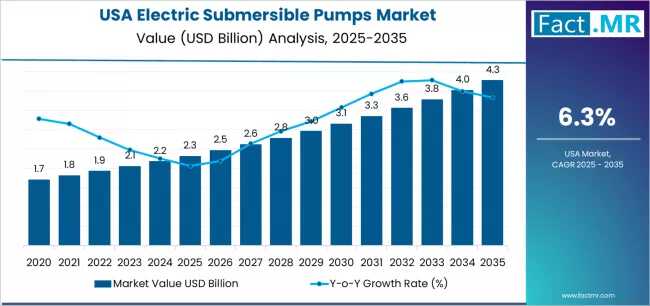

The United States electric submersible pump (ESP) market is poised for significant growth over the next decade, driven by rising industrialization, enhanced oil and gas production activities, and increasing water management initiatives. According to recent market research, the ESP market in the U.S. is projected to reach $2.8 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035.

Electric submersible pumps, widely used in oil and gas extraction, water supply systems, and industrial fluid handling, are increasingly recognized for their efficiency, durability, and ability to handle high-volume pumping applications in challenging environments. The shift toward sustainable and energy-efficient pumping solutions is further bolstering market adoption, particularly among energy-intensive industries.

Key Market Drivers

-

Rising Oil and Gas Production: The resurgence of oil production activities in shale-rich regions such as Texas and North Dakota is a primary driver of ESP demand. Operators increasingly rely on ESPs to enhance well productivity, with high-volume and high-depth wells benefiting from the technology. Market data indicates that nearly 70% of U.S. oil wells employing artificial lift systems utilize ESPs, highlighting their critical role in sustaining production efficiency.

-

Water and Wastewater Management Initiatives: Urbanization and agricultural expansion have intensified the need for efficient water pumping solutions. Municipalities and private operators are deploying ESPs in water treatment plants and irrigation systems, where the pumps’ reliability and energy efficiency are key benefits. According to the U.S. Environmental Protection Agency, water infrastructure investments are projected to exceed $100 billion by 2030, with a significant portion allocated to pumping solutions.

-

Industrial and Mining Applications: Beyond energy and water sectors, ESPs are increasingly applied in mining and chemical processing industries, handling abrasive fluids, slurry, and corrosive liquids. Technological advancements, including variable frequency drives (VFDs) and corrosion-resistant materials, are expanding the operational scope of ESPs in these sectors.

Market Segmentation and Share Insights

The U.S. ESP market is segmented by type, application, and end-use industry. In 2025, oil and gas applications dominate with a 60% share, followed by water and wastewater management at 25%, and industrial applications at 15%. Among pump types, horizontal ESPs account for 55% of the market, owing to their higher efficiency in high-volume extraction, while vertical ESPs are favored for municipal and water treatment applications due to space and installation constraints.

By region, Texas and Oklahoma lead in market adoption, driven by shale oil production and extensive industrial infrastructure. California, Florida, and New York are also witnessing increased ESP deployment, particularly in municipal water supply and wastewater management projects.

Emerging Trends Shaping the Market

-

Smart Pump Integration: Integration of IoT-enabled monitoring systems and predictive maintenance software is enhancing operational efficiency and reducing downtime. Companies investing in digital solutions are experiencing up to 20% higher operational uptime compared to conventional pumps.

-

Energy-Efficient Solutions: Rising energy costs and sustainability mandates are accelerating adoption of ESPs designed for low energy consumption, aligning with state-level renewable energy and emissions reduction initiatives.

-

Aftermarket Services Growth: With increasing ESP installations, demand for aftermarket services, including maintenance, repair, and optimization, is projected to grow at a CAGR of 5.8% over the forecast period.

Competitive Landscape

The U.S. ESP market is moderately consolidated, with key players including Schlumberger Limited, Baker Hughes Company, Halliburton Company, Flowserve Corporation, and Grundfos Pumps Corporation. These companies are investing in research and development, advanced materials, and smart pumping technologies to maintain a competitive edge. Strategic partnerships with oilfield operators and municipal authorities are also driving market penetration.

Strategic Outlook and Market Forecast

The ESP market in the U.S. is expected to exhibit steady growth from $1.7 billion in 2025 to $2.8 billion by 2035, reflecting increasing adoption across oil and gas, water management, and industrial sectors. Technological advancements, combined with favorable government policies promoting infrastructure development and industrial efficiency, are key catalysts supporting this growth.

Analysts predict that shale oil production and municipal water infrastructure projects will collectively account for over 65% of new ESP installations by 2030. Furthermore, the adoption of smart ESP systems and predictive maintenance solutions is expected to reshape market dynamics, providing a competitive advantage to manufacturers offering integrated technology solutions.

Browse Full Report :https://www.factmr.com/report/united-states-electric-submersible-pumps-market

Conclusion

The U.S. electric submersible pump market is on a clear growth trajectory, driven by industrial expansion, energy efficiency imperatives, and the critical role of ESPs in modern water and oil infrastructure. With robust market opportunities across oil, water, and industrial sectors, manufacturers and investors are well-positioned to capitalize on the rising demand for reliable, high-performance pumping solutions over the next decade.