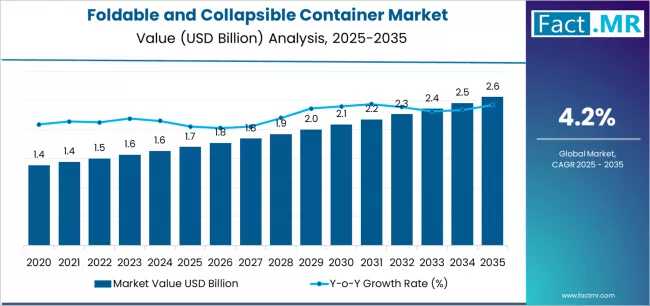

A new market analysis report reveals that the global foldable and collapsible container market is projected to grow from a valuation of US$ 1.70 billion in 2025 to US$ 2.56 billion by 2035, at a steady Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period.

This growth reflects a rising wave of demand across manufacturing, e‑commerce, logistics, and warehousing sectors — as companies increasingly adopt efficient, reusable, and space‑saving container solutions to optimize supply chains, reduce transportation costs, and support circular‑economy initiatives.

Market Overview & Key Drivers

The increase of US$ 0.86 billion in total market value over the next decade is driven by multiple converging trends:

-

Logistics optimization needs: As global supply chains grow more complex, businesses are turning to foldable/collapsible containers for cost-effective transport, warehousing, and returnable packaging.

-

E‑commerce boom & warehousing expansion: Rapid growth in online retail and e‑commerce fulfillment — especially in Asia Pacific and emerging markets — has spurred demand for efficient, reusable containers to support high-volume distribution operations.

-

Sustainability & circular economy focus: Rising environmental awareness, waste-reduction policies, and corporate ESG commitments encourage adoption of reusable and returnable containers over single-use packaging alternatives.

-

Technological innovation & container design improvements: Manufacturers are investing in lightweight materials, durable plastic composites, and standardized collapsible bulk bin designs that improve container lifecycle, handling efficiency, and space utilization.

Many supply‑chain operators realize 60–75% volume reduction when containers are collapsed, making foldable containers an economic and operationally attractive solution for returnable packaging and reverse‑logistics systems.

Market Segmentation: Materials, Product Types & End Uses

Materials

-

Plastic dominates, capturing 53.0% of the total market share in 2025.

-

Plastic’s dominance stems from its lightweight nature, cost-effective production, corrosion resistance, ease of cleaning, and suitability across multiple logistics applications.

-

Metal containers remain significant for heavy-duty applications, carrying roughly 22.0% market share, especially where high load capacity and durability are critical (e.g., industrial parts, automotive components).

-

The remaining share is held by wood and other materials, often used in specialized or traditional packaging applications.

Product Types

-

Bulk bins lead adoption with a 25.0% share in 2025 — widely used in industrial logistics, automotive parts distribution, and manufacturing supply chains where large-volume, returnable containers are essential.

-

Crates, pallets, boxes, cartons, and other container types serve use cases in retail distribution, food & beverage logistics, pharmaceuticals, and general warehousing.

End‑Use Industries

-

The industrial & automotive sector is the largest consumer, representing approx. 31.0% of the market in 2025 — driven by parts distribution networks, just-in-time delivery systems, and high-volume manufacturing logistics.

-

The pharmaceutical & chemical sector accounts for around 20.0%, reflecting demand for compliant, reusable containers suited for regulated goods, contamination-sensitive products, and chemical handling/distribution.

-

Other applications — including food & beverage, construction & building materials, and general logistics — also contribute notably, particularly where space-saving and reuse value matter.

Regional Growth: Spotlight on Asia Pacific & India

Key growth regions through 2035 include Asia Pacific, North America, and Europe.

-

India is singled out with a robust projected CAGR of 4.8%, just behind China at 5.1%.

-

Growth in India is being driven by rapid expansion in warehousing infrastructure, accelerated e-commerce fulfillment operations, retail distribution network growth, and logistics modernization efforts.

-

Across Asia Pacific, increasing adoption of returnable packaging, sustainable logistics practices, and pooling/return-logistic systems underpin steady market penetration.

North America and Europe are also expected to grow, albeit at slightly lower regional CAGRs — driven mainly by regulatory momentum around sustainability, container reuse programs, and logistics automation investments.

Market Outlook: Key Trends & Future Opportunities

From 2025 to 2030, the market is expected to rise from US$ 1.70 b to US$ 2.08 b, capturing about 44% of total forecast growth. During this phase, momentum will be driven by demand for returnable packaging, lightweight collapsible bulk-bin designs, and growing warehouse automation.

Between 2030 and 2035, growth will accelerate further — from US$ 2.08 b to US$ 2.56 b — accounting for the remaining 56%+ of total expansion. This second phase is expected to see:

-

Widespread deployment of specialized container derivatives — customized load-capacity bins, collapsible designs tailored for specific sectors (e.g., pharmaceuticals, automotive, retail).

-

Strategic collaborations between container manufacturers and logistics service providers, aiming to deliver container pooling, tracking, and reusable-packaging services globally.

-

Growing emphasis on sustainable packaging, carbon footprint reduction, and circular-economy compliance, boosting demand for returnable containers over disposable alternatives.

Technological adoption trends — such as RFID-enabled container tracking, IoT integration, and modular container designs — are likely to accelerate container management efficiency, traceability, and lifecycle management across supply chains.

Challenges & Market Restraints

Despite positive growth prospects, certain challenges could temper adoption speed, especially among smaller logistics providers or in regions with limited infrastructure. Key constraints include:

-

Volatility in raw material costs (e.g., plastic resins, metals), which can increase manufacturing costs and complicate rental or pooling pricing strategies.

-

Capital investment requirements for container-pooling systems, reverse logistics, and tracking infrastructure, which may deter smaller or resource-constrained players.

-

Standardization and compatibility limitations, as containers must meet dimension, strength, and compliance standards. Lack of uniformity across regions can hinder adoption and interoperability.

-

Operational complexity in container pooling & reverse logistics, including tracking, cleaning, maintenance, and lifecycle management, which can be resource-intensive and logistically challenging.

Widespread adoption will likely favor larger logistics operators, manufacturing companies, and e-commerce firms capable of investing in pooling infrastructure and long-term returnable packaging strategies.

Market Winners & Competitive Landscape

The market comprises around 25–35 significant players globally, with the top three firms controlling approximately 20–25% of global production capacity.

Key industry players include:

-

Schoeller Allibert

-

WestRock Company

-

A B Sea Container Private Limited

-

Other notable firms: Vinsum Axpress, Spectainer, SAHAY RACKS, Flexible Packaging Solutions, Logimarkt, CHEP, Flex Container, RPP Containers, Corplex

These companies are investing in product innovation, durable material development, container-pooling services, and global distribution networks to capture growing demand — especially as companies increasingly prioritize returnable packaging, circular economy compliance, and logistics cost-efficiency.

What This Means for Stakeholders

For logistics providers, e-commerce companies, manufacturers, and distributors, the projected growth represents a clear signal to invest in returnable container systems to capture long-term cost savings, reduce environmental impact, improve warehouse utilization, and streamline distribution.

For container manufacturers and service providers, the demand trajectory opens opportunities to design specialized, high-performance, collapsible containers tailored for sectors such as automotive, pharmaceuticals, retail, food & beverage, and chemical distribution — especially with added value via tracking, pooling, and lifecycle management services.

For policy-makers and supply-chain regulators, the shift toward reusable packaging and circular economy practices offers tangible pathways to reduce packaging waste, optimize logistics operations, and promote sustainable industrial and retail distribution practices worldwide.

Browse Full Report : https://www.factmr.com/report/foldable-and-collapsible-container-market

This data is drawn from the comprehensive industry report titled “Foldable and Collapsible Container Market: Size and Share Forecast Outlook 2025 to 2035.”

The report provides a granular analysis of market size and forecasts, segmentation by material, product type, end use, and region, competitive landscape, growth drivers and restraints, and long-term outlook — offering actionable insights for businesses, investors, and supply-chain stakeholders.