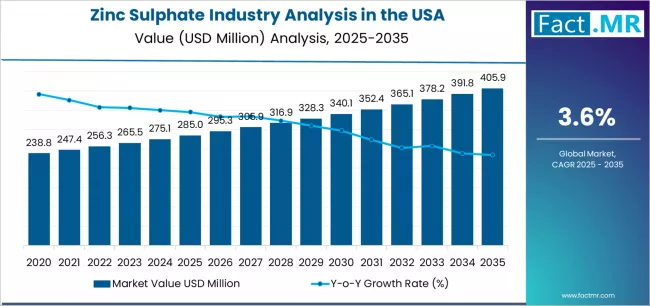

The United States zinc sulphate industry is set for steady expansion over the next decade, backed by strengthening adoption in agricultural micronutrients, premium fertilizers, and high-bioavailability animal nutrition. According to the latest industry analysis from Fact.MR, the market is forecasted to grow from USD 285 million in 2025 to approximately USD 405.9 million by 2035, recording an absolute increase of USD 125 million at a CAGR of 3.6% through 2035.

Rising emphasis on nutrient-efficient crop production, livestock health optimization, and soil micronutrient balancing are collectively accelerating domestic zinc sulphate utilization across modern U.S. farming systems.

Strategic Market Drivers

Agriculture Sector Leads Consumption

Zinc sulphate remains indispensable in U.S. crop nutrition programs, especially in high-yield cultivation of cereals, fruits, vegetables, and oilseeds. Its proven ability to support:

- Higher crop yields

- Strong disease resistance

- Enhanced nutrient uptake

- Improved soil micronutrient composition

is driving increased application in next-generation fertilizers and farming protocols.

Browse Full Report: https://www.factmr.com/report/united-states-zinc-sulphate-industry-analysis

Animal Feed & Fertilizer Segment Commands 47% of Demand

The animal feed and fertilizers segment is projected to account for 47.0% of total U.S. zinc sulphate demand in 2025, reinforcing its pivotal role in:

- Comprehensive livestock nutrition

- Poultry and dairy health formulations

- Zinc-fortified feed additives

- Large-scale fertilizer blending

Superior bioavailability, stable mineral performance, and measurable livestock health outcomes continue to define product preference among U.S. feed and fertilizer manufacturers.

Essential Role in Agricultural Efficiency

From correcting zinc-deficient soils to supporting livestock immunity and growth, zinc sulphate is widely relied upon to meet national agricultural performance goals where high bioavailability, optimized crop productivity, and improved animal health remain critical.

Segmentation Insights

By Key End-Use

- Fertilizers (Agriculture) – Dominant due to increasing soil micronutrient correction

- Animal Feed – High adoption on account of superior bio-absorption and livestock health outcomes

- Industrial & Chemical Uses – Stable demand in specialty applications

By Product Benefits

- High bioavailability zinc source

- Cost-effective micronutrient fortification

- Compatibility with fertilizer and feed additive formulations

Challenges Impacting Industry Growth

- Raw material price fluctuations

- Environmental and compliance standards for chemical fertilizers and additives

- Competitive pressure from alternative micronutrient zinc compounds

Competitive Landscape

The U.S. zinc sulphate industry features a mixture of domestic producers and multinational chemical suppliers, with companies focusing on:

- High-purity formulations

- Optimized zinc delivery for crops and feed

- Sustainable mineral solutions

- Expansion into advanced agricultural inputs

Future Outlook

Over the next decade, zinc sulphate demand in the USA will continue to be shaped by:

- Growth of zinc-fortified fertilizers and feed additives

- Increased focus on crop micronutrient efficiency

- Rising investment in livestock nutritional performance

- Sustainable agricultural intensification

With U.S. farmers and feed manufacturers prioritizing higher crop yields, better soil health, and proven animal nutrition performance, the national zinc sulphate sector is positioned for consistent and scalable growth through 2035.