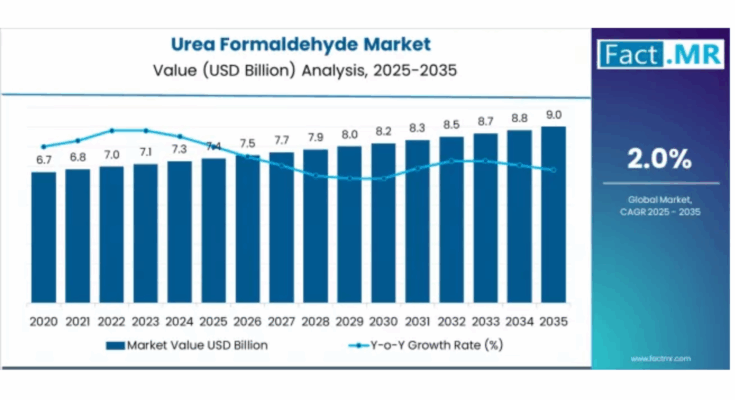

The global urea formaldehyde market is positioned for steady expansion over the next decade, supported by rising demand from the construction, furniture, and wood-based panel industries. According to a new analysis by Fact.MR, the market is expected to grow from USD 7.4 billion in 2025 to approximately USD 9.0 billion by 2035, recording an absolute increase of USD 1.6 billion over the forecast period. This represents a total growth of 21.6%, with the market expanding at a CAGR of 2.0% from 2025 to 2035.

The continued preference for cost-effective, high-performance thermosetting resins in plywood, particleboard, MDF, and laminates is a major factor sustaining demand for urea formaldehyde worldwide.

Strategic Market Drivers

Construction and Infrastructure Expansion Fuels Demand

Rapid urbanization, residential housing growth, and infrastructure development—particularly in emerging economies—are driving increased consumption of engineered wood products. Urea formaldehyde resins remain a preferred choice due to their:

• Strong bonding performance

• Fast curing properties

• Low production cost

• Compatibility with mass-scale manufacturing

These advantages make urea formaldehyde indispensable in large-volume construction and interior applications.

Browse Full Report: https://www.factmr.com/report/2950/urea-formaldehyde-market

Furniture and Wood Panel Industry Growth

The global furniture industry continues to expand, driven by rising disposable incomes, urban living, and demand for modular and ready-to-assemble furniture. Urea formaldehyde is extensively used in:

• Particleboard

• Medium-density fiberboard (MDF)

• Plywood

• Decorative laminates

Its excellent surface hardness and smooth finish make it ideal for furniture and interior décor.

Cost Advantage Over Alternative Resins

Compared to phenol formaldehyde and melamine formaldehyde, urea formaldehyde offers a significant cost advantage, enabling manufacturers to maintain profitability while meeting large-scale demand—especially in price-sensitive markets.

Regional Growth Highlights

Asia Pacific: Dominant Manufacturing and Consumption Hub

Asia Pacific leads the global urea formaldehyde market due to:

• Rapid construction growth in China and India

• Expanding furniture manufacturing base

• Rising exports of wood panels and furnishings

China remains the largest producer and consumer, supported by its strong real estate and furniture sectors.

North America: Stable Demand from Housing and Renovation

The U.S. and Canada maintain steady demand driven by residential construction, home remodeling, and furniture replacement cycles. Growth is supported by consistent use of engineered wood products.

Europe: Sustainability and Regulatory Influence

Europe shows moderate growth, influenced by stringent emission regulations and increasing adoption of low-emission and E0/E1 grade resins. Manufacturers are focusing on reformulated urea formaldehyde products to comply with environmental standards.

Emerging Markets: Gradual but Consistent Uptake

Latin America, the Middle East, and Africa are witnessing gradual growth due to infrastructure projects, urban housing demand, and increasing local furniture production.

Market Segmentation Insights

By Application

- Particleboard – Largest share due to high usage in furniture and interiors

• Plywood – Strong demand from construction and housing

• MDF – Growing adoption in premium furniture and cabinetry

• Laminates & Others – Used in flooring, wall panels, and decorative surfaces

By End Use

- Construction & Building Materials – Dominant segment

• Furniture Manufacturing – High-volume consumption

• Automotive Interiors – Limited but stable usage

• Electrical & Consumer Goods – Niche applications

Challenges Impacting Market Growth

Formaldehyde Emission Regulations

Growing concerns about indoor air quality and health risks associated with formaldehyde emissions are pushing regulators to impose stricter standards, potentially limiting conventional resin usage.

Competition from Alternative Resins

Phenol formaldehyde, melamine formaldehyde, and bio-based adhesives are gaining traction, especially in applications requiring higher moisture resistance or lower emissions.

Environmental and Sustainability Concerns

Increasing emphasis on green building materials is driving R&D investments toward low-emission and formaldehyde-free alternatives.

Competitive Landscape

The urea formaldehyde market is moderately consolidated, with manufacturers focusing on emission reduction technologies, product reformulation, and capacity optimization.

Key Companies Profiled

- BASF SE

• Hexion Inc.

• Dynea AS

• Acron PJSC

• Prefere Resins

• INEOS Group

• Georgia-Pacific Chemicals

• Metadynea

Companies are actively investing in low-formaldehyde and ultra-low-emission resin technologies to align with evolving environmental standards.

Future Outlook: Stability with Incremental Innovation

While the urea formaldehyde market is mature, the next decade will focus on:

• Development of low-emission and E0-grade resins

• Stable demand from construction and furniture sectors

• Incremental process innovations to improve performance

• Expansion in emerging economies

As affordability, performance, and scalability remain key priorities, urea formaldehyde will continue to play a vital role in global wood-based manufacturing through 2035, maintaining its position as a cornerstone resin in the construction and furniture industries.