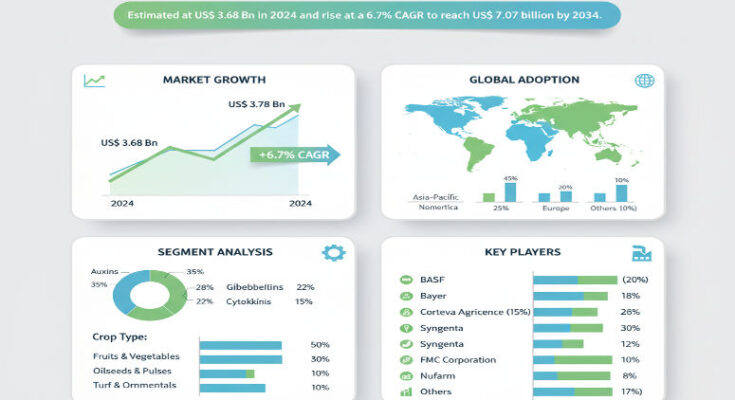

The global crop growth regulator market is entering a period of notable expansion. In 2024, it is estimated at around US$ 3.68 billion, and over the next decade it is projected to reach approximately US$ 7.07 billion by 2034, yielding a compound annual growth rate (CAGR) of about 6.7%. This growth underscores the rising importance of crop growth regulators (CGRs) as farmers and agribusinesses work to enhance yield, improve crop quality, adapt to climate challenges and satisfy tightening sustainability mandates.

Drivers of Growth: Food Security, Precision Agriculture & Sustainable Intensification

Several key factors are propelling the crop growth regulator market forward. First, escalating global food-demand pressures, shrinking arable land and increasing crop-stress conditions are prompting broad adoption of growth-regulating compounds to boost productivity. CGRs help modify plant physiology—improving nutrient uptake, stress tolerance, fruit-set, lodging control and harvest timing.

Second, the growing sophistication of agricultural practices—precision-agriculture, targeted inputs, smart farming—raises the bar for what plant-growth tools must deliver. CGRs provide an advanced layer beyond fertilisers and pesticides, allowing growers to fine-tune plant development and optimise resource efficiency.

Third, increasing regulatory and market emphasis on crop quality, uniformity, shelf-life, aesthetics (especially in fruits & vegetables) and post-harvest performance creates demand for formulators of CGRs. Growers using premium seeds or targeting export markets see CGRs as tools to differentiate and meet quality standards.

Fourth, emerging-market expansion is significant: regions such as East Asia, Southeast Asia, South America and parts of Africa are upgrading agronomic practices and moving from basic cropping to more managed systems—creating clear upside for CGR suppliers.

Segmentation Insights: Product Types & Key Applications

In terms of product type, the market subdivides into major hormone classes such as auxins, cytokinins, gibberellins, ethylene (and related regulators). Among these, auxins are projected to reach a value of about US$ 1.58 billion by 2034, indicating strong uptake. The solutions formulation type (liquid forms) dominates due to ease of use and application efficiency; for example, solutions are forecast at approximately US$ 3.9 billion by 2034.

By crop type, fruits & vegetables, cereals & grains, oilseeds & pulses, and turf & ornamentals each play a role. Fruits & vegetables emerge as a high-growth segment given the high value, premium quality requirements and multiple applications of CGRs—such as fruit setting, size control, colour and post-harvest longevity.

By function, regulators are classified as promoters (encouraging growth, fruit set, rooting) or inhibitors (dwarfing, lodging control, harvest synchronisation). Both functions contribute to the value chain: for example, lodging control in cereals or bunch-management in fruit trees.

Regional Outlook: East Asia Leads, North America Holds Strong

East Asia (including China, Japan, Korea) is forecast to attain a market value of around US$ 1.63 billion by 2034, making it the largest regional market. Growth is driven by large cropping bases, strong fruit & vegetable sectors, rising exports, intensification of agriculture and adoption of advanced inputs.

North America is forecast to capture about 24.3% of the global market share by 2034. The region’s mature cropping systems, high input-adoption rates and presence of fruit/vegetable export industries support strong demand for CGRs. For example, the U.S. sub-market is projected to grow at a ~7.2% CAGR from 2024 to 2034, reaching about US$ 783.2 million.

Other regions—South Asia, Latin America, Middle East & Africa—also present attractive growth opportunities as agricultural modernisation, export orientation, quality demands and sustainability drivers take hold.

Key Players & Competitive Landscape

The competitive arena is led by established agrochemical and specialised plant-growth companies. Major players include BASF SE, Corteva Agriscience, Syngenta Group, FMC Corporation, Bayer AG, UPL, Sumitomo Chemical Co., Ltd., among others. These companies are investing in new formulations, specialty product launches, targeted crops (e.g., high-value fruit & vegetables), and global distribution networks.

Competitive differentiation is achieved through: formulation innovation (higher specificity, lower dose, better performance under stress), brand strength with growers, integrated technical service (agronomics support), regulatory compliance, global supply presence and sustainability credentials. Strategic partnerships or acquisitions in emerging markets also bolster growth.

Challenges & Restraints

While the outlook is positive, several barriers remain. Regulatory processes for approval of new growth regulator chemistries are lengthy and costly—this slows pipeline development. Grower awareness and willingness to adopt CGRs in certain regions remain limited, especially where traditional fertiliser/pesticide use dominates. Cost sensitivity in lower-income agricultural sectors may constrain uptake of premium CGR solutions. Performance variability of CGRs—dependent on crop stage, weather, soil conditions—means growers expect strong agronomic support and clear ROI. Finally, competition from alternative agronomic inputs (e.g., biostimulants, fertilisers, new seed traits) means CGRs must continually demonstrate additional value.

Strategic Outlook & Takeaways

Looking ahead to 2034, the crop growth regulator market presents a compelling growth narrative: from US$ 3.68 billion in 2024 to US$ 7.07 billion by 2034. For suppliers, several strategic imperatives stand out:

-

Focus on high-value crops (fruits & vegetables, export-oriented produce, horticulture) where growth regulators deliver strong ROI.

-

Expand in emerging geographies—East Asia, Latin America, South Asia—where shifting agricultural practices and export demand create new opportunity.

-

Invest in service-oriented agronomic support to educate growers, manage application precision and deliver consistent results.

-

Develop formulations tuned for stress-conditions (drought, heat, lodging) as climate variability increases.

-

Partner with growers and supply-chain actors to deliver value propositions—higher yield, better quality, improved uniformity, reduced losses.

Browse Full Report: https://www.factmr.com/report/crop-growth-regulator-market

Editorial Perspective

The crop growth regulator market may not receive as much spotlight as major agrochemicals, but it represents a critical layer in modern crop management—bridging agronomy, physiology and chemistry. In an era with rising food-security imperatives, limited arable land and increasing environmental stress, CGRs offer precision tools for yield optimisation and quality enhancement. Suppliers who combine technical excellence, grower service and global scale will be well-positioned as agriculture undergoes its next phase of intensification.