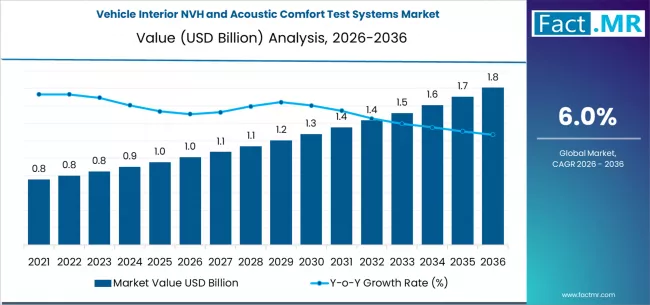

The global vehicle interior NVH (Noise, Vibration, and Harshness) and acoustic comfort test systems market is poised for steady expansion over the next decade, driven by increasing consumer expectations for quieter cabins, rapid electric vehicle (EV) adoption, and stricter automotive quality standards. According to a new study by Fact.MR, the market is projected to grow from USD 1.01 billion in 2026 to USD 1.80 billion by 2036, reflecting a total growth of 78.2% and registering a CAGR of 6.0% during the forecast period.

As automakers prioritize enhanced cabin comfort, reduced road and powertrain noise, and premium driving experiences, the adoption of advanced NVH and acoustic comfort testing solutions is accelerating across passenger and commercial vehicle segments worldwide.

Strategic Market Drivers

Rising Consumer Demand for Quiet and Comfortable Vehicle Interiors

Modern vehicle buyers increasingly associate low noise levels and smooth ride quality with premium value. This trend is significantly boosting demand for interior NVH and acoustic comfort test systems during vehicle design, validation, and production phases.

Luxury vehicles, EVs, and autonomous platforms especially require precise acoustic tuning to deliver superior cabin experiences.

Browse Full Report: https://www.factmr.com/report/vehicle-interior-nvh-and-acoustic-comfort-test-systems-market

Electric Vehicle (EV) Growth Elevates Acoustic Testing Needs

The rapid expansion of electric mobility is reshaping NVH requirements. While EVs eliminate engine noise, road, wind, and component-level noises become more noticeable, increasing the need for advanced sound and vibration analysis.

NVH and acoustic comfort test systems are essential for:

- Motor and inverter noise analysis

- Cabin sound quality optimization

- Vibration isolation testing

- Passenger comfort enhancement

Stringent Automotive Quality & Safety Regulations

Global automotive standards are becoming increasingly strict regarding noise levels, vibration exposure, and passenger comfort, pushing OEMs and suppliers to integrate advanced NVH testing early in vehicle development cycles.

Regulatory compliance, combined with brand differentiation strategies, is accelerating system adoption across OEMs and Tier-1 suppliers.

Advancements in Sound & Vibration Measurement Technologies

Technological progress in sensor accuracy, real-time data analytics, AI-based signal processing, and digital simulation is significantly improving NVH testing capabilities.

According to Fact.MR, the sound and vibration measurement systems segment is expected to account for 36.0% of the total market in 2026, highlighting its dominant role in vehicle acoustic evaluation.

Regional Growth Highlights

North America: Strong Automotive R&D and EV Innovation

North America remains a prominent market due to:

- High investments in vehicle R&D

- Rapid EV and autonomous vehicle development

- Strong presence of automotive OEMs and testing labs

The U.S. leads regional growth with increasing adoption of advanced NVH validation tools.

Europe: Premium Vehicle Manufacturing Drives Demand

Europe’s strong focus on luxury vehicles, sustainability, and passenger comfort is driving market expansion. Countries such as Germany, France, and the U.K. are at the forefront due to:

- Advanced automotive engineering

- Strict noise and comfort regulations

- Growing EV production

East Asia: Automotive Production Hub

China, Japan, and South Korea dominate vehicle production globally, creating sustained demand for NVH and acoustic comfort test systems. Rising EV manufacturing and smart mobility initiatives are further accelerating adoption.

Emerging Markets: Growing Automotive Manufacturing Base

India, Southeast Asia, and Latin America are witnessing rising demand due to:

- Expansion of automotive manufacturing facilities

- Increasing vehicle ownership

- Growing focus on quality and comfort in mass-market vehicles

Market Segmentation Insights

By Product Type

- Sound & Vibration Measurement Systems – Leading segment with 36.0% market share in 2026

- Data Acquisition Systems

- Simulation & Analysis Software

By Application

- Passenger Vehicles – Largest share driven by comfort-focused designs

- Electric Vehicles – Fastest-growing segment

- Commercial Vehicles – Increasing adoption for driver comfort and fatigue reduction

By End User

- OEMs – High adoption during vehicle development

- Tier-1 Suppliers – Integration in component testing

- Testing & Certification Laboratories

Challenges Impacting Market Growth

High System Costs

Advanced NVH and acoustic testing systems involve high initial investments, limiting adoption among small manufacturers and testing facilities.

Technical Complexity

Operating and interpreting NVH data requires specialized expertise, increasing training and operational costs.

Integration with Vehicle Development Cycles

Integrating NVH testing seamlessly into fast-paced automotive development timelines remains a challenge for some manufacturers.

Competitive Landscape

The vehicle interior NVH and acoustic comfort test systems market is moderately competitive, with companies focusing on:

- High-precision sensors

- AI-driven noise analysis

- Digital twin and simulation-based testing

- Compact and portable testing solutions

Leading players are strengthening partnerships with automotive OEMs and expanding capabilities for EV-specific acoustic testing.

Recent Developments

- 2024: Introduction of AI-enabled acoustic analysis software for real-time NVH optimization

- 2023: Increased deployment of NVH testing solutions in EV and autonomous vehicle platforms

- 2022: OEMs integrate digital simulation tools to reduce physical testing cycles

Future Outlook: Precision, Comfort, and Intelligent Mobility

The next decade will witness sustained growth in the vehicle interior NVH and acoustic comfort test systems market, driven by:

- Continued EV and autonomous vehicle adoption

- Rising demand for premium in-cabin experiences

- Advances in AI, simulation, and sensor technologies

- Strong focus on passenger comfort and vehicle refinement

As automakers compete on comfort, quietness, and driving experience, NVH and acoustic comfort testing will remain a critical pillar of vehicle innovation, positioning the market for strong growth through 2036.