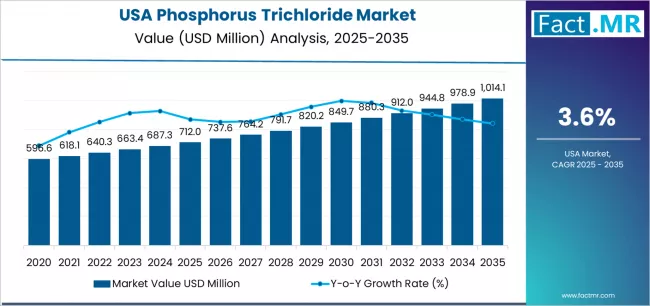

A newly released comprehensive market analysis reveals that demand for Phosphorus Trichloride (PCl₃) in the United States is poised for robust growth over the next decade, rising from an estimated US$ 712.0 million in 2025 to approximately US$ 1,010.0–1,014.1 million by 2035, representing a compound annual growth rate (CAGR) of about 3.6 %.

This upward trajectory highlights a strong rebound in demand across agrochemical, chemical‑intermediate, and specialty‑grade segments, driven by intensified agricultural activity, expanding chemical manufacturing infrastructure, and growing demand for high‑purity chemical intermediates.

Key Market Figures

-

2025 Market Valuation (U.S.): USD 712.0 million

-

2035 Projected Market Value (U.S.): USD 1,010.0–1,014.1 million (≈ 42 % growth over the decade)

-

Overall U.S. Market CAGR (2025–2035): ~3.6 %

-

Rapid Growth (2025–2030): Climb to ~USD 844.0 million — a gain of USD 132.0 million in first half of forecast period

-

Application Mix (2025): ~52.3 % of demand attributed to agrochemicals (phosphorus‑derivatives) – the largest single segment

-

Purity/Grade Mix (2025): Tech‑grade PCl₃ expected to comprise ~74.8 % of demand, reflecting dominance of industrial and large-scale chemical‑processing applications

What’s Driving the Surge

1. Rising Agrochemical and Agricultural Demand

The agrochemical sector remains the leading end‑user of phosphorus trichloride in the U.S. In 2025, over half of all PCl₃ demand is linked to phosphorus‑derivative agrochemical manufacturing, especially for herbicides, insecticides, and other crop‑protection products.

As U.S. farming operations increasingly adopt modern, yield‑driven practices and precision agriculture methods, demand for efficient and reliable phosphorus-based inputs continues to rise. This trend is reinforced by a broader push for sustainable farming — which, paradoxically, can require higher‑performance agrochemicals and intermediates.

2. Expansion of U.S. Chemical Infrastructure & Manufacturing

Beyond agriculture, the expansion of chemical manufacturing capacity — including production of specialty chemicals, flame retardants, plasticizers, and intermediates for pharmaceuticals — is fueling PCl₃ demand. The versatility of PCl₃ as a chlorinating and phosphorus-donating intermediate makes it indispensable across multiple industrial applications.

Tech‑grade PCl₃, comprising nearly three‑quarters of demand, is favored for its reliability and compatibility with large‑scale chemical operations.

3. Shift to Premium & High‑Purity Grades for Advanced Applications

Emerging requirements from semiconductor, pharmaceutical, and high‑spec specialty chemical sectors are driving demand for higher‑purity PCl₃ and precision‑manufactured intermediates. This subtle shift is gradually reshaping the market mix toward more sophisticated, value‑added applications.

Additionally, ongoing regulatory pressure and environmental standards are encouraging producers to adopt cleaner, more controlled processes — a move that indirectly boosts demand for high‑quality PCl₃ supply.

Regional Demand Patterns

As of 2025, the U.S. market for phosphorus trichloride is geographically diverse. The largest share of demand is concentrated in the West region, which leads in chemical‑processing capacity and infrastructure growth.

Other regions — the Northeast, South and Midwest — are also expected to register steady growth, with CAGRs ranging between 3.4 % and 3.6 %.

This widespread regional adoption underlines the national scale of demand, suggesting robust and geographically distributed market opportunities rather than localized demand pockets.

Challenges & Market Dynamics

While the growth outlook is optimistic, the PCl₃ market faces several headwinds:

-

Regulatory and Environmental Pressures: Heightened scrutiny around chemical intermediates, especially chlorinated phosphorus compounds, could lead to stricter regulatory oversight — potentially increasing compliance costs or limiting certain uses.

-

Supply‑Chain Constraints & Raw‑Material Volatility: Prices and availability of feedstock (e.g., yellow phosphorus or phosphate rock) remain subject to global supply disruptions, geopolitical tensions, or mining limitations.

-

Cost Pressures and Competitive Alternatives: As the chemical industry evolves, demand for greener, less hazardous alternatives could challenge traditional phosphorus‑chloride technologies, especially in agrochemicals and specialty applications.

Strategic Implications for Stakeholders

Given the forecasted growth, stakeholders across chemical manufacturing, agrochemical production, specialty chemical supply, and industrial intermediates stand to benefit significantly:

-

Chemical Producers & Distributors should consider scaling up PCl₃ production capacity — especially tech‑grade and high‑purity variants — to meet rising demand across multiple sectors.

-

Agrochemical Manufacturers should anticipate an expansion in PCl₃‑derived product pipelines, driven by increased crop‑protection demand and evolving farming practices.

-

Investors and Industry Analysts might see PCl₃‑linked assets (chemical plants, intermediates services, specialty chemical portfolios) as strong long‑term plays given stable demand growth and diversified application base.

-

Regulators & Environmental Policy Makers would do well to monitor this expansion carefully, balancing the benefits of enhanced agricultural yield and chemical innovation against environmental and safety considerations.

Browse Full Report : https://www.factmr.com/report/united-states-phosphorus-trichloride-market

About This Analysis

This data‑driven market insight is based on a comprehensive U.S. phosphorus trichloride forecast study projecting demand growth through 2035.

The 2025 baseline estimate and future projections reflect conservative scenarios accounting for known growth drivers — yet actual demand may exceed projections if agricultural modernization accelerates, regulatory trends favor phosphorus‑based intermediates, or demand from emerging chemical sectors intensifies.

Forward‑Looking Statements

This press release contains forward‑looking statements regarding anticipated market growth, future demand patterns, and industry dynamics. Actual results could differ materially based on regulatory, economic, or supply‑chain developments.

About Chemical Insights Group

Chemical Insights Group is a market‑intelligence and industry‑analysis firm specializing in chemicals, materials, and industrial intermediates. The firm offers in‑depth, data‑backed insights for producers, investors, and stakeholders across the chemical value chain.