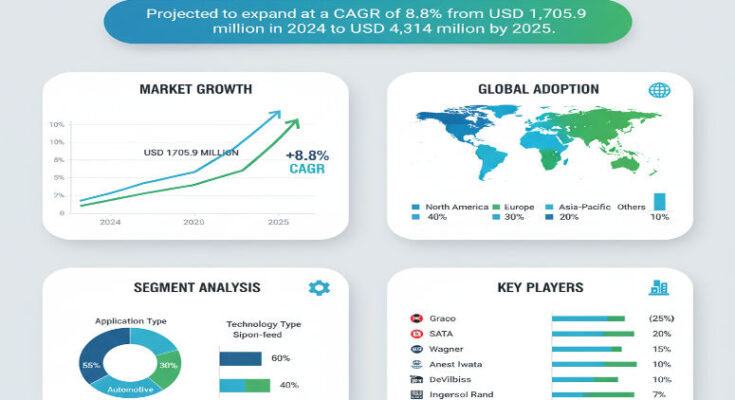

The global High Volume Low Pressure (HVLP) spray gun market is poised for remarkable expansion over the next decade, with comprehensive market analysis projecting growth from USD 1,856 million in 2025 to USD 4,314 million by 2035, representing a robust compound annual growth rate (CAGR) of 8.8%. This substantial growth trajectory reflects the accelerating shift toward environmentally compliant coating technologies and precision surface finishing across multiple industries worldwide.

According to the latest market forecast, the HVLP spray gun industry is experiencing transformative momentum driven primarily by stringent environmental regulations limiting volatile organic compound (VOC) emissions, increased demand for precision surface finishing in manufacturing, and the expanding automotive refinishing sector. The technology’s superior transfer efficiency and material waste reduction capabilities position HVLP systems as the preferred choice for both industrial applications and high-volume craft manufacturing environments.

Environmental Compliance Drives Market Transformation

Regulatory pressure to reduce VOC emissions represents the primary driver propelling the replacement of conventional spray guns with HVLP technology. As industries increasingly adopt sustainable coating practices, HVLP spray guns offer compelling advantages including improved paint transfer efficiency, significantly reduced overspray, and minimized material waste. These operational benefits are attracting substantial investments across the furniture, automotive, and metal-intensive manufacturing sectors.

The automotive refinishing sector has emerged as a particularly critical application area, especially within aftermarket repair and professional detailing services. HVLP systems are increasingly preferred for delivering high-quality finishing results while maintaining compliance with stringent local environmental standards. Both original equipment manufacturers (OEMs) and independent body shops are transitioning to HVLP technology to align with emerging sustainability mandates and regional regulatory requirements.

Gravity Feed Systems Dominate Market Landscape

Gravity feed HVLP spray guns command the leading market position with a 36.9% market share in 2025, driven by superior efficiency in fluid delivery and control. These systems have achieved widespread adoption across automotive refinishing, industrial coating lines, and woodworking applications, offering exceptional transfer efficiency and minimal material waste while meeting global VOC compliance standards.

The gravity feed design, featuring top-mounted paint cups that ensure consistent gravity-driven flow without requiring pressure tanks or siphon mechanisms, continues to drive market leadership. As sustainability and coating precision remain paramount priorities, gravity feed systems are expected to maintain their dominant position. Their adaptability to robotic applications and ongoing ergonomic improvements sustain robust demand across manufacturing centers worldwide.

Siphon feed HVLP spray guns are projected to grow at an impressive 9.4% CAGR, while pressure feed, electrostatic, and low-inlet-pressure variants address specialized application requirements across diverse industrial segments.

Regional Market Dynamics and Growth Leaders

The HVLP spray gun market exhibits distinctive regional growth patterns reflecting varying levels of industrialization, regulatory frameworks, and manufacturing capabilities. The United States leads with a projected 9.5% growth rate, maintaining its position as the engineering backbone of HVLP innovation. American manufacturers dominate the market with advanced turbine-based HVLP systems and electrostatic enhancements widely deployed across automotive finishing, aerospace coating, and consumer applications.

Germany follows closely at 9.0% growth, leveraging its renowned engineering heritage and regulatory leadership in low-emission technologies. German HVLP products are synonymous with precision atomization, ergonomic design, and durable systems that meet demanding industrial-scale requirements. The nation’s stringent VOC reduction goals and sustainability priorities drive robust domestic demand while supporting premium export markets.

Japan demonstrates strong growth at 9.1%, driven by miniaturized engineering excellence and advanced fluid systems expertise. Japanese manufacturers have refined nozzle precision and airflow calibration, making their products particularly well-suited for electronics manufacturing, automotive detailing, and compact industrial applications. The focus on portable, energy-efficient devices continues to drive innovation in ergonomic equipment and multi-purpose spray systems.

Technology Segmentation and Innovation Trends

The market segments across multiple technology platforms, with turbine-driven HVLP systems maintaining strong positions alongside compressor-driven alternatives. Emerging technologies including digital control HVLP, automated systems, and hybrid HVLP-LVLP (Low Volume Low Pressure) configurations are gaining traction, particularly in high-precision manufacturing environments requiring advanced process control and monitoring capabilities.

In manufacturing-intensive economies, HVLP spray guns are rapidly displacing conventional air spray systems. The technology offers distinct advantages through compatibility with both water-based and high-solid coatings. Additionally, automation-compliant models featuring electrostatic enhancements are driving implementation in sophisticated robotic paint booths, particularly across Asia Pacific and North American manufacturing sectors.

Application Diversity Supports Market Expansion

HVLP spray gun adoption spans diverse application segments, with automotive finishing representing a primary growth driver. Industrial and commercial painting applications account for substantial market share, while woodworking and furniture finishing, aerospace coating, and marine coating segments demonstrate steady growth. Other specialty applications continue to emerge, reflecting the technology’s versatility and performance advantages.

The industrial coating sector benefits from HVLP technology’s ability to deliver consistent, high-quality finishes while reducing material consumption and environmental impact. Furniture manufacturers particularly value the systems’ capability to achieve superior wood finishes with enhanced efficiency, supporting both production volume requirements and quality standards.

Distribution Strategy and Market Access

Direct sales channels anchor brand control and technical enablement within the HVLP spray gun market. This distribution model remains critically important as manufacturers seek to maintain pricing integrity, provide comprehensive training programs, and deliver customization capabilities. Brands align closely with end-user technical standards and regional compliance requirements through dedicated in-house teams and certified dealer networks.

The direct sales approach proves particularly effective in industrial coating applications, where procurement decisions prioritize post-sale service quality, calibration options, and parts availability. As HVLP systems grow increasingly sophisticated, direct sales channels enable value-based interactions that indirect distribution cannot replicate effectively. Leading manufacturers are expanding demonstration facilities and online platforms to strengthen direct customer engagement in international markets.

Market Challenges and Strategic Considerations

Despite robust growth prospects, the HVLP spray gun market faces several challenges. High initial capital costs present barriers for small-scale manufacturers, who often opt for lower-cost alternatives despite higher long-term operational expenses. This cost sensitivity particularly impacts market penetration in Southeast Asia and Latin America.

Compatibility limitations with high-viscosity coatings represent another constraint. While HVLP systems deliver excellent transfer efficiency, their low-pressure design can prove less effective with certain formulations, requiring pre-thinned materials or pressure feed systems. This reduces operational versatility in environments applying multiple coating types simultaneously.

Technological fragmentation also poses challenges as OEMs introduce proprietary spray mechanisms and turbine configurations, resulting in standardization gaps. Maintenance complexity, spare parts availability, and technician training requirements become more demanding and costly, potentially limiting large-scale industrial adoption where consistency and scalability prove essential.

Competitive Landscape and Key Players

The HVLP spray gun market features a competitive landscape divided between high-end branded manufacturers and cost-competitive regional players. Innovation leaders differentiate through superior nozzle precision, optimized transfer efficiencies, and ergonomic system designs tailored to specific industry requirements. The industry’s transition toward automated and eco-efficient painting systems is intensifying R&D investments focused on airflow control optimization and enhanced material compatibility.

Key market participants include Apollo Sprayers International, Inc., DeVilbiss Automotive Refinishing, Graco Inc., Binks (Carlisle Fluid Technologies), Fuji Spray, Wagner SprayTech, SATA GmbH & Co. KG, Iwata, Walcom, C.A. Technologies, AirVerter, Lex-Aire, Lemmer Spray Systems, and Asturo. Procurement trends are shifting toward value-based contracts emphasizing lifecycle costs, comprehensive after-sales support, and robust warranty programs.

Competition is intensifying particularly in the Asia Pacific region, where local manufacturers offer competitively priced systems, prompting international brands to localize operations, establish training partnerships, and develop bundled service agreements to maintain market position.

Recent Product Innovations

Recent market developments highlight ongoing innovation momentum. In August 2024, Fuji Spray introduced the Diamond Series D6, a six-stage HVLP system delivering 11.5 psi with six pre-set pressure settings and a cool-running motor promising extended service life and efficient atomization of thick finishes with minimal overspray.

In March 2024, Apollo Sprayers debuted the Precision-6 Pro, a six-stage TrueHVLP turbine system designed to atomize high-viscosity coatings without thinning. The Vista, California-based specialist emphasized the unit’s 11.5 psi output, dual-air filtration, and comprehensive performance monitoring capabilities, making it ideal for professional woodworkers seeking reduced overspray and accelerated project completion.

Browse Full Report: https://www.factmr.com/report/hvlp-spray-guns-market

Future Outlook and Market Opportunities

The HVLP spray gun market’s trajectory signals fundamental shifts in coating technology adoption and surface finishing standards worldwide. As environmental regulations continue tightening and manufacturing precision requirements escalate, HVLP technology is positioned to capture expanding market share across both established and emerging industrial sectors.

The convergence of sustainability imperatives, technological advancement, and manufacturing automation creates compelling opportunities for market participants who can deliver integrated solutions combining superior equipment performance, comprehensive technical support, and demonstrated environmental compliance capabilities.