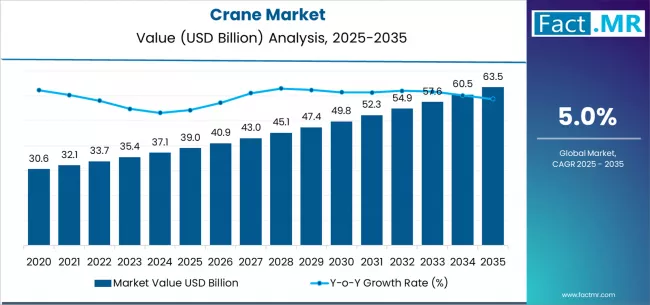

The global crane market is set for steady growth over the next decade, supported by rising infrastructure investment, rapid urbanization, and modernization of construction and industrial operations. According to a new analysis by Fact.MR, the market is projected to grow from USD 39.0 billion in 2025 to USD 63.5 billion by 2035, marking an absolute growth of USD 24.5 billion and a CAGR of 5.0% during the forecast period.

As global construction activity strengthens and industries increasingly adopt advanced material-handling equipment, cranes are becoming indispensable across construction, mining, logistics, and energy sectors.

Strategic Market Drivers

Infrastructure Development & Urbanization Fuel Demand

Massive global investments in transportation networks, smart cities, commercial high-rises, and residential construction are significantly accelerating crane deployment.

Rising demand for heavy lifting, enhanced mobility, and high-precision load handling continues to reinforce crane usage across construction and civil engineering projects.

Industrial Expansion & Automation Strengthen Adoption

Industries such as manufacturing, mining, steel, and shipping are integrating cranes for streamlined operations, improved safety, and efficient handling of heavy components.

Automation trends, including the use of telemetry, anti-collision systems, and remote monitoring, are boosting operational efficiency and safety.

Browse Full Report: https://www.factmr.com/report/crane-market

Growth in Renewable Energy Projects

Wind power installations, solar infrastructure development, and energy transition initiatives require high-capacity cranes for turbine assembly, tower lifting, and module placement.

This is driving significant demand for mobile cranes, tower cranes, and heavy-duty crawler cranes.

Rise of Logistics & Port Modernization

Global trade expansion and modernization of seaports and inland terminals are increasing the adoption of gantry cranes, container-handling cranes, and ship-to-shore cranes.

Automation in cargo handling and warehouse operations further amplifies crane demand.

Technological Advancements Enhance Safety & Efficiency

Integration of IoT, automation systems, telematics, and load-moment indicators is improving operational precision.

Electric and hybrid cranes are gaining traction due to their lower emissions and reduced operational costs.

Regional Growth Highlights

North America: Infrastructure Renewal & Industrial Upgrades

The United States and Canada are experiencing strong demand due to infrastructure renewal programs, expansion of warehousing facilities, and the surge in oil & gas and mining activities.

Growing adoption of automated cranes in manufacturing facilities supports regional growth.

Europe: Sustainability & Smart Construction Drive Innovation

EU sustainability standards, modernization of buildings, and rapid expansion of offshore wind projects are fueling crane adoption.

Germany, the U.K., France, and the Nordics lead the market with high deployment of tower cranes and crawler cranes in large-scale projects.

East Asia: Global Manufacturing Hub with Strong Construction Activity

China, Japan, and South Korea dominate global crane production and consumption.

Large-scale industrial projects, robust real estate development, and rapid urbanization underpin steady demand.

Emerging Markets: Fast-Paced Infrastructure & Energy Investments

India, Southeast Asia, Latin America, and the Middle East are experiencing rising demand owing to:

• Rapid infrastructural development

• Expansion of mining and energy sectors

• Surge in commercial construction

• Growth of transport and logistics industries

Market Segmentation Insights

By Type

- Mobile Cranes – Largest segment due to high flexibility and widespread usage in construction and industrial operations.

• Tower Cranes – Strong demand in high-rise construction and urban infrastructure.

• Crawler Cranes – Rising deployment in heavy industrial and energy projects.

• Fixed Cranes / Overhead Cranes – Essential in factories, warehouses, and ports.

By Lifting Capacity

- Up to 5 Tons – Preferable for light construction and maintenance tasks.

• 5–50 Tons – Widely used in industrial and commercial projects.

• 50–250 Tons & Above – Increasing adoption in infrastructure, mining, and energy applications.

By Application

- Construction – Largest and fastest-growing segment.

• Mining – High usage of heavy-duty cranes for excavation and transport.

• Industrial Manufacturing – Growth driven by material-handling automation.

• Shipping & Logistics – Expansion of seaports and cargo operations.

• Energy – Wind and oil & gas sectors drive demand for high-capacity cranes.

Challenges Impacting Market Growth

High Capital Costs

Cranes require significant upfront investment, limiting adoption in cost-sensitive regions and small contractors.

Maintenance & Safety Compliance

Regular inspections and adherence to strict safety regulations add to operational costs and downtime.

Skilled Operator Shortage

Complex crane systems demand trained operators, and skill shortages pose challenges in developing markets.

Competitive Landscape

The crane market is moderately competitive, with global manufacturers focusing on:

• Smart crane technologies

• Electric and hybrid cranes

• High-load lifting capabilities

• Modular design and enhanced mobility

Key Companies Profiled

- Liebherr Group

• Manitowoc

• Konecranes

• Terex Corporation

• Tadano Ltd.

• Zoomlion Heavy Industry

• XCMG

• SANY Group

• Kobelco Cranes

• Palfinger AG

Companies are investing in automation, telematics, lightweight materials, and emission-reduction technologies.

Recent Developments

- 2024: Launch of AI-enabled crane safety and control systems for predictive maintenance.

• 2023: Surge in deployment of mobile cranes for global wind turbine installations.

• 2022: Major port authorities adopt automated container-handling cranes to boost throughput efficiency.

Future Outlook: A Decade of Infrastructure Expansion & Smart Lifting

Over the next decade, growth will be shaped by:

• Increased global infrastructure spending

• Adoption of automated and electric cranes

• Rise of renewable energy mega-projects

• Demand for high-capacity lifting solutions

• Construction sector modernization

As industries strive for safety, precision, and productivity, the crane market is positioned for strong and sustained expansion through 2035.