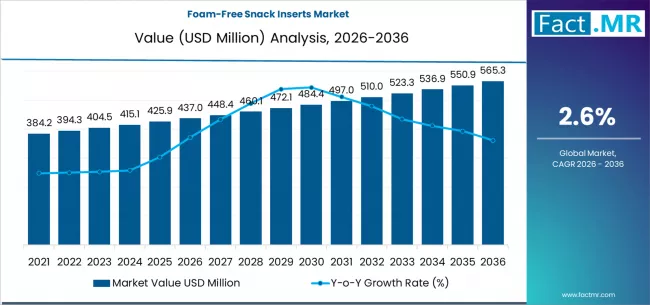

The global foam-free snack inserts market is gaining strategic importance as sustainability, regulatory compliance, and packaging performance converge across the food industry. By 2036, the market is projected to reach approximately USD 595 million, rising from around USD 460 million in 2026, reflecting a steady compound annual growth rate (CAGR) of about 2.6% over the ten-year period. While growth is measured rather than explosive, the market’s role within the broader sustainable packaging ecosystem is becoming increasingly critical.

Market Overview: Structural Change in Snack Packaging

Snack packaging has traditionally relied on expanded polystyrene and plastic foams for cushioning and product separation. However, mounting environmental concerns, landfill pressures, and recycling limitations have accelerated the transition toward foam-free alternatives. Foam-free snack inserts—typically produced from molded fiber, paperboard, and biodegradable composites—are now positioned as functional replacements that align with corporate sustainability targets and evolving consumer expectations.

Globally, over 65% of snack manufacturers have announced packaging sustainability commitments extending to 2030 and beyond. These pledges include reductions in virgin plastic use, increased recyclability, and adoption of fiber-based packaging components. Foam-free inserts directly support these goals by offering recyclability rates exceeding 85–90%, compared with near-zero recycling rates for conventional foam materials.

Technology Shifts: Engineering Efficiency and Material Innovation

Technological innovation within foam-free snack inserts is centered on performance optimization and production efficiency. Advances in molded fiber engineering have enabled weight reductions of 10–20% per unit while maintaining comparable shock absorption and structural integrity to foam-based alternatives. This light-weighting contributes directly to lower material costs and reduced transportation emissions.

Barrier technology represents another significant shift. Modern fiber-based inserts increasingly incorporate water-resistant and grease-resistant coatings, enabling safe use with oily or moisture-sensitive snack products. These coatings are engineered to remain compatible with recycling streams, addressing one of the primary historical limitations of fiber inserts.

Automation-ready designs are also reshaping the market. Insert manufacturers are now developing products compatible with high-speed, automated snack packaging lines, reducing downtime and labor costs for large-scale food processors. Digital modeling and AI-driven design tools further shorten development timelines, allowing for rapid customization based on snack size, fragility, and pack configuration.

Demand Dynamics: Sustainability, Regulation, and Consumer Influence

Demand growth for foam-free snack inserts is strongly correlated with regulatory developments and brand-driven sustainability strategies. In Europe and North America, extended producer responsibility (EPR) regulations and packaging waste directives are increasing the cost of non-recyclable materials. In some markets, fees for non-compliant packaging have risen by 20–30% over the past five years, materially shifting cost-benefit calculations in favor of foam-free solutions.

Consumer behavior is reinforcing this shift. Surveys indicate that over 70% of consumers prefer products packaged in recyclable or plastic-free materials, and nearly 40% report being willing to switch snack brands based on packaging sustainability. As a result, foam-free inserts are increasingly viewed not only as a compliance measure but also as a brand differentiation tool.

Asia-Pacific is emerging as a notable growth engine. While per-unit costs remain a concern in price-sensitive markets, investments in domestic paper recycling infrastructure and molded fiber manufacturing are reducing cost gaps. The region is expected to account for more than one-third of incremental market growth through 2036, driven by rising snack consumption and expanding middle-class populations.

Competitive Landscape: Scale, Reliability, and Co-Development

The foam-free snack inserts market remains moderately fragmented, with competition focused less on price erosion and more on technical capability and supply reliability. Leading suppliers are investing in capacity expansion, automation, and vertically integrated fiber sourcing to ensure consistent quality and mitigate raw material volatility.

Co-development partnerships between insert manufacturers and snack brands are becoming increasingly common. These collaborations focus on optimizing insert geometry to reduce overall packaging volume, improve pallet efficiency, and lower logistics costs. In some cases, redesigned inserts have delivered logistics cost savings of 5–8%, alongside measurable reductions in carbon footprint.

Investment Outlook: Stable Returns with Sustainability Alignment

From an investment standpoint, the foam-free snack inserts market offers relatively low volatility and long-term visibility. Demand is tied to staple food categories rather than discretionary consumption, providing resilience during economic downturns. At the same time, regulatory pressure and ESG-driven procurement policies create durable structural tailwinds.

Capital allocation in the sector is primarily directed toward manufacturing automation, R&D in barrier performance, and regional capacity expansion. Mergers and acquisitions are expected to remain selective, focusing on companies with proprietary molding technologies, strong customer relationships, or access to recycled fiber supply chains.

Return profiles are characterized by steady margins rather than rapid expansion, making the sector attractive to strategic investors, packaging conglomerates, and infrastructure-oriented funds seeking predictable cash flows aligned with sustainability themes.

Browse Full Report : https://www.factmr.com/report/foam-free-snack-inserts-market

Outlook to 2036: From Alternative to Industry Standard

By 2036, foam-free snack inserts are expected to transition from an alternative packaging choice to an industry standard across most major snack categories. As brands move toward fully recyclable packaging systems, inserts will be evaluated as integral components of holistic packaging design rather than optional add-ons.

The market’s evolution reflects a broader transformation in food packaging—one where incremental material innovations collectively deliver significant environmental and operational benefits. Foam-free snack inserts may operate behind the scenes, but their impact on waste reduction, regulatory compliance, and brand perception positions them as a foundational element of the next generation of sustainable snack packaging.