The U.S. market for anti-static polymer compounds is set to expand strongly over the next decade as electronics miniaturization, e-commerce packaging needs, semiconductor manufacturing, and evolving safety standards increase demand for static-control materials. Anti-static polymer compounds — including masterbatches, engineered compounds, and surface-treatment additives — are used across electronics, packaging, automotive, medical devices, and industrial applications to prevent electrostatic discharge (ESD), protect sensitive components, and improve handling and processing safety.

Manufacturers are shifting toward integrated, performance-grade compounds that combine antistatic function with flame retardancy, UV stability and processing ease. As U.S. supply chains re-tool for resilience and higher throughput, requirement for reliable static control in both production and end-use environments will drive recurring demand for anti-static compounds.

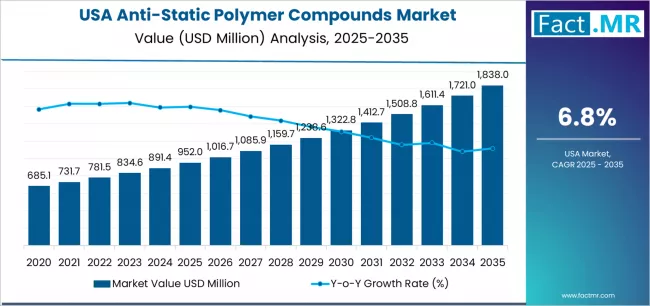

Quick Stats (2025–2035)

-

2025 Market Value (USA): USD 952.0 million.

-

2035 Forecast Market Value (USA): USD 1,838.0 million.

-

Absolute Growth (2025–2035): USD 898.0 million.

-

Forecast CAGR (2025–2035): ≈ 6.8%.

-

Leading Product Format (2025): Masterbatches (~42.5% share).

-

Top End-Use (2025): Electronics & electricals (~36.8% share).

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12427

Key Market Drivers

1. Electronics & Semiconductor Industry Demand

-

Miniaturized electronics and high-density PCBs are increasingly ESD-sensitive, requiring antistatic compounds for housings, connectors, and cable insulation.

-

Rising domestic semiconductor manufacturing and reshoring of critical supply chains amplify steady consumption.

2. E-commerce & Protective Packaging Growth

-

Explosion in parcel volumes and automated sortation systems increases triboelectric charging risk; anti-static films and molded parts reduce product damage and dust attraction.

-

Anti-static masterbatches for blown and cast films help packaging converters meet stricter handling standards.

3. Regulatory & Safety Standards

-

Industry safety norms and buyer requirements for ESD protection in medical, aerospace, and defense applications push adoption of certified antistatic materials.

-

Fire-safety, biocompatibility and cleanliness specifications often require multi-functional compound formulations.

4. Automation & High-Speed Processing

-

Automated assembly lines and high-speed extrusion or molding processes intensify static generation; durable antistatic additives or intrinsic antistatic polymer grades improve process yields.

5. Multi-Functional Compound Demand

-

Customers prefer compounds that combine antistatic behavior with UV resistance, flame retardancy, or color stability — driving R&D and premium pricing.

Market Structure & Segment Insights

By Product Type

-

Masterbatches: Largest format due to flexibility, cost-efficiency and ease of dosing across polymer converters.

-

Pre-compounded Anti-Static Polymers: Preferred where consistent, long-term conductivity and fast qualification are required.

-

Surface Treatments & Coatings: Used for retrofitting or localized ESD control on finished parts.

By End-Use

-

Electronics & Electrical (~36.8%): Leading segment for housings, connectors, wires and cable jacketing.

-

Packaging: Growing use in e-commerce protective films, trays, and conductive liners.

-

Automotive: Interior trims, fuel-system components, and sensor housings need static mitigation as vehicle electronics proliferate.

-

Medical Devices & Pharma Packaging: Critical for sterile processing, component protection, and cleanroom compatibility.

-

Industrial & Consumer Goods: Antistatic solutions for appliances, tooling, and safety equipment.

Challenges & Restraints

-

Performance vs. Durability Tradeoffs: Some migratory antistatic additives wear off over time, requiring re-formulation or stabilized masterbatches.

-

Cost Pressure: High-performance antistatic systems and multifunctional compounds can be costlier than commodity grades.

-

Compatibility & Processing Constraints: Additive-polymer interactions may affect mechanical or optical properties; compounding expertise is essential.

-

Regulatory & Environmental Scrutiny: Preference for non-migratory, non-toxic, and recyclable antistatic solutions increases R&D burdens.

Opportunities & Strategic Directions

-

Development of Long-Life, Non-Migratory Additives — To satisfy cleanroom and medical applications.

-

High-Value Masterbatch Solutions for Packaging Converters — Target e-commerce and food/pharma packaging niches.

-

Tailored Compounds for EV & Automotive Electronics — Address thermal stability and long-term ESD protection.

-

Partnerships with Electronics OEMs & Contract Manufacturers — Embedded supply agreements and qualification support.

-

Sustainability & Recyclability Focus — Formulate antistatic systems compatible with recycled polymers and circular-economy goals.

Outlook

With demand forecast to grow from USD 952.0 million in 2025 to USD 1,838.0 million by 2035 (≈ 6.8% CAGR), the U.S. anti-static polymer compounds market presents a sizable growth opportunity driven by electronics, e-commerce packaging, and higher automation in manufacturing. Suppliers who invest in durable, multifunctional, and recyclable antistatic solutions — while supporting customers with compounding expertise and qualification services — will capture the strongest share of the expanding market.

Browse Full Report: https://www.factmr.com/report/united-states-anti-static-polymer-compounds-market