The global precious metal market is entering a period of steady growth, projected to rise from USD 330.0 billion in 2025 to USD 450.0 billion by 2035, representing a CAGR of 3.2%. With rising demand in jewelry, investment, and industrial sectors, this market is attracting attention from investors, manufacturers, and policymakers worldwide. Advancements in mining technologies and refined extraction processes are further boosting market potential, enabling companies to meet global demand efficiently and profitably.

Market Drivers and Opportunities

The growth of the precious metal market is fueled by three primary factors:

-

Investment Diversification: Precious metals such as gold, platinum, and palladium provide 70–85% portfolio stability, making them attractive for investors seeking safe, high-value assets.

-

Jewelry Demand: Increasing disposable income, cultural significance, and luxury consumption drive the jewelry segment, accounting for approximately 50% of market share in 2025.

-

Technological Advancements: Improved mining and refining processes reduce production costs while enhancing metal purity, benefiting both industrial applications and investment-grade products.

Despite these drivers, volatile commodity prices and complex mining regulations may challenge growth, especially in developing regions lacking technical infrastructure for precious metal trading and storage.

Segment Analysis

By Metal

-

Gold: Dominates with 65% market share due to its stability, investment-grade value, and extensive use in jewelry and industrial applications.

-

Platinum: Accounts for 15%, offering advanced properties for specialized industrial and catalytic applications.

-

Palladium & Silver: Each holds roughly 10%, used in electronics, automotive catalysts, and precision manufacturing.

Gold’s dominance is supported by advanced purity technologies, multi-market compatibility, and enhanced stability, ensuring consistent value across economic cycles.

By Application

-

Jewelry: Leading application segment with 50% share, driven by cultural demand and luxury consumption trends.

-

Investment: 30% share, catering to portfolio diversification, wealth preservation, and hedge investments.

-

Industrial: 20% share, serving specialized applications such as electronic components and automotive catalysts.

The jewelry and investment segments together account for 80% of market share, highlighting the importance of consumer preference and financial demand in driving growth.

Regional Insights

| Country/Region | CAGR (2025–2035) | Highlights |

|---|---|---|

| India | 4.2% | Gold Monetization Scheme, rising jewelry demand |

| China | 3.8% | Investment expansion, Belt and Road economic initiatives |

| Mexico | 3.0% | Mining-driven growth, export opportunities |

| Germany | 2.7% | Advanced financial infrastructure, trading |

| USA | 2.6% | Investment modernization, portfolio diversification |

| South Korea | 2.5% | Financial technology integration |

| Japan | 2.4% | Advanced financial compliance and portfolio management |

India is projected to lead global growth due to economic expansion, cultural affinity for gold jewelry, and supportive government policies. China follows closely with modernization of financial networks and integrated investment solutions. Mexico’s growth is concentrated in mining regions, while Europe and North America focus on financial infrastructure and portfolio modernization.

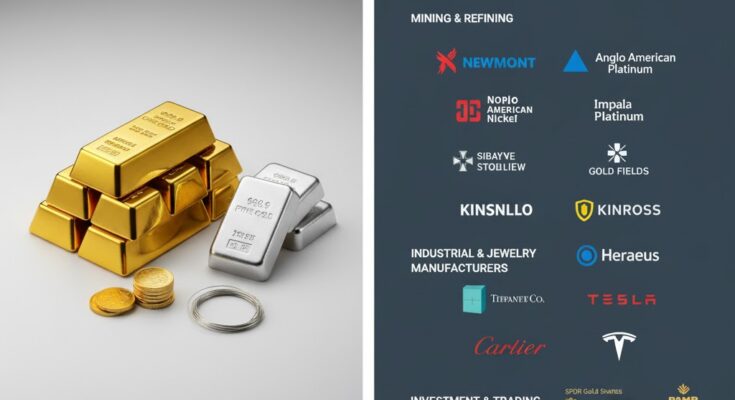

Competitive Landscape

The market features 20–25 key players, with the top three companies controlling 20–30% of global market share. Leading players include:

-

Newmont Corporation

-

Barrick Gold Corporation

-

Anglo American Platinum Ltd.

-

Norilsk Nickel PJSC

-

Impala Platinum Holdings Ltd. (Implats)

-

Sibanye Stillwater Ltd.

Competition is based on extraction efficiency, refining quality, and market access rather than pricing alone. Regional players in India and China are gaining traction by leveraging local market expertise and compliance advantages.

Trends and Future Outlook

By 2035, the precious metal market is expected to expand further due to:

-

Integration with digital trading platforms and advanced portfolio monitoring tools

-

Growth in luxury jewelry and investment products

-

Strategic partnerships between mining companies, manufacturers, and financial institutions

-

Increasing adoption in emerging markets with high consumer demand

Governments and industry bodies play a crucial role in growth by:

-

Funding mining development programs

-

Offering tax incentives and R&D support

-

Establishing quality standards and certification programs

-

Supporting skills development and professional training

Manufacturers and technology providers can enhance the ecosystem by developing next-gen extraction technologies, offering intelligence platforms for investment optimization, and expanding collaborative R&D initiatives.

Conclusion

The precious metal market presents a significant opportunity for investors, manufacturers, and policymakers. With expected growth from USD 330.0 billion in 2025 to USD 450.0 billion in 2035, companies that invest in advanced mining technologies, innovative financial solutions, and strategic market expansion will gain competitive advantages.

Quick Snapshot:

| Metric | Value |

|---|---|

| Market Value (2025) | USD 330.0 billion |

| Market Forecast (2035) | USD 450.0 billion |

| CAGR (2025–2035) | 3.2% |

| Leading Metal | Gold |

| Key Regions | Asia-Pacific, Europe, North America |

Investors and businesses that strategically align with market trends and technological advancements in precious metals are well-positioned to capture value and maximize returns over the next decade.

Browse Full Report : https://www.factmr.com/report/precious-metal-market