The global aerial work platforms (AWP) market is entering a decisive growth phase as construction modernization, industrial maintenance, and infrastructure renewal converge worldwide. The market is projected to nearly double in value over the next decade, underscoring the strategic importance of height-access solutions across industries.

Market Size Outlook and Long-Term Growth Trajectory

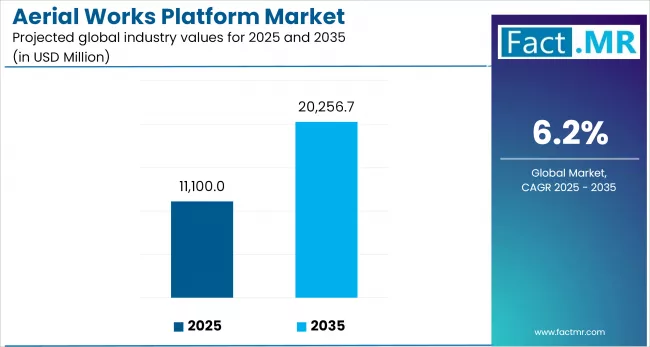

The global aerial work platforms market was valued at approximately USD 10.5 billion in 2024 and is forecast to reach USD 20.3 billion by 2035, expanding at a compound annual growth rate (CAGR) of about 6.2% during 2025–2035. Extending this trajectory into 2036, industry stakeholders anticipate sustained momentum supported by stricter workplace safety regulations, growing rental penetration, and rapid infrastructure development in emerging economies.

This growth reflects a structural shift away from traditional scaffolding toward mechanized, safer, and more efficient access equipment. Contractors and industrial operators increasingly view AWPs not merely as equipment but as productivity multipliers that reduce labor time, accidents, and project delays.

Strategic Benchmarking: Competitive Dynamics

The AWP market is moderately consolidated, with global manufacturers competing on technology, reliability, and lifecycle cost optimization. Market leaders are heavily investing in:

-

Electrification and hybrid platforms to meet sustainability targets,

-

Telematics and IoT integration for fleet monitoring and predictive maintenance,

-

Modular designs to improve versatility across construction, warehousing, and utilities.

Companies with strong rental-channel partnerships and localized manufacturing footprints outperform peers in both margins and market reach. North American and European manufacturers dominate premium segments, while Asian players are rapidly closing the gap through cost-competitive offerings and regional expansion.

Pricing Trends and Cost Structure Evolution

Pricing in the aerial work platforms market is shaped by raw material volatility, technology upgrades, and shifting buyer preferences. Over the past five years, average selling prices have shown moderate upward pressure, primarily due to:

-

Increased use of high-strength steel and lightweight alloys,

-

Integration of advanced safety sensors and control systems,

-

Compliance with evolving emission and noise regulations.

Rental companies—key buyers in the ecosystem—exert counter-pressure on pricing by negotiating volume-based contracts and favoring standardized models. While capital equipment prices are rising gradually, total cost of ownership (TCO) is improving due to better energy efficiency, longer service intervals, and digital diagnostics.

Electric scissor lifts and compact boom lifts, in particular, are seeing strong demand as urban job sites prioritize low emissions and reduced noise. These trends are expected to stabilize pricing while accelerating replacement cycles, especially in mature markets.

Regional Hotspots: Where Growth Is Concentrated

North America remains the largest and most mature AWP market, driven by high rental penetration, stringent safety norms, and continuous investment in commercial construction and infrastructure renewal. The United States serves as a benchmark market where innovation adoption occurs fastest, setting standards later replicated globally.

Europe follows closely, with Western Europe leading in electric and hybrid platform adoption. Sustainability regulations and urban redevelopment projects are key growth enablers. Rental companies in Germany, France, and the UK are increasingly refreshing fleets with low-emission models, reinforcing steady demand.

Asia-Pacific represents the fastest-growing regional hotspot. Rapid urbanization, industrialization, and government-led infrastructure programs in China, India, and Southeast Asia are driving double-digit growth in certain segments. While penetration rates remain lower than in North America, the sheer scale of construction activity positions Asia-Pacific as the primary engine of incremental demand through 2036.

Middle East & Africa and Latin America are emerging opportunities, particularly in energy, utilities, and large-scale infrastructure projects. Although cyclical investment patterns create short-term volatility, long-term fundamentals remain positive.

End-Use Segmentation and Demand Shifts

Construction continues to account for the largest share of AWP demand, but non-construction applications are gaining traction. Industrial maintenance, logistics, and facility management are increasingly adopting AWPs to improve operational efficiency. Warehouse automation and the expansion of large distribution centers are fueling demand for compact and indoor-friendly platforms.

Rental remains the dominant mode of access, especially for small and mid-sized contractors. This trend lowers entry barriers for end users while creating recurring revenue streams for manufacturers through fleet sales and aftermarket services.

Browse Full Report : https://www.factmr.com/report/4674/aerial-work-platforms-market

Outlook to 2036: Strategic Implications

Looking ahead to 2036, the aerial work platforms market is set to benefit from a convergence of safety regulation enforcement, urban infrastructure renewal, and technology-driven differentiation. Companies that align product portfolios with electrification, digital fleet management, and regional customization will be best positioned to capture value.

Success in the next decade will depend not only on scale but on strategic agility—balancing pricing discipline, innovation investment, and regional expansion. As AWPs become indispensable across industries, the market’s evolution will mirror broader trends in construction technology, sustainability, and smart equipment ecosystems.