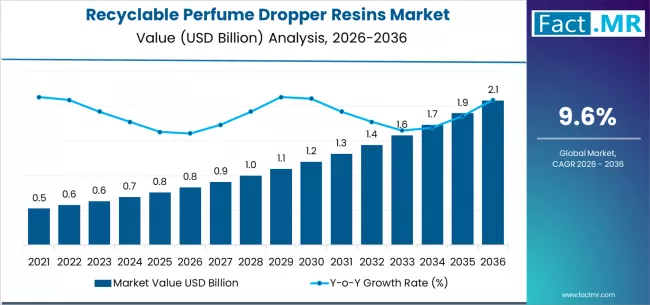

The global recyclable perfume dropper resins market is emerging as a critical solution to one of the most persistent sustainability challenges in luxury packaging. As premium fragrance brands accelerate their shift toward eco-conscious materials, demand for recyclable resin-based droppers is gaining strong momentum. According to a new analysis by Fact.MR, the market is projected to expand from USD 0.83 billion in 2026 to USD 2.08 billion by 2036, registering a robust CAGR of 9.6% over the forecast period.

This rapid expansion reflects mounting regulatory pressure, rising consumer demand for sustainable luxury products, and increased innovation in recyclable polymer formulations tailored for high-end perfume applications.

Browse Full Report: https://www.factmr.com/report/recyclable-perfume-dropper-resins-market

Strategic Market Drivers

Sustainability Imperatives Transform Luxury Packaging

Luxury fragrance brands are under growing pressure to reduce plastic waste without compromising aesthetics or performance. Traditional multi-material perfume droppers—often combining metal, rubber, and non-recyclable plastics—pose major recycling challenges.

Recyclable perfume dropper resins offer:

- Mono-material or easily separable designs

- Compatibility with existing recycling streams

- Premium finish and chemical resistance

These advantages are positioning recyclable resins as the preferred alternative for next-generation fragrance packaging.

Regulatory Pressure Accelerates Adoption

Stringent global regulations targeting single-use plastics and non-recyclable packaging are compelling perfume manufacturers to redesign packaging components.

- EU Circular Economy Action Plan

- Extended Producer Responsibility (EPR) mandates

- Brand-level sustainability commitments

Together, these initiatives are significantly accelerating the adoption of recyclable resin droppers across premium and mass-market fragrances.

Rising Demand for Sustainable Luxury Products

Modern consumers—particularly Millennials and Gen Z—are increasingly factoring sustainability into luxury purchasing decisions. Brands are responding by adopting recyclable droppers as a visible and impactful sustainability upgrade.

Eco-labeled, refill-friendly, and recyclable perfume packaging is becoming a strong differentiator in competitive fragrance markets.

Advancements in Resin Technology

Continuous innovation in polymer science has led to the development of:

- High-clarity recyclable resins

- Chemically resistant materials compatible with alcohol-based perfumes

- Lightweight, durable, and aesthetically refined formulations

These advancements are enabling recyclable droppers to meet both functional and luxury design expectations.

Regional Growth Highlights

Europe: Sustainability Regulation Leader

Europe dominates early adoption due to strict environmental regulations and strong sustainability commitments from luxury fragrance houses. France, Italy, and Germany—global fragrance hubs—are leading demand for recyclable droppers.

North America: Brand-Led Sustainability Transition

The U.S. market is expanding steadily as premium and niche fragrance brands prioritize recyclable packaging to meet corporate ESG goals and consumer expectations.

East Asia: Rapid Growth in Premium Beauty Packaging

Japan, South Korea, and China are witnessing rising adoption driven by:

- Expanding luxury beauty markets

- High demand for premium yet sustainable packaging

- Innovation in recyclable polymer manufacturing

Emerging Markets: Long-Term Growth Potential

India, Southeast Asia, and Latin America are expected to see strong growth as international fragrance brands expand presence and introduce global sustainability standards.

Market Segmentation Insights

By Resin Type

- Polypropylene (PP) – Widely adopted due to recyclability and chemical resistance

- Polyethylene (PE) – Lightweight and cost-effective

- Bio-based & Advanced Recyclable Polymers – Fastest-growing segment

By Dropper Component

- Pipette Tubes

- Bulbs & Squeezers

- Caps & Collars

By End Use

- Luxury & Premium Perfumes – Dominant segment

- Mass-Market Fragrances

- Niche & Artisanal Perfume Brands

Challenges Impacting Market Growth

Higher Material & Development Costs

Advanced recyclable resins often carry higher upfront costs compared to conventional plastics, impacting adoption among cost-sensitive manufacturers.

Performance & Compatibility Constraints

Ensuring long-term chemical stability with alcohol-based and oil-based fragrances remains a technical challenge for some recyclable resin formulations.

Recycling Infrastructure Limitations

Inconsistent recycling systems across regions can reduce the real-world recyclability of packaging components.

Competitive Landscape

The recyclable perfume dropper resins market is moderately fragmented, with players focusing on material innovation, luxury-grade aesthetics, and circular packaging solutions.

Key Companies Profiled

- AptarGroup

- RPC Group

- Silgan Holdings

- Berry Global

- Albéa Group

- Quadpack

- Gerresheimer AG

Manufacturers are investing in mono-material designs, bio-based resins, refill-compatible droppers, and collaborations with luxury fragrance brands.

Recent Developments

- 2024: Luxury perfume brands introduce fully recyclable dropper assemblies aligned with EU sustainability targets

- 2023: Resin manufacturers launch high-clarity recyclable polymers for premium fragrance packaging

- 2022: Increased adoption of mono-material droppers to simplify recycling processes

Future Outlook: Circular Luxury Packaging Takes Center Stage

Over the next decade, the recyclable perfume dropper resins market will benefit from:

- Growing sustainability commitments by luxury brands

- Expansion of refillable and circular perfume systems

- Advancements in recyclable and bio-based polymers

- Increasing consumer demand for eco-conscious luxury

As sustainability becomes integral to brand identity, recyclable perfume dropper resins are set to play a pivotal role in reshaping the future of fragrance packaging through 2036.