The global peptide therapeutics market is expanding rapidly as biotechnology innovations, increasing chronic disease prevalence, and rising demand for targeted and safer therapies reshape the pharmaceutical landscape. Peptide-based drugs, known for their high receptor specificity, minimal toxicity, and favorable safety profiles, are increasingly used across therapeutic areas including metabolic disorders, oncology, cardiovascular diseases, and neurological conditions.

With growing investment in advanced drug development technologies and improved delivery mechanisms, peptide therapeutics are emerging as one of the most promising drug classes in modern medicine. The market outlook remains strong as pharmaceutical companies, biotech firms, and research institutions push the boundaries of peptide science.

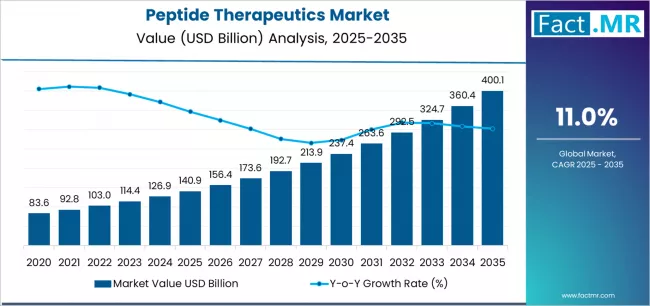

Quick Stats (2025–2035)

-

Market Value 2025: USD 140.9 billion

-

Market Value 2035: USD 400.1 billion

-

Absolute Growth: USD 259.2 billion

-

CAGR (2025–2035): 11.0%

-

Leading Application Segment (2025): Metabolic disorders (approx. 61.9% share)

-

Dominant Product Type (2025): Innovative peptide therapeutics (~79.1% share)

-

Leading Synthesis Technology (2025): Recombinant DNA-based manufacturing (~79.3% share)

-

Key Growth Regions: Asia Pacific, North America, Europe

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12120

Key Market Drivers

1. Rising Burden of Chronic and Metabolic Diseases

The global increase in diabetes, obesity, and associated metabolic conditions continues to drive strong demand for peptide therapeutics. Owing to their targeted mechanism of action and improved safety profiles compared to many small-molecule drugs, peptides have become a preferred treatment option for metabolic health management.

2. Advancements in Drug Design and Delivery Technologies

Significant progress in recombinant DNA technology, chemical synthesis, and peptide engineering has enhanced the production efficiency and therapeutic performance of peptide drugs. Innovations such as long-acting formulations, injectable pens, and controlled-release delivery systems are making peptide therapies more patient-friendly and commercially viable.

3. Expansion of Therapeutic Applications

While metabolic disorders currently dominate the market, peptides are increasingly being developed for cancer treatment, immunotherapy, rare diseases, chronic pain management, and neurological disorders. Their precision targeting and lower side-effect profile make them attractive candidates for next-generation therapies.

4. Growing Availability of Peptide Generics and Biosimilars

As patents on major peptide drugs begin to expire, opportunities for biosimilar development are increasing. This is expected to boost market accessibility, reduce treatment costs, and accelerate adoption in emerging regions.

Additionally, the expansion of contract development and manufacturing organizations (CDMOs) is supporting large-scale peptide production worldwide.

Market Challenges

1. Complex Manufacturing Requirements

Peptide production often requires advanced purification systems, sterile manufacturing environments, and sophisticated formulation techniques. These complexities increase development time and capital expenses.

2. Strong Competition from Other Drug Classes

Small molecules and monoclonal antibodies remain dominant in many therapeutic areas. In certain sectors, peptides must compete on cost, delivery convenience, and long-term safety data.

3. Regulatory and Clinical Trial Barriers

As peptides evolve in structural complexity, clinical validation and regulatory review processes become more demanding. This can slow time-to-market for innovative peptide drugs.

4. Limited Penetration in Some Developing Markets

High production costs and the need for robust cold-chain logistics can restrict access in lower-income and infrastructure-constrained regions.

Where Revenue Comes From — Now vs Next

NOW (2025)

-

Metabolic disorders remain the largest revenue generator, driven by high global prevalence.

-

Innovative peptide drugs dominate due to strong R&D pipelines and premium pricing.

-

Recombinant DNA-based peptide production accounts for the majority of manufacturing due to scalability and efficiency.

NEXT (2035)

-

Oncology, neurology, and chronic disease segments are expected to grow faster as peptide research expands beyond metabolic applications.

-

Long-acting and sustained-release peptide formulations will become more mainstream.

-

Biosimilars and generics will broaden access, particularly in Asia Pacific and Latin America.

-

Combination therapies pairing peptides with biologics, antibodies, or small molecules will gain traction as part of personalized medicine strategies.

Future Outlook

The peptide therapeutics market is set to more than double between 2025 and 2035, underscoring its role as a transformative force in global pharmaceutical innovation. As healthcare systems shift toward safer, more targeted, and personalized treatments, peptides are poised to play a central role.

Continuous advancements in drug delivery technologies, increasing investment in biotechnology, and growing focus on long-acting formulations will shape the industry’s future. The rise of biosimilar peptides and expansion in emerging markets will further accelerate growth and accessibility.

Overall, peptide therapeutics will remain a high-growth, high-innovation segment of the healthcare industry, with strong long-term prospects supported by clinical advancements, global disease burden, and technological progress.

Browse Full Report: https://www.factmr.com/report/peptide-therapeutics-market