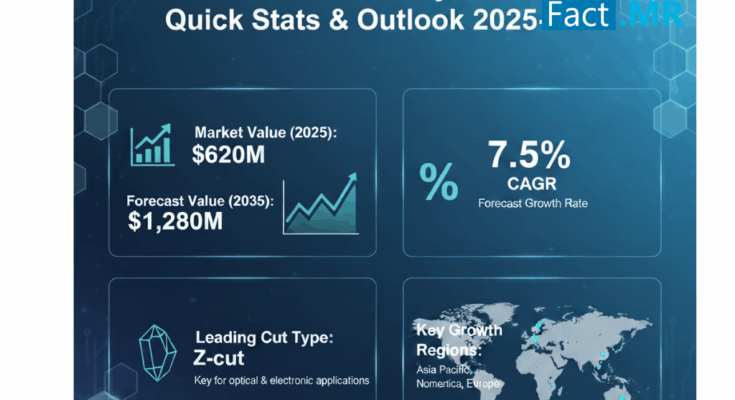

The global lithium tantalate crystal market is poised for significant expansion, projected to reach USD 1,280 million by 2035, marking an absolute growth of USD 660 million from its 2025 valuation of USD 620 million. This growth trajectory reflects a 7.5% CAGR over the decade, underpinned by rising adoption across telecommunications, electronics, and electro-optical systems.

Between 2025 and 2035, the market is expected to grow 2.1 times, as demand for 5G network components, surface acoustic wave (SAW) devices, and precision electro-optical technologies accelerates. The ongoing digital transformation, coupled with semiconductor innovation, is redefining material requirements—making lithium tantalate crystals an indispensable component in next-generation devices.

Growth Analysis: Two Phases of Market Expansion

-

2025–2030: Market value is expected to climb from USD 620 million to USD 915 million, reflecting a 44.7% growth share for the decade. This growth is driven by 5G infrastructure rollout, crystal innovation in SAW/filters, and integration with semiconductor and optical device production.

-

2030–2035: The market will add another USD 365 million, accounting for 55.3% of total decade growth. Demand will center on advanced electro-optical systems, nonlinear optical devices, and precision crystal fabrication for telecommunications and photonics.

Segmental Insights

By Cut Type: Z-Cut Leads the Market

The Z-cut segment commands approximately 40% of the total market share in 2025, owing to its superior piezoelectric and acoustic characteristics essential for SAW and EO applications. These crystals provide enhanced signal stability, wave propagation, and frequency control—making them vital for 5G filters and precision optical systems.

The X/Y-cut category follows with 35% share, addressing high-performance optical alignment needs for electro-optical and photonic devices. The remaining 25% is held by engineered cuts, used in customized or experimental crystal configurations for advanced device applications.

By Application: SAW/Filters Dominate

SAW/filters represent the largest application segment, capturing 45% of total market share in 2025. This growth is attributed to 5G deployment and the escalating demand for frequency filters and high-precision signal processing in telecommunications equipment.

The pyroelectric/IR segment follows with 25% share, driven by the increasing use of thermal sensors and infrared detectors in automation and security systems. The EO/nonlinear optics segment accounts for 20%, benefiting from the rise in laser communication systems and optical computing technologies.

Regional Dynamics

The Asia Pacific region leads global growth, underpinned by high electronics production rates and government-backed semiconductor initiatives.

-

India emerges as the fastest-growing market with a 9.5% CAGR, driven by Make in India manufacturing initiatives and telecommunications infrastructure expansion.

-

China follows with 8.6% CAGR, supported by 5G deployment and large-scale semiconductor investments.

-

South Korea (7.0%) and Japan (6.0%) continue to focus on high-precision optical manufacturing.

-

In North America, the U.S. market maintains a 6.8% CAGR, propelled by robust telecom upgrades and R&D-driven innovations.

-

Europe, led by Germany (6.9%), is expected to grow from USD 155 million to USD 324 million by 2035 due to its precision manufacturing capabilities and crystal technology modernization.

Market Drivers

-

5G and High-Frequency Applications:

Expansion of 5G networks worldwide is creating substantial demand for SAW filters and frequency management devices that rely on high-quality lithium tantalate crystals. -

Electronics Miniaturization:

Compact device architectures require precision crystals with superior performance in smaller form factors. -

Optical and Photonic Advancements:

Increasing adoption of laser, infrared, and photonic technologies enhances market reliance on lithium tantalate for electro-optical modulation and signal integrity.

Challenges and Restraints

-

Complex Manufacturing Processes: Precision crystal orientation and cutting demand high-cost, specialized equipment.

-

Supply Chain Volatility: Limited raw material sources and quality inconsistencies affect production stability.

-

Regional Infrastructure Gaps: Developing economies face challenges in establishing high-precision crystal fabrication units.

Competitive Landscape

The market is moderately concentrated, with 10–18 active global players. The top three companies—Shin-Etsu, Sumitomo Metal Mining, and Crystal Technology—control 35–45% of the market through vertically integrated manufacturing and extensive client networks in electronics and telecom sectors.

Other key participants include Orient Tantalum, Roditi, MTI Corp, CoorsTek, Oxide Corp, Fujian Jinhua, and H.C. Starck, which focus on specialized cuts and application-specific innovations. Regional players in India and China are emerging as agile competitors through localized production and cost-efficient technologies.

Investment and Policy Outlook

-

Governments are urged to integrate crystal manufacturing into national technology development plans, offering tax incentives and R&D funding to accelerate local production.

-

Investors are focusing on crystal growth technology startups and regional expansion financing to capture emerging demand in Asia-Pacific and Latin America.

-

Industry alliances are emphasizing standards harmonization and certification frameworks to ensure interoperability and quality compliance across electronic and optical applications.

Conclusion

The lithium tantalate crystal market stands at the intersection of materials science and digital transformation, powering advancements in telecommunications, semiconductor manufacturing, and photonics. With a projected USD 1.28 billion valuation by 2035, supported by a 7.5% CAGR, the sector offers lucrative opportunities for investors, manufacturers, and policymakers aiming to strengthen their position in next-generation electronics and optical systems.

Browse Full Report : https://www.factmr.com/report/lithium-tantalate-crystal-market