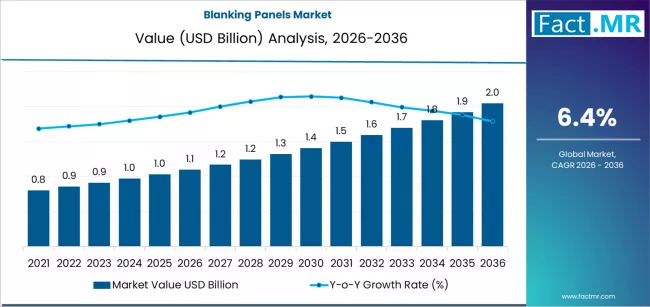

The global blanking panels market is poised for robust expansion through 2036, unlocking significant opportunities for manufacturers, distributors, and technology integrators across data centers, enterprise networks, and evolving infrastructure ecosystems. The global industry is projected to nearly double in value from 2026 to 2036, underpinned by a growing emphasis on thermal management, energy-efficiency, and network optimization strategies across industries.

Market Size & Long-Term Growth Outlook

-

2026 Market Value: ~USD 1.1 billion

-

2036 Forecast Value: ~USD 2.0 billion

-

Compound Annual Growth Rate (CAGR): ~6.4% (2026–2036)

The market’s growth at a 6.4% CAGR reflects sustained investment in rack-level airflow management and enclosure optimization, particularly in data facilities where cooling efficiency is a top operational priority.

Key Market Drivers

1. Rising Demand for Enhanced Cooling & Airflow Management

Blanking panels are an integral part of modern rack systems, preventing unwanted airflow through unused spaces to improve cooling efficiency, reduce energy consumption, and lower operating costs—a core driver for adoption in high-density facilities.

2. Acceleration of Data Center Construction & Retrofit Projects

Deployment in data centers and enterprise server rooms accounts for the lion’s share of demand (~59% of total market), as operators prioritize thermal containment strategies in both greenfield and existing facilities.

3. Operational Efficiency Priorities in Network Infrastructure

Network planners and facility engineers increasingly mandate blanking panels to support predictable temperature control, compliance goals, and sustainable cooling targets, driving standardized deployment across racks.

4. Innovations Driving Product Differentiation

Emerging high-performance designs, modular snap-in mechanisms, and specialized brush/pass-through variants enable more efficient installations and better cabling management, forcing product evolution in the market.

Segment Analysis: What’s Fueling Demand?

Panel Type

-

Toolless Snap-In Panels: Dominant category with ~46% share due to quick installation and operational flexibility.

-

Screw-Mount & Brush Panels: Serve specialized applications where rigid fixation or cable management is required.

End Use

-

Data Centers & Enterprise Server Rooms: Commanding segment (~59% share) reflecting crucial need for effective thermal containment and airflow management.

-

Telecom Sites & Other Industrial Users: Growing adoption as equipment density increases.

Sales Channels

-

Direct OEM Bundles, IT/Network Distributors, E-Commerce: Highlighting diverse purchaser preferences and the strategic importance of both traditional and digital supply channels.

Regional Dynamics & Growth Opportunities

Analysts identify Asia Pacific, North America, and Europe as key drivers of market growth, with notable country-level trends:

| Country | Projected CAGR (2026–2036) |

|---|---|

| India | ~8.4% (fastest-growing) |

| China | ~7.8% |

| UAE | ~7.3% |

| Saudi Arabia | ~7.0% |

| Singapore | ~6.7% |

| U.S. | ~4.5% |

| Germany | ~3.6% |

| Japan | ~3.1% |

India’s rapid data center expansion, supportive regulatory frameworks for energy efficiency, and strong demand for advanced network infrastructure position it as a strategic opportunity market. Similarly, China’s connectivity build-out and Middle East digital infrastructure investments sustain elevated growth rates.

Competitive Landscape

The global blanking panels market exhibits healthy competition, driven by established players and evolving value-added offerings:

-

Key Companies: Chatsworth Products, Schneider Electric, Rittal, Vertiv, Panduit, Legrand, Eaton, nVent, Siemon, Tripp Lite.

Leading suppliers are investing in product innovation, global distribution networks, and custom airflow solutions, strengthening their positions in a market where performance and reliability are paramount.

Emerging Opportunities & Strategic Insights

1. Modular & Smart Installations

Product designs emphasizing tool-free installation and modular adaptability are enabling faster deployment across diverse environments, reducing downtime and labor costs.

2. Sustainability & Energy Efficiency

With global emphasis on minimizing carbon footprints, blanking panels support energy-efficient cooling strategies, especially in high-power data facilities.

3. Broader Industrial Application

Beyond data centers, blanking panel adoption is increasing in telecommunications, industrial control rooms, and smart manufacturing facilities, reflecting broader infrastructural modernization.

4. Market Entry & Expansion

For new entrants, India and Asia Pacific present high-growth terrain with favorable CAGR prospects and expanding digital infrastructure spend.

Browse Full Report : https://www.factmr.com/report/blanking-panels-market

Outlook Summary

The global blanking panels market is positioned for sustained growth through 2036, supported by increasing digital infrastructure demands, cooling efficiency imperatives, and technological innovations. With an expanding competitive landscape and diverse application use cases, stakeholders from OEMs to system integrators are presented with actionable opportunities to scale solutions into rapidly evolving global markets.