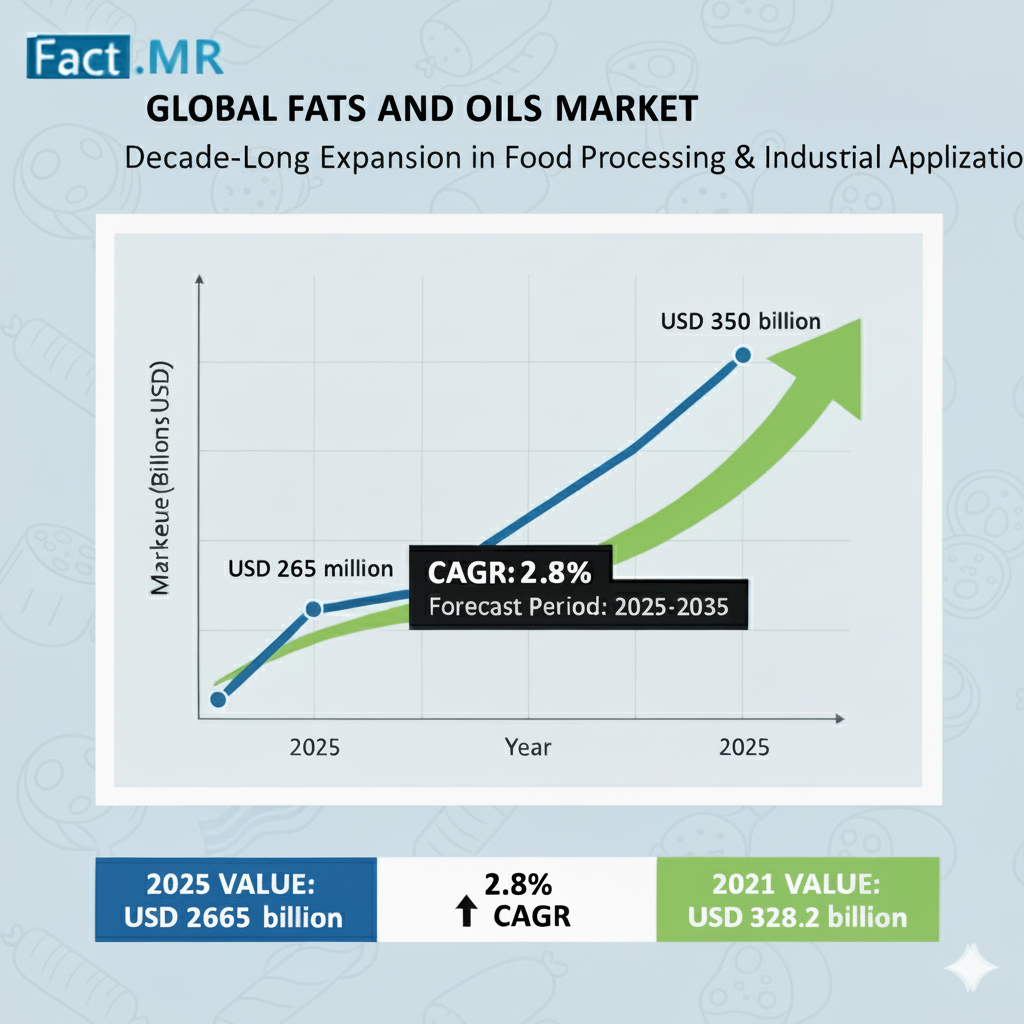

The fats and oils market stands at the threshold of a decade-long expansion trajectory that promises to reshape food processing and industrial applications solutions. The market’s journey from USD 265 billion in 2025 to USD 350 billion by 2035 represents substantial growth, the market will rise at a CAGR of 2.8% which demonstrating the accelerating adoption of vegetable oil technology and lipid optimization across food manufacturing facilities, industrial processing operations, and global commodity markets. This expansion reflects a new era in food processing technology, sustainable lipid innovation, and renewable industrial applications—defining a marketplace where versatility, quality, and environmental responsibility converge.

Market Transformation: From Commodity to Capability:

The first half of the forecast period (2025–2030) is projected to add approximately USD 40 billion in market value, driven by the rapid adoption of vegetable oil systems, sustainability mandates, and the modernization of food processing infrastructure across North America, Western Europe, and East Asia.

Between 2030 and 2035, an additional USD 45 billion in value will be realized as manufacturers accelerate the integration of certified sustainable oil systems, carbon-neutral production facilities, and traceable supply networks.

By 2035, vegetable oils will represent 71% of total market share, confirming their dominance as the preferred lipid system for food processors and industrial operators. Meanwhile, animal fats (29%) continue to hold relevance in specialty and artisanal food applications where authentic flavor and texture remain priorities.

Why Manufacturers Are Paying Attention:

The Shift to Sustainable Production: Sustainability is now a decisive differentiator. The next five years will see 75–80% of all vegetable oils sourced from certified sustainable or traceable origins, transforming procurement models across the industry. Manufacturers are expected to adopt non-GMO, organic, and carbon-neutral oil systems, coupled with full supply chain transparency and ESG compliance reporting.

Food Safety as a Non-Negotiable Standard: With increasing regulatory scrutiny, food processors are prioritizing comprehensive testing protocols, contamination control, and food-grade certifications. These measures not only enhance safety and quality but also strengthen brand integrity in global markets.

Diversification Across Industrial and Renewable Applications: Beyond food, the fats and oils sector is gaining momentum in biofuel and industrial applications, which together account for nearly 30% of total market utilization. Biodiesel demand is projected to grow 16–18% over the next decade, supported by renewable energy mandates and carbon reduction policies worldwide.

Supply Chain Reliability as a Competitive Edge: Global commodity traders such as Cargill, ADM, and Bunge are leveraging their scale to ensure sourcing resilience. Advanced logistics, multi-origin sourcing, and data-backed traceability are now core pillars of industry competitiveness, mitigating volatility from geopolitical or environmental disruptions.

Regional Market Highlights:

United States (3.2% Growth Rate): The U.S. leads the global market through advanced food processing programs and integrated biofuel infrastructure. Over 75% of food manufacturers utilize fats and oils in production, supported by strong agribusiness capabilities in Iowa, Illinois, and California.

Germany (2.6% Growth Rate): Germany remains the epicenter of sustainable sourcing, with 72% annual growth in certified oil utilization. Manufacturers in Bavaria and North Rhine-Westphalia are integrating environmentally compliant oil systems aligned with EU sustainability directives.

United Kingdom (2.3% Growth Rate): The UK emphasizes food innovation and sustainable sourcing, with leading global commodity firms (Cargill, ADM, Bunge) maintaining premium positions. Local processors are focusing on certified oil systems for retail and industrial applications.

France (2.5% Growth Rate): France’s market reflects its culinary excellence, prioritizing premium oil systems for gastronomy and high-end food processing. Partnerships between French culinary institutions and international oil producers are enhancing product quality and regulatory compliance.

Japan (2.2% Growth Rate): Japan’s fats and oils market emphasizes premium quality, purity, and technology integration, reflecting the country’s advanced culinary and food manufacturing standards.

Mexico (3.0% Growth Rate): Mexico represents an emerging hub for industrial modernization and food manufacturing expansion, supported by government-led agricultural initiatives and new processing infrastructure investments.

Segmental Insights: Where the Opportunities Lie:

Product Outlook:

- Vegetable Oils– Dominant due to sustainability, versatility, and compatibility across food and industrial applications.

- Animal Fats– Retain niche demand for traditional flavor and texture in culinary industries.

Application Outlook:

- Food Processing– Represents 64% of total market value, driven by the global shift toward processed foods.

- Industrial Use– 22% market share, encompassing cosmetics, lubricants, and manufacturing sectors.

- Biodiesel– 14% share, powered by renewable energy transitions and eco-policy frameworks.

Distribution Channels:

- B2B Bulk Sales– 82% market share, reflecting industrial demand for high-volume, cost-optimized supply solutions.

- Retail Packaged Oils– 20–22% share, driven by growing consumer interest in healthy, branded oil products.

Innovation:

The fats and oils industry is moderately consolidated, with 10–15 major players controlling nearly half of total global revenue. Key participants—Cargill, ADM, Bunge, Wilmar, COFCO, Olam, Louis Dreyfus, Savola, Sime Darby, and AAK—are expanding portfolios into sustainable sourcing, specialty formulations, and traceable oil systems to enhance value margins.

The market’s future belongs to those who can combine scale, sustainability, and specialization—offering customers not just oil, but integrated processing solutions, traceability frameworks, and supply reliability.

Final Word: Redefining Lipid Value in a Sustainable Future:

The fats and oils market is no longer a commodity business—it is an innovation-driven ecosystem where food technology, sustainability, and performance optimization converge. As the industry evolves toward traceable, certified, and multi-application lipid systems, manufacturers and investors have a clear opportunity:

to lead the next decade of global food and industrial transformation through advanced oil technology and sustainable supply chain integration.

Browse Full Report-https://www.factmr.com/report/410/fats-oils-market