The electric vehicle (EV) revolution is entering a decisive scale-up phase, and printed circuit boards (PCBs) are emerging as one of the most strategic components enabling this transition. As EV architectures evolve toward software-defined vehicles, high-voltage electrification, advanced driver assistance systems (ADAS), and centralized computing, demand for Xpedition-style scalable PCB platforms—modular, high-density, and simulation-driven design ecosystems—has accelerated sharply. Looking ahead to 2036, the EV PCB market is set to transform in both value and complexity, reshaping competitive dynamics across regions and suppliers.

Market Size and Growth Outlook to 2036

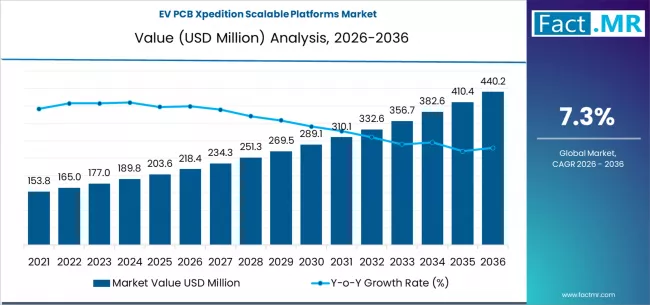

The automotive PCB market is projected to grow from approximately USD 7.6 billion in 2024 to nearly USD 11.9 billion by 2030, reflecting a CAGR above 7%, largely driven by EV and hybrid platforms. Within this, PCBs dedicated specifically to electric vehicles—including battery management systems (BMS), power electronics, inverters, and onboard chargers—are forecast to reach USD 4.4 billion by 2035, expanding at around 8.5% CAGR.

Extrapolating these trajectories, the EV PCB Xpedition Scalable Platforms segment—which integrates advanced PCB design, digital twins, and manufacturing optimization—could surpass USD 6–7 billion by 2036, as OEMs increasingly standardize on scalable electronics architectures across vehicle lines.

Strategic Benchmarking: OEMs and Tier-1 Suppliers

From a competitive standpoint, benchmarking reveals a clear split between platform leaders and cost-driven followers:

-

Global OEMs and Tier-1 suppliers (notably in East Asia, Germany, and the U.S.) are prioritizing multilayer, HDI, and flexible PCBs designed using advanced electronic design automation (EDA) platforms such as Siemens Xpedition. These players focus on lifecycle cost reduction, faster time-to-market, and compliance with functional safety standards.

-

Emerging suppliers in Southeast Asia and Eastern Europe are competing aggressively on price, often supplying 4–8 layer rigid PCBs for entry-level EVs and two-wheelers, but with limited adoption of scalable design platforms.

Companies using integrated PCB design and validation platforms report 15–25% reductions in design re-spins and up to 20% faster product development cycles, a decisive advantage as OEMs race to refresh EV models every 18–24 months.

Pricing Trends: From Cost Pressure to Value-Based Models

Pricing dynamics in the EV PCB market are undergoing a structural shift. Historically, PCB pricing has been driven by raw material costs—particularly copper, laminates, and resins. However, as EV platforms demand higher voltage tolerance, thermal stability, and signal integrity, value-based pricing is gaining traction.

-

Average prices for standard automotive PCBs remain relatively stable, increasing at only 2–3% annually.

-

In contrast, high-density interconnect (HDI) and power electronics PCBs used in EVs command premiums of 30–50%, justified by tighter tolerances and higher reliability requirements.

-

Scalable PCB platforms designed with advanced simulation and manufacturability analysis are enabling suppliers to bundle design services, IP reuse, and compliance assurance, pushing margins higher despite OEM cost pressures.

By 2036, over 60% of EV PCB contracts are expected to be negotiated on a total cost of ownership (TCO) basis rather than per-unit pricing, fundamentally altering supplier–OEM relationships.

Regional Hotspots: Where Growth Concentrates

East Asia remains the undisputed leader in EV PCB production and innovation. China alone accounts for more than 40% of global EV PCB volume, supported by aggressive EV adoption, vertically integrated supply chains, and strong domestic EDA ecosystems. Japan and South Korea continue to lead in high-reliability and advanced substrate technologies, especially for power modules and ADAS applications.

Europe is emerging as a strategic hotspot for scalable PCB platforms. Germany, France, and the Nordic countries are investing heavily in localized EV electronics manufacturing to reduce dependence on Asian imports. Western Europe is expected to see the highest incremental opportunity between 2025 and 2035, driven by premium EVs and strict regulatory requirements on safety and sustainability.

North America is regaining momentum, supported by policy incentives and investments in domestic EV supply chains. While PCB manufacturing volumes remain lower than Asia, the region excels in high-value design, software integration, and advanced EDA adoption, making it a key market for Xpedition-style scalable platforms.

Southeast Asia and Eastern Europe are rising as cost-competitive manufacturing hubs. Countries such as Vietnam, Malaysia, and Poland are attracting PCB capacity expansions, supported by favorable labor costs and proximity to major EV assembly plants.

Technology and Platform Evolution Toward 2036

The defining trend toward 2036 will be the convergence of scalable PCB platforms, digital twins, and AI-driven design optimization. As EVs incorporate centralized compute architectures and higher levels of autonomy, PCB complexity will increase significantly, with multilayer counts exceeding 20 layers in some applications.

At the same time, sustainability is becoming a differentiator. OEMs are pressuring suppliers to adopt low-loss materials, recyclable substrates, and energy-efficient manufacturing, influencing both design choices and regional sourcing strategies.

Browse Full Report : https://www.factmr.com/report/ev-pcb-xpedition-scalable-platforms-market

Outlook: A Decisive Decade Ahead

By 2036, the EV PCB Xpedition Scalable Platforms market will no longer be a niche segment—it will be a core pillar of the global EV value chain. Suppliers that combine advanced design platforms, regional manufacturing resilience, and value-based pricing will emerge as long-term winners. Conversely, players competing solely on cost risk marginalization as EV electronics complexity continues to rise.

With global PCB industry revenues projected to exceed USD 100 billion by 2030 and EVs accounting for an increasing share of that value, the strategic importance of scalable PCB platforms is set to intensify—making the road to 2036 both highly competitive and richly rewarding.