The global packaging industry is at a pivotal inflection point as sustainability imperatives, regulatory pressure, and performance expectations converge. Within this transition, oxygen barrier paper wraps are emerging as a high-growth packaging solution, combining renewable paper substrates with advanced barrier technologies to protect oxygen-sensitive products. By 2036, this segment is expected to evolve from a niche alternative into a strategically important component of food and consumer goods packaging worldwide.

Market Size and Growth Trajectory

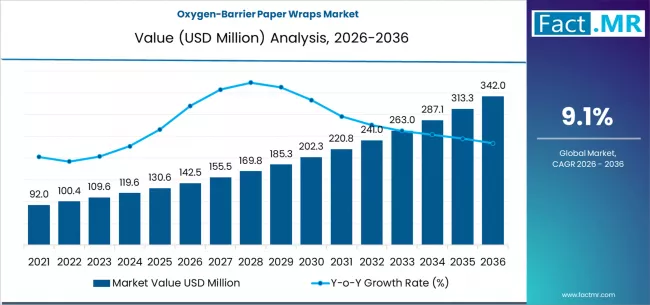

The global oxygen barrier paper wraps market is projected to grow from approximately US$145 million in 2026 to more than US$350 million by 2036, reflecting a compound annual growth rate (CAGR) of around 9% over the ten-year period. This growth significantly outperforms the broader paper packaging sector, signaling strong demand for value-added paper formats that can compete with plastic laminates on performance.

Growth is driven by three structural forces:

-

Rising demand for extended shelf life in food and beverage packaging

-

Accelerating substitution of plastic-based wraps due to recyclability concerns

-

Premiumization of paper packaging, where functional barriers justify higher unit pricing

Together, these drivers are reshaping procurement strategies among food processors and retailers, particularly in protein, bakery, and fresh food categories.

Strategic Benchmarking: End-Use and Technology Leadership

From an end-use perspective, meat, poultry, and seafood applications account for more than 40% of total demand. These products are highly sensitive to oxygen exposure, which causes oxidation, discoloration, and reduced shelf life. Oxygen barrier paper wraps enable processors to maintain product quality while aligning with sustainability commitments.

Bakery and confectionery segments represent the second-largest demand cluster, supported by the need to preserve freshness and aroma without relying on multi-layer plastic films. Ready meals and fresh produce are also gaining share as barrier performance improves.

On the technology front, extrusion-coated barrier paper dominates with nearly half of total market volume. This process offers scalability, uniform coating thickness, and compatibility with high-speed converting lines. In terms of materials, paper structures incorporating EVOH or similar high-barrier polymers represent roughly 44% of market share, balancing oxygen transmission resistance with downgauging potential.

Strategic benchmarking among suppliers increasingly centers on:

-

Oxygen transmission rate (OTR) efficiency

-

Coating weight reduction

-

Recyclability within existing paper streams

-

Line speed compatibility and cost per square meter

These metrics are becoming decisive differentiators in long-term supply contracts.

Pricing Trends: From Premium to Competitive

Oxygen barrier paper wraps currently command a price premium of 15–30% over conventional paper wraps, reflecting higher material input costs and specialized coating processes. However, pricing trends indicate gradual normalization over the forecast period.

As production volumes increase and coating technologies mature, unit costs are expected to decline steadily, narrowing the gap with plastic laminates. By the early 2030s, barrier paper wraps are projected to achieve cost parity in select food applications, particularly where reduced food waste and sustainability compliance offset higher material costs.

Brand owners are increasingly willing to absorb premium pricing in exchange for:

-

Longer shelf life

-

Lower spoilage rates

-

Improved recyclability claims

-

Stronger consumer perception of sustainability

This willingness supports margin stability for converters while encouraging continued investment in innovation.

Regional Hotspots: Where Growth Is Concentrated

Regionally, North America and Europe together account for more than 55% of current market value, driven by strict packaging waste regulations, high penetration of packaged foods, and strong retailer sustainability mandates. These regions also lead in adoption of recyclable and water-based barrier coatings.

Looking ahead, Asia-Pacific is forecast to register the fastest growth rate through 2036, supported by rising urbanization, expanding cold-chain infrastructure, and increasing consumption of packaged meat and bakery products. China and India are emerging as key growth engines as domestic converters invest in barrier paper capacity and multinational brands standardize packaging formats across markets.

Latin America and the Middle East & Africa represent smaller but strategically important markets, particularly for export-oriented meat and seafood packaging where oxygen control is critical for long-distance logistics.

Competitive Landscape: Innovation Over Commoditization

The competitive landscape remains moderately consolidated, with global packaging groups competing alongside regional specialists. Rather than volume-driven commoditization, competition is defined by innovation intensity and application-specific customization.

Key competitive strategies include:

-

Development of recyclable and compostable barrier coatings

-

Reduction of polymer content without sacrificing barrier performance

-

Co-development programs with food processors

-

Investments in high-speed, low-energy coating lines

Suppliers that can tailor oxygen barrier performance to specific food categories—rather than offering one-size-fits-all solutions—are gaining a measurable advantage in customer retention and contract duration.

Browse Full Report : https://www.factmr.com/report/oxygen-barrier-paper-wraps-market

Outlook to 2036: From Alternative to Mainstream

By 2036, oxygen barrier paper wraps are expected to transition from an alternative packaging format to a mainstream solution across multiple food categories. Market expansion will be supported by improving cost structures, tightening environmental regulations, and growing consumer preference for fiber-based packaging.

For manufacturers, converters, and brand owners, the next decade presents a strategic window to:

-

Benchmark performance against best-in-class barrier technologies

-

Secure long-term partnerships across the value chain

-

Invest in scalable, future-ready coating infrastructure

As sustainability shifts from differentiation to requirement, oxygen barrier paper wraps are positioned to become a cornerstone of next-generation packaging strategies—delivering both environmental value and measurable commercial returns.