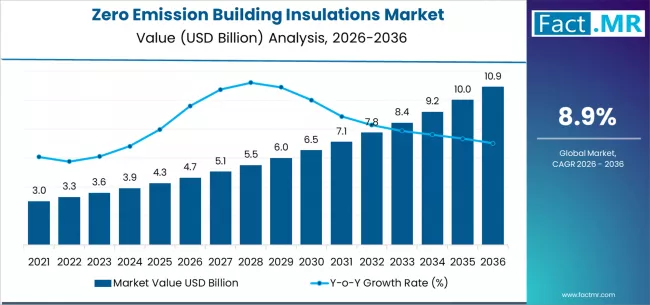

The global zero emission building insulations market is undergoing a profound strategic transformation as governments, developers, and building owners accelerate the shift toward net-zero and low-carbon construction. According to a new analysis by Fact.MR, the market is projected to expand from USD 4.65 billion in 2026 to USD 10.91 billion by 2036, advancing at a robust CAGR of 8.9% during the forecast period.

This rapid growth is fundamentally driven by the evolution of building codes, green certifications, and sustainability frameworks, which are moving beyond operational energy efficiency to include full lifecycle carbon accounting, embodied emissions, and material transparency.

Zero emission insulation materials—designed to minimize or eliminate greenhouse gas emissions during production, installation, use, and end-of-life—are emerging as critical enablers of next-generation sustainable buildings.

Browse Full Report: https://www.factmr.com/report/zero-emission-building-insulations-market

Strategic Market Drivers

Lifecycle Carbon Regulations Reshape Building Materials

Governments worldwide are tightening climate policies to address embodied carbon in buildings. Regulations and certifications such as LEED, BREEAM, WELL, and national net-zero building codes are pushing developers to adopt insulation materials with ultra-low or zero emissions across the value chain.

This regulatory shift is accelerating demand for:

- Bio-based and recycled insulation materials

- Low-carbon mineral and aerogel solutions

- Insulation systems with Environmental Product Declarations (EPDs)

Net-Zero Buildings and Green Construction Surge

The global push toward net-zero buildings, smart cities, and climate-resilient infrastructure is significantly increasing insulation requirements in both new construction and retrofitting projects.

Zero emission insulation plays a vital role by:

- Reducing heating and cooling loads

- Lowering operational energy consumption

- Supporting long-term carbon neutrality goals

Commercial offices, residential housing, public infrastructure, and industrial buildings are rapidly integrating advanced insulation solutions to meet sustainability targets.

Energy Efficiency Mandates Drive Material Innovation

Rising energy costs and aggressive efficiency mandates are compelling architects and builders to adopt high-performance insulation materials that deliver superior thermal resistance with minimal environmental impact.

Innovations in:

- Natural fiber insulation

- Vacuum insulation panels (VIPs)

- Aerogels and advanced foams

are expanding application scope while meeting zero emission benchmarks.

Circular Economy and Sustainable Material Adoption

Manufacturers are increasingly focusing on recyclability, renewable inputs, and closed-loop production systems. The integration of circular economy principles—such as recycled content and biodegradable materials—is strengthening market adoption across regions.

Regional Growth Highlights

Europe: Carbon-Neutral Construction Leadership

Europe leads the global market due to stringent EU climate policies, embodied carbon limits, and widespread adoption of green building standards. Countries such as Germany, France, the U.K., and Nordic nations are at the forefront of zero emission insulation deployment.

North America: Net-Zero Commitments Accelerate Adoption

The U.S. and Canada are witnessing rising demand driven by federal decarbonization initiatives, state-level energy codes, and green retrofit programs. Commercial real estate developers and institutional builders are increasingly prioritizing low-carbon insulation solutions.

East Asia: Sustainable Urbanization Fuels Growth

China, Japan, and South Korea are integrating zero emission insulation into smart city projects, green residential developments, and industrial infrastructure, supported by government-backed sustainability goals.

Emerging Markets: Green Infrastructure Expansion

Regions such as India, Southeast Asia, Latin America, and the Middle East are showing strong growth potential due to:

- Rapid urbanization

- Green building investments

- Climate-resilient infrastructure programs

Market Segmentation Insights

By Material Type

- Bio-Based Insulation – Fastest-growing due to low embodied carbon

- Mineral Wool & Recycled Materials – Strong adoption in commercial buildings

- Aerogels & Advanced Insulation – Premium applications requiring ultra-high performance

By Application

- Residential Buildings – High growth from green housing initiatives

- Commercial Buildings – Offices, retail, and data centers drive demand

- Industrial & Infrastructure – Energy-intensive facilities adopt low-carbon insulation

- Public & Institutional Buildings – Schools, hospitals, and government projects

By Construction Type

- New Construction – Dominant due to net-zero mandates

- Retrofit & Renovation – Rapidly expanding as older buildings undergo decarbonization

Challenges Impacting Market Growth

Higher Initial Costs

Zero emission insulation materials often involve higher upfront costs compared to conventional insulation, creating adoption barriers in price-sensitive markets.

Supply Chain and Raw Material Constraints

Limited availability of sustainable raw materials and regional supply chain dependencies can impact scalability.

Certification and Compliance Complexity

Meeting evolving global certification and carbon disclosure standards adds complexity for manufacturers and developers.

Competitive Landscape

The market is moderately fragmented, with players focusing on material innovation, carbon footprint reduction, and certification compliance. Strategic partnerships with construction firms and green building consultants are becoming increasingly common.

Key Companies Profiled

- Saint-Gobain

- ROCKWOOL Group

- Kingspan Group

- Owens Corning

- BASF SE

- Knauf Insulation

- Johns Manville

- GAF Materials

- Aspen Aerogels

Companies are investing in bio-based formulations, recycled inputs, digital carbon tracking, and next-generation insulation technologies.

Recent Developments

- 2025: Expansion of bio-based insulation production capacity in Europe

- 2024: Launch of insulation products with verified net-zero embodied carbon

- 2023: Major construction firms mandate zero emission materials in flagship projects

Future Outlook: Decarbonizing the Built Environment

The next decade will be transformative for the zero emission building insulations market, driven by:

- Stricter lifecycle carbon regulations

- Global net-zero construction targets

- Rapid growth in green retrofitting

- Advances in sustainable material science

- Integration of digital carbon measurement tools

As the construction industry transitions toward carbon-neutral and climate-positive buildings, zero emission insulation will remain a foundational element of sustainable design—positioning the market for strong, long-term growth through 2036.