The U.S. market for monochloroacetic acid (MCAA) is forecast to register steady, moderate growth through 2035 as demand from polymers, surfactants, agrochemicals, and specialty chemical applications remains consistent. MCAA is a vital chemical intermediate — most prominently used in carboxymethyl cellulose (CMC) production, surfactant synthesis, and a range of specialty intermediates — and its broad application base provides resilience against cyclical downturns in any single end-use sector.

Quick Stats (2025–2035)

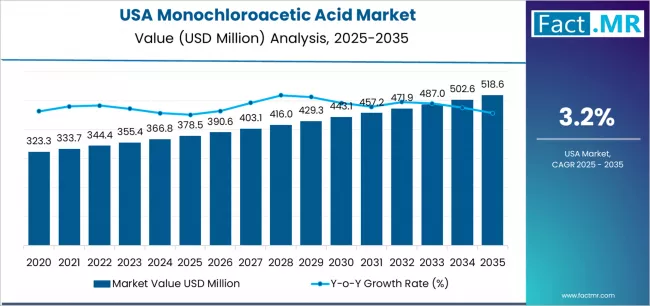

- Market Value 2025: USD 378.5 million

- Market Forecast Value 2035: USD 518.6 million

- Absolute Growth (2025–2035): USD 147.3 million

- Forecast CAGR (2025–2035): 3.2%

- Leading Grade (2025): Technical/Industrial (~69.5% share)

- Top Application Segment (2025): Carboxymethyl Cellulose (CMC) production (~42.8% share)

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12280

Market Drivers

Versatile Industrial Intermediate

MCAA functions as a core building block for multiple downstream chemistries. The largest single user, CMC production, supports food processing, pharmaceuticals, paints & coatings, textiles, and personal-care formulations — sectors that require reliable, high-volume MCAA supply. Surfactant manufacture for detergents and personal-care products represents another major driver, tying MCAA demand to household consumption patterns and industrial cleaning markets.

Steady Demand from Specialty Chemicals & Pharmaceuticals

Beyond commodity applications, MCAA supports specialty markets where higher purity grades are required. Growth in pharmaceuticals, cosmetics, and specialty surfactants increases the share of value-added, higher-margin MCAA grades, prompting suppliers to expand purification capabilities and offer differentiated product lines.

Industrial Upgrades & Onshoring Trends

Investment in domestic chemical capacity, process modernization, and vertical integration among polymer and specialty-chemical producers supports stable long-term demand. Onshoring of certain chemical value chains and efforts to reduce supply-chain risk favor domestic MCAA sourcing for manufacturers seeking shorter lead times and supply security.

Broad End-Use Diversity Buffers Volatility

Because MCAA feeds into multiple end-use industries (CMC, agrochemicals, surfactants, pharmaceutical intermediates), demand volatility in any one segment is partially offset by sustained consumption in others. This diversity enhances market stability and supports measured growth even amid macroeconomic uncertainty.

Market Structure & Segment Insights

By Grade

Technical and industrial grades dominate current consumption due to large-scale polymer and CMC production requirements. Specialty and high-purity grades—targeted at pharmaceutical and cosmetic applications—are a smaller but growing portion of the market, enabling producers to capture higher margins.

By Application

CMC production remains the single largest application, accounting for a substantial share of total MCAA demand. Surfactants, agrochemical intermediates, and specialty chemistries follow, each contributing meaningful volume and offering differentiated growth potential depending on end-market dynamics.

By Form & Delivery

MCAA is supplied in various forms (solid/crystalline or purified liquid formulations) to meet specific processing requirements. Demand for liquid and purified forms is increasing in precision applications where handling or formulation convenience is prioritized.

Regional Dynamics within the USA

The U.S. market is regionally diverse, with chemical manufacturing hubs distributed across multiple regions. The West region is projected to register comparatively faster growth through 2035, supported by advanced chemical infrastructure, specialty manufacturing, and technology-driven production investments. Other regions including the South, Midwest, and Northeast continue to host significant chemical and polymer production facilities that collectively sustain national demand.

Challenges & Risks

Raw Material & Feedstock Volatility

MCAA production depends on upstream reagents and energy inputs. Fluctuations in prices of acetic acid derivatives, chlorine feedstocks, and energy can compress margins and prompt periodic price volatility.

Regulatory & Environmental Compliance

As a chlorinated intermediate, the production and handling of MCAA are subject to environmental and safety regulations. Investment in waste-treatment, emissions control, and worker safety measures is necessary, potentially raising compliance costs for producers.

Downstream Demand Sensitivity

Certain downstream sectors (e.g., agrochemicals, detergents) are sensitive to economic cycles, raw-material substitution, and shifts in commodity prices. Volatility in these sectors can indirectly affect MCAA volumes.

Competitive & Trade Pressures

Global trade dynamics and competitive import/export flows can influence domestic pricing and supply balance. Producers must manage cost competitiveness and logistics efficiency to retain market share.

Opportunities & Strategic Priorities

Move Up the Value Chain

Producers can pursue higher-margin opportunities by supplying specialty and pharmaceutical-grade MCAA, investing in purification technologies, and offering tailored logistics and technical support to downstream partners.

Process Efficiency & Environmental Upgrades

Investing in more efficient production routes, energy-saving technologies, and advanced effluent treatments can lower operating costs and improve regulatory compliance — strengthening long-term competitiveness.

Supply-Chain Resilience & Partnerships

Long-term supply agreements with major CMC and surfactant manufacturers, strategic inventory planning, and flexible contract structures can mitigate raw-material volatility and secure steady offtake.

Outlook

From a 2025 base of USD 378.5 million, the U.S. MCAA market is anticipated to grow to approximately USD 518.6 million by 2035 — an increase reflecting steady industrial demand, diversification into specialty applications, and ongoing investments in domestic chemical capacity. While growth is moderate (reflecting the commodity nature of much of the market), the broad, cross-industry use of MCAA provides solid foundation for sustainable demand. Suppliers focused on product differentiation, regulatory compliance, and supply-chain reliability are best positioned to capture value as the market evolves over the coming decade.

Browse Full Report: https://www.factmr.com/report/united-states-monochloroacetic-acid-market