- Dominance of PVDF and Fluoropolymers: PVDF currently leads the market with approximately 40% market share due to its exceptional chemical resistance and low surface roughness ($R_a$), which inhibits bacterial adhesion.

- Integration of IoT and AI: Next-generation ultra-pure systems now feature integrated sensors for real-time monitoring of resistivity, dissolved oxygen, and total oxidizable carbon (TOC). These “”smart”” systems allow for predictive maintenance, reducing the risk of costly unscheduled downtime.

- Sustainability and Recyclability: As ESG mandates tighten, manufacturers are developing bio-based polymers and focusing on the recyclability of piping materials without compromising the “”virgin”” quality required for ultra-pure applications.

Regional Outlook: Asia-Pacific vs. The West

Asia-Pacific continues to dominate, holding over 42% of the revenue share as of late 2025. Countries like China and India are investing heavily in “”Smart Cities”” and large-scale industrial water treatment, further boosting the demand for high-purity infrastructure.

However, the United States and Europe are closing the gap, spurred by policy-driven initiatives like the CHIPS Act. These regions are prioritizing the onshoring of critical supply chains, which necessitates the immediate construction of high-spec facilities.

Browse Full Report : https://www.factmr.com/report/ultra-pure-pipes-market

Market Segmentation and Competitive Landscape

The Ultra-pure Pipes Market is segmented by material (Plastic, Stainless Steel), application (IDM, Foundry, Laboratory), and pipe diameter. Currently, small-diameter pipes (<2 inches) lead the market for point-of-use delivery, while medium-diameter pipes (2–6 inches) are seeing the fastest growth for main distribution loops.

Top-tier players are increasingly engaging in strategic mergers and acquisitions to acquire specialized material technologies, particularly in the realm of beadless welding and advanced jointing techniques that eliminate “”dead legs”” where contaminants can collect.

About the Industry Analysis: This report provides a comprehensive overview of the global Ultra-pure Pipes Market, utilizing current 2025-2026 data to forecast trends through 2030. It serves as a strategic guide for investors, engineers, and facility managers navigating the complexities of high-purity fluid handling.