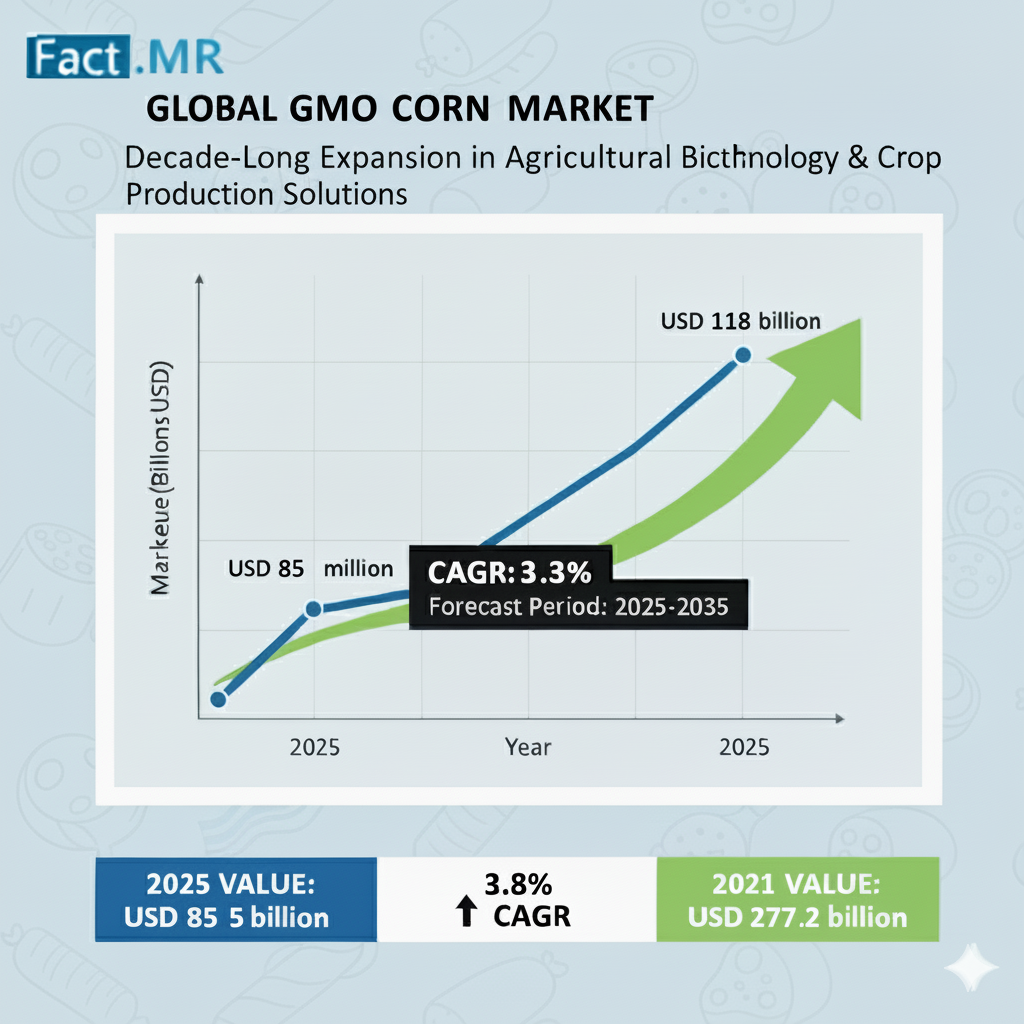

The GMO corn market stands at the threshold of a decade-long expansion trajectory that promises to reshape agricultural biotechnology and crop production solutions. The market’s journey from USD 85 billion in 2025 to USD 118 billion by 2035 represents substantial growth, the market will rise at a CAGR of 3.3% This upward trajectory underscores the growing importance of genetically modified seed technology in enhancing crop productivity, resilience, and global food security.

Growth Outlook and Market Evolution:

The market’s first growth phase, spanning 2025–2030, will witness value expansion from USD 85 billion to USD 100 billion, adding USD 15 billion or 45% of the decade’s total forecasted growth. This acceleration is attributed to the rising adoption of herbicide-tolerant traits, which now command a 44% share of total market value, supported by advancements in multi-herbicide resistance and integrated farm management systems.

Between 2030 and 2035, the GMO corn market is forecasted to expand from USD 100 billion to USD 118 billion, contributing the remaining 55% of decade-long growth. This phase will see the mainstreaming of stacked trait technologies, advanced breeding platforms, and deep integration with digital agriculture and precision farming ecosystems—transforming crop protection into a data-driven science.

Market Structure and Trait Segmentation:

The GMO corn market is defined by three primary trait segments:

- Herbicide Tolerance (44%) – Leading the market with enhanced weed resistance, glyphosate compatibility, and farm efficiency optimization.

- Insect Resistance (37%) – Driven by Bt protein-based pest management systems offering sustainable, biological control.

- Stacked Traits (19%) – Combining multiple benefits for premium agricultural systems, high-performance yield, and sustainability integration.

As the market matures, advanced stacked traits are expected to capture 25–30% market share by 2030, reflecting the industry’s shift toward multi-trait combinations and stress-resilient hybrids that deliver measurable performance advantages under varying climatic conditions.

Application Landscape: Feed Takes the Lead:

Feed applications currently represent 52% of total market demand, underscoring the crucial role of GMO corn in livestock nutrition and animal productivity. Feed corn continues to dominate as global protein demand rises, particularly in North America, Western Europe, and East Asia, where livestock industries increasingly rely on genetically enhanced feed crops.

Food applications hold 32% of market share, driven by demand for corn-based food ingredients and processing-grade varieties that meet human consumption and nutritional standards. Meanwhile, industrial applications such as ethanol production and starch manufacturing account for 16%, supported by bioenergy growth and agricultural modernization.

Regional Dynamics: North America Leads, Asia Accelerates:

- North America remains the global leader, with the United States commanding a 3.6% CAGR, driven by robust seed innovation, farmer adoption programs, and established biotechnology infrastructure.

- Europe follows with a projected increase from USD 18.5 billion in 2025 to USD 25.2 billion by 2035 (3.1% CAGR). Germany dominates with a 31.2% share, while the UK (26.8%) leverages post-Brexit flexibility to enhance GMO approvals and agricultural R&D.

- East Asia is emerging as the fastest-developing biotechnology hub. Japan (2.4%) and South Korea (2.5%) are investing in feed applications and agricultural research collaborations.

- Mexico (3.1%) showcases rapid modernization, integrating GMO corn into smallholder and industrial-scale farming systems, aligning with government-backed food security programs.

Distribution Channels and Market Access:

Seed retailers dominate with a 58% share, offering farmers access to high-performance hybrids and agronomic support services. This segment’s success stems from local presence, technical expertise, and farmer trust, making it the preferred distribution route for both global and regional seed companies.

Competitive Landscape:

The global GMO corn market is consolidated, with 8–12 credible players controlling 70–75% of revenue. Market leadership is driven by trait innovation, regulatory stewardship, and global distribution strength.

Key players include:

- Bayer (Dekalb) – Leading with herbicide-tolerant and stacked trait innovation.

- Corteva – Pioneering advanced seed genetics and climate resilience.

- Syngenta – Offering integrated pest management and trait reliability.

- KWS and Limagrain – Strengthening regional portfolios and sustainable breeding programs.

Emerging players like Land O’Lakes, Advanta, and Rallis are expanding market reach through partnerships, seed retail networks, and farmer engagement initiatives.

Strategic Imperatives for Industry Leaders:

To remain competitive, manufacturers and agri-biotech firms must focus on:

- Sustainability-first design – Integrating GMO innovation with agronomic support, resistance management, and stewardship.

- Regulatory readiness – Establishing harmonized safety and environmental compliance frameworks across regions.

- Value demonstration – Offering clear ROI through yield transparency, performance guarantees, and digital integration.

- Market localization – Adapting global technologies to regional agronomic and regulatory environments.

Conclusion: Redefining Agricultural Biotechnology:

The decade ahead positions the GMO Corn Market as a cornerstone of global food and feed security. With robust technological pipelines, expanding trait portfolios, and increasing digital-farming adoption, industry leaders are poised to capture value across feed, food, and industrial applications.

Manufacturers investing in stacked traits, climate-resilient hybrids, and precision agriculture compatibility will be best positioned to lead this transformation—reshaping how the world grows, feeds, and sustains its future.

Browse Full Report-https://www.factmr.com/report/424/gmo-corn-market