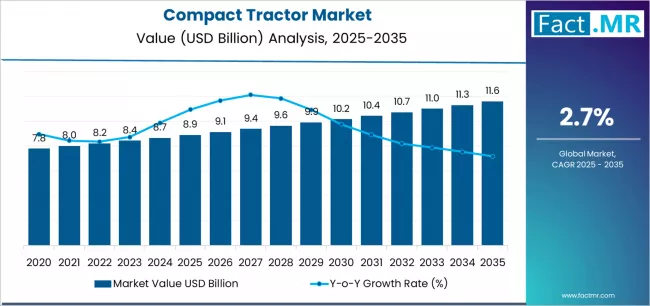

The global compact tractor market is set for consistent expansion over the next decade, supported by rising farm mechanization, growth in small and mid-sized agricultural holdings, and increasing demand for versatile, cost-efficient farming equipment. According to a recent analysis by Fact.MR, the market is valued at USD 8.9 billion in 2025 and is projected to reach USD 11.6 billion by 2035, registering an absolute growth of USD 2.7 billion over the forecast period.

This represents a total growth of 30.3%, with the market expected to expand at a CAGR of 2.7% from 2025 to 2035. The steady rise reflects the critical role compact tractors play in modern agriculture, landscaping, construction, and municipal operations.

Strategic Market Drivers

Rising Farm Mechanization Among Small & Medium Farmers

Compact tractors are increasingly preferred by small and medium-scale farmers due to their:

- Affordable ownership costs

- Multi-attachment compatibility

- Ease of operation in limited land areas

Government-backed mechanization programs and subsidies in developing economies are further accelerating adoption.

Expanding Applications Beyond Agriculture

Beyond farming, compact tractors are gaining traction in:

- Landscaping and gardening

- Construction and material handling

- Municipal services (road maintenance, snow removal, waste handling)

Their versatility makes them an ideal solution for non-agricultural utility tasks.

Browse Full Report: https://www.factmr.com/report/3940/compact-tractor-market

Labor Shortages Fuel Equipment Demand

Persistent labor shortages in rural areas are compelling farmers to invest in compact tractors to improve productivity and reduce dependency on manual labor.

Technological Advancements in Tractor Design

Manufacturers are introducing:

- Fuel-efficient engines

- Ergonomic operator cabins

- Improved hydraulics and transmission systems

These upgrades enhance performance, comfort, and operational efficiency.

Regional Growth Highlights

North America: Strong Adoption in Landscaping & Hobby Farming

The U.S. and Canada remain mature yet stable markets, driven by hobby farms, landscaping services, and municipal applications.

Europe: Sustainability and Precision Farming

European demand is supported by sustainable farming practices, compact landholdings, and increasing use of precision agriculture tools.

East Asia: Mechanization of Small Farms

Countries such as Japan, China, and South Korea are witnessing steady growth due to fragmented landholdings and strong domestic tractor manufacturing bases.

Emerging Markets: Infrastructure & Agricultural Development

India, Southeast Asia, Latin America, and Africa are experiencing rising demand due to:

- Government subsidies for farm equipment

- Growth in horticulture and specialty crops

- Expansion of rural infrastructure

Market Segmentation Insights

By Power Output

- Below 25 HP – Dominant segment, ideal for small farms and landscaping

- 25–40 HP – Widely used for utility and light commercial applications

- Above 40 HP – Growing demand in construction and heavy-duty tasks

By Drive Type

- 2WD – Cost-effective option for basic farming operations

- 4WD – Fastest-growing segment due to superior traction and versatility

By Application

- Agriculture – Largest share driven by small-scale farming

- Landscaping & Gardening – Rapid adoption in urban and suburban areas

- Construction & Municipal Use – Steady growth in public infrastructure projects

Challenges Impacting Market Growth

Limited Power Output

Compact tractors are not suitable for large-scale farming, restricting their use to specific applications.

Price Sensitivity in Developing Regions

Despite being cost-effective compared to larger tractors, affordability remains a concern for small farmers without subsidies.

Dependence on Seasonal Demand

Sales are influenced by agricultural cycles, impacting year-round demand stability.

Competitive Landscape

The compact tractor market is moderately fragmented, with manufacturers focusing on product reliability, fuel efficiency, and attachment versatility.

Key Companies Profiled

- Kubota Corporation

- Deere & Company

- CNH Industrial

- Mahindra & Mahindra Ltd.

- AGCO Corporation

- Yanmar Co., Ltd.

- CLAAS Group

- Sonalika Group

Players are investing in compact, eco-friendly engines, smart attachments, and operator-friendly designs.

Recent Developments

- 2024: Introduction of fuel-efficient and low-emission compact tractor models

- 2023: Increased adoption of compact tractors in landscaping and municipal projects

- 2022: Expansion of government subsidy programs supporting farm mechanization

Future Outlook: Steady Growth Through Practical Innovation

Over the next decade, the compact tractor market will continue evolving through:

- Mechanization of small and fragmented farms

- Growth in landscaping and utility applications

- Advancements in fuel efficiency and ergonomics

- Increased government support for agricultural modernization

As agriculture and allied sectors prioritize efficiency, versatility, and affordability, the global compact tractor market is positioned for stable and sustained growth through 2035.