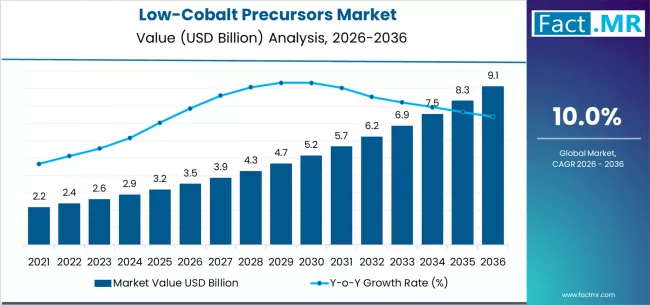

The global low-cobalt precursors market is positioned for strong and sustained growth over the next decade, driven by the rapid expansion of electric vehicle (EV) production, rising demand for cost-efficient lithium-ion batteries, and growing emphasis on sustainable battery chemistries. According to a new analysis by Fact.MR, the market is projected to grow from USD 3.52 billion in 2026 to USD 9.13 billion by 2036, registering a robust CAGR of 10.0% during the forecast period.

This expansion represents a total growth of 159.4%, highlighting the strategic importance of low-cobalt cathode precursor materials in next-generation battery manufacturing.

The global shift toward high-energy-density, lower-cost, and ethically sourced battery materials is significantly accelerating adoption across automotive, energy storage, and electronics applications.

Browse Full Report: https://www.factmr.com/report/low-cobalt-precursors-market

Strategic Market Drivers

Electric Vehicle (EV) Expansion Fuels Market Growth

Low-cobalt precursors are becoming a critical component in advanced lithium-ion batteries used in EVs due to their ability to:

- Reduce reliance on expensive and volatile cobalt supplies

- Lower battery production costs

- Improve energy density and cycle life

- Support sustainable and ethical sourcing initiatives

With global EV production accelerating across passenger vehicles, two-wheelers, and commercial fleets, demand for low-cobalt battery chemistries continues to rise sharply.

Shift Toward High-Nickel Cathode Chemistries

Battery manufacturers are increasingly transitioning toward high-nickel, low-cobalt cathode formulations, particularly in NMC (Nickel Manganese Cobalt) systems. These chemistries deliver improved performance while minimizing cobalt content, making low-cobalt precursors essential for scalable battery production.

Cost Reduction & Supply Chain Stability

Cobalt price volatility and geopolitical supply risks are pushing battery makers to adopt low-cobalt alternatives. By reducing cobalt dependency, manufacturers can:

- Achieve better cost predictability

- Improve supply chain resilience

- Align with long-term sustainability targets

Government Policies & Clean Energy Initiatives

Government incentives for EV adoption, renewable energy storage, and decarbonization are accelerating investments in advanced battery materials, further strengthening demand for low-cobalt precursor solutions.

Market Segmentation Insights

By Battery Chemistry

- NMC 811 / NMC 9.5.5 Segment

This segment is set to account for 38.0% of the global low-cobalt precursors market in 2026, driven by its high nickel content, reduced cobalt usage, and superior energy density—making it a preferred choice for long-range EV batteries. - Other Low-Cobalt NMC Variants

Increasing adoption across energy storage systems and consumer electronics due to balanced performance and safety characteristics.

By End Use

- Automotive (EVs) – Largest and fastest-growing segment

- Energy Storage Systems (ESS) – Rising demand from renewable integration

- Consumer Electronics – Smartphones, laptops, and wearables

- Industrial Applications – Backup power and grid stabilization

Regional Growth Highlights

East Asia: Battery Manufacturing Hub

China, South Korea, and Japan dominate the low-cobalt precursors market due to their leadership in lithium-ion battery production, EV manufacturing, and cathode material innovation.

Europe: Sustainability-Driven Growth

Europe’s strong EV adoption, strict emissions regulations, and investments in localized battery supply chains are driving rapid demand for low-cobalt precursor materials, particularly in Germany, France, and Scandinavia.

North America: EV & Battery Localization Initiatives

Rising investments in domestic battery manufacturing and EV infrastructure—supported by government incentives—are accelerating market growth across the U.S. and Canada.

Emerging Markets: Long-Term Growth Potential

India, Southeast Asia, and Latin America are witnessing increased battery manufacturing activity, EV penetration, and renewable energy projects, creating new growth opportunities.

Challenges Impacting Market Expansion

Technical Complexity

Producing high-performance low-cobalt precursors requires advanced processing technologies and strict quality control.

Nickel Supply Constraints

While cobalt use is reduced, higher nickel dependency introduces new supply chain considerations.

Capital-Intensive Manufacturing

Establishing precursor production facilities requires significant upfront investment.

Competitive Landscape

The low-cobalt precursors market is moderately consolidated, with companies focusing on:

- High-nickel precursor development

- Performance optimization and scalability

- Long-term supply agreements with battery manufacturers

- Sustainable sourcing and recycling initiatives

Future Outlook: A Decade of Battery Material Transformation

Over the next decade, the low-cobalt precursors market will be shaped by:

- Accelerating EV adoption worldwide

- Continued innovation in high-nickel cathode chemistries

- Cost and sustainability pressures across battery supply chains

- Expansion of energy storage systems

- Strategic push toward ethical and low-risk raw material sourcing

As battery manufacturers prioritize performance, affordability, and sustainability, low-cobalt precursors are set to play a pivotal role in the future of global energy storage and electric mobility through 2036.