The global wear-resistant steel plate market is projected to experience significant growth over the next decade, fueled by increasing industrialization, the expansion of infrastructure projects, and technological advancements in steel manufacturing. According to a recent analysis, the market is expected to reach USD 12.3 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030.

Wear-resistant steel plates, known for their high hardness, durability, and resistance to abrasion and impact, are critical materials in industries such as mining, construction, oil & gas, and heavy machinery. These plates are increasingly preferred for applications where extended service life and minimal maintenance are required, reducing overall operational costs.

Market Dynamics Driving Growth

The primary driver for the market is the surge in infrastructure and construction activities, particularly in emerging economies such as India, China, and Brazil. For instance, India’s government has allocated over USD 1 trillion for infrastructure projects by 2030, directly boosting demand for wear-resistant steel plates in highways, bridges, and urban development projects.

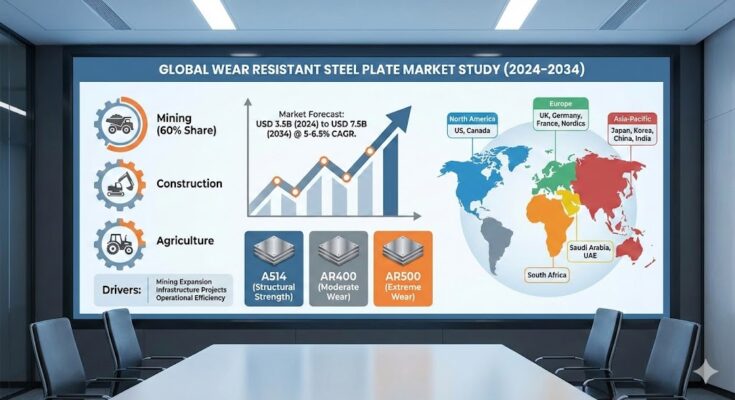

In addition, the mining sector continues to be a major consumer. According to the World Mining Data Report 2023, global mineral extraction increased by 4.5% year-on-year, necessitating robust and wear-resistant materials for equipment such as crushers, conveyors, and hoppers.

Technological advancements in steel production, such as the development of hardox-type high-strength steels and innovations in heat treatment processes, are further propelling market growth. These innovations improve abrasion resistance while maintaining machinability, offering a more efficient solution for heavy-duty applications.

Market Segmentation Insights

The wear-resistant steel plate market can be segmented by type, thickness, and end-user industry:

-

By Type: AR400, AR500, Hardox, and Customized Grades. AR500 steel plates dominate the market due to their superior hardness and widespread usage in industrial applications.

-

By Thickness: <6mm, 6-25mm, 26-50mm, and >50mm. Plates in the 6-25mm range account for over 40% of the market share, balancing durability with ease of fabrication.

-

By End-User Industry: Mining, Construction, Oil & Gas, Manufacturing, and Others. The mining sector remains the largest end-user, contributing approximately 38% of global consumption, while construction is rapidly emerging as a key segment.

Regional Outlook

Asia-Pacific dominates the global wear-resistant steel plate market, accounting for over 45% of total consumption in 2023. China, India, and Japan are the leading contributors, driven by heavy investments in industrial and infrastructure development. North America and Europe are witnessing steady growth, propelled by modernization projects and the replacement of aging equipment in industrial sectors.

Competitive Landscape

The market is highly competitive, featuring key players such as SSAB AB, ArcelorMittal, Tata Steel, Baosteel Group, and Voestalpine AG. Companies are increasingly focusing on strategic partnerships, capacity expansions, and technological innovations to capture a larger market share. For instance, SSAB recently launched a new ultra-hard steel grade, designed to reduce maintenance cycles in the mining industry by up to 20%.

Industry Challenges

Despite robust growth, the market faces challenges such as high raw material costs, fluctuating steel prices, and stringent environmental regulations. Companies are addressing these concerns by investing in eco-friendly manufacturing processes, recycling programs, and optimizing supply chains to reduce operational costs.

Browse Full Report : https://www.factmr.com/report/522/wear-resistant-steel-plate-market

Future Outlook

The wear-resistant steel plate market is expected to continue its upward trajectory, driven by urbanization, industrial automation, and adoption of advanced materials. Analysts project that increasing demand for customized steel solutions will open new avenues for manufacturers, particularly in high-wear industrial applications such as cement plants, sugar mills, and metal recycling industries.

By 2030, Asia-Pacific is expected to maintain dominance, while North America and Europe will gradually grow through innovative steel grades and aftermarket services. Additionally, digitalization in steel manufacturing, including AI-driven quality control and predictive maintenance, is likely to enhance product reliability and customer satisfaction.

Expert Insights

“Wear-resistant steel plates are no longer just a commodity product; they are strategic industrial assets,” said Dr. Lisa Morgan, Industry Analyst at Global Steel Insights. “The combination of technological innovation, sustainable production methods, and global industrial expansion will redefine the steel landscape over the next decade.