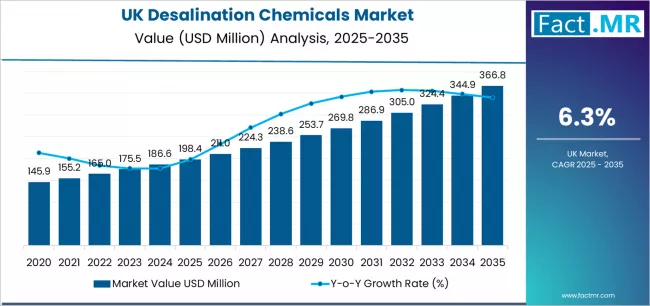

The UK’s demand for desalination chemicals is expected to increase at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035, from USD 198.4 million in 2025 to roughly USD 366.8 million.

Desalination chemicals are specialty formulations used to enhance the efficiency, safety, and longevity of desalination systems by preventing scaling, fouling, corrosion, microbial growth, and membrane degradation. These chemicals play a critical role in ensuring consistent water output and reducing operational downtime in desalination plants.

In the United Kingdom, demand for desalination chemicals is steadily rising as water scarcity concerns, climate variability, industrial water requirements, and infrastructure modernization drive increased adoption of desalination and advanced water treatment solutions. While the UK is not traditionally a large desalination market, growing pressure on freshwater resources is accelerating investment in desalination and related chemical solutions.

Quick Stats (2025–2035)

-

Estimated Market Value (2025): ~USD 95–105 million

-

Projected Market Value (2035): ~USD 185–200 million

-

Forecast CAGR (2025–2035): ~6.8–7.4%

-

Leading Chemical Type (2025): Scale inhibitors and antiscalants

-

Dominant Technology: Reverse osmosis (RO) desalination

-

Primary End Users: Municipal utilities and industrial water treatment operators

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12503

Market Overview

Desalination chemicals are essential for maintaining performance and cost efficiency in desalination systems, particularly those using reverse osmosis membranes. These chemicals help manage mineral scaling, biofouling, corrosion, and suspended solids, ensuring consistent water quality and extending membrane life.

In the UK, desalination chemicals are primarily used in coastal desalination plants, industrial water treatment facilities, power generation units, offshore installations, and emergency water supply systems. Increasing adoption of advanced membrane technologies further boosts the need for specialized chemical formulations tailored to specific feedwater conditions.

Key Drivers of Demand in the UK

1. Rising Water Scarcity & Climate Variability

Changing rainfall patterns, prolonged dry spells, and regional water stress are increasing reliance on alternative water sources. Desalination offers a reliable supply option, particularly in coastal regions, increasing demand for supporting chemical solutions.

2. Growth in Industrial Water Consumption

Industries such as power generation, pharmaceuticals, food & beverage, chemicals, and electronics require high-purity water. Desalination combined with advanced treatment systems is gaining importance, driving consistent demand for desalination chemicals.

3. Expansion of Reverse Osmosis Infrastructure

Reverse osmosis remains the preferred desalination technology due to energy efficiency improvements. RO systems require continuous chemical treatment to prevent membrane fouling and degradation, sustaining chemical demand.

4. Focus on Operational Efficiency & Cost Reduction

Desalination chemicals reduce membrane replacement frequency, energy consumption, and downtime. Plant operators increasingly prioritize optimized chemical dosing to improve total cost of ownership.

5. Regulatory Emphasis on Water Quality & Sustainability

Stricter environmental regulations related to water discharge quality and plant efficiency encourage the use of advanced chemical formulations that support sustainable operations.

Market Segmentation & Insights

By Chemical Type

-

Scale Inhibitors & Antiscalants:

The largest segment, used to prevent mineral scaling on membranes and heat exchangers. -

Biocides & Disinfectants:

Control microbial growth and biofouling, critical for membrane longevity. -

Coagulants & Flocculants:

Improve pretreatment efficiency by removing suspended solids and organic matter. -

Corrosion Inhibitors:

Protect pipelines, pumps, and metal components from degradation. -

Dechlorination Chemicals:

Used to neutralize residual chlorine to prevent membrane damage.

By Technology

-

Reverse Osmosis (RO):

Dominates the market due to widespread adoption and high chemical dependency. -

Thermal Desalination:

Limited but relevant in specific industrial and power generation applications. -

Hybrid Systems:

Combining RO with other treatment technologies to enhance efficiency.

By End User

-

Municipal Water Utilities:

Major users due to desalination’s role in augmenting drinking water supplies. -

Industrial Facilities:

Power plants, refineries, and manufacturing units with high water purity needs. -

Offshore & Marine Applications:

Includes offshore platforms and marine vessels requiring onboard desalination. -

Emergency & Temporary Installations:

Used in contingency planning and disaster response scenarios.

Challenges & Market Constraints

1. Limited Scale of Desalination in the UK

Compared to arid regions, the UK has fewer large-scale desalination plants, limiting absolute chemical demand.

2. Environmental Concerns

Chemical discharge and brine disposal must meet strict environmental standards, increasing formulation and compliance complexity.

3. Cost Sensitivity

Water utilities operate under tight budgets, making cost-effective chemical solutions essential.

4. Technical Customization Requirements

Feedwater variability requires tailored chemical formulations, increasing complexity for suppliers.

Opportunities for Market Expansion

1. Growth in Modular & Small-Scale Desalination

Portable and decentralized desalination systems create new demand for flexible chemical solutions.

2. Innovation in Eco-Friendly Chemicals

Development of biodegradable, low-toxicity formulations supports regulatory compliance and sustainability goals.

3. Integration with Smart Water Management

Digital monitoring and automated dosing systems enhance chemical efficiency and usage optimization.

4. Industrial Water Recycling & Reuse

Desalination combined with reuse initiatives increases overall chemical consumption.

5. Public–Private Infrastructure Investments

Ongoing modernization of water infrastructure creates opportunities for long-term chemical supply contracts.

Outlook (2025–2035)

The UK desalination chemicals market is expected to witness steady growth over the next decade as water security becomes a higher national priority. While desalination remains a supplementary water source, its role in industrial, emergency, and coastal applications is expanding, driving consistent chemical demand.

Scale inhibitors and antiscalants will remain dominant, supported by widespread use of reverse osmosis systems. Suppliers offering high-performance, environmentally compliant, and application-specific chemical solutions will gain competitive advantage.

Overall, desalination chemicals will play an increasingly strategic role in the UK’s water treatment ecosystem, supporting reliable water supply, infrastructure resilience, and sustainable resource management in the years ahead.

Browse Full Report: https://www.factmr.com/report/united-kingdom-desalination-chemicals-market