The U.S. cell culture supplements market — a critical backbone for biopharmaceutical manufacturing, cell and gene therapy, and regenerative medicine — is on track for substantial expansion in the coming years. The market is expected to reach USD 2.30–2.50 billion by 2033, up from approximately USD 813–835 million in 2024.

From 2025 through 2033, the market is forecast to grow at a compound annual growth rate (CAGR) of around 12.8–12.9%, reflecting strong underlying demand and accelerating adoption of advanced cell culture technologies.

🔹 Key Market Drivers — Why the Surge?

• Rising Demand for Biologics, Biosimilars & Advanced Therapies

The surge in biologics production — including monoclonal antibodies, recombinant proteins, viral vectors, and more — is a primary growth engine. As pharmaceutical and biotech companies ramp up production of biologics and biosimilars, there is a corresponding need for high-performance, reliable cell culture supplements to support cell growth, viability, and yield.

Simultaneously, advancements in cell- and gene-therapy pipelines — including next-generation cell therapies, personalized medicine, and regenerative medicine — are pushing demand for specialized culture environments. This shift toward complex therapies inherently demands advanced, consistent, and regulatory-compliant supplements.

• Transition to Chemically Defined, Serum‑Free & Animal‑Free Supplements

A notable market evolution is the shift away from traditional, animal-derived culture media toward chemically defined, serum-free, and xeno-free supplements. These formulations offer improved batch-to-batch consistency, reduced risk of contamination, and better alignment with regulatory standards for therapeutic manufacturing.

This shift also supports scalability and reproducibility in large-scale biomanufacturing — a critical requirement as companies move from research labs to commercial production.

• Growth of Cell & Gene Therapy, 3D Culture, Organoids, and Advanced Models

Emerging technologies such as 3D cell culture, organoid models, and organ-on-chip platforms are gaining traction in research, drug discovery, and therapeutic development. These advanced culture systems often require more sophisticated supplement formulations, tailored for physiological relevance, cell differentiation, or long-term viability — driving demand for specialized supplements.

The growth of regenerative medicine, stem-cell R&D, and gene therapies adds another layer of demand, since these applications typically require high-quality, defined supplements to ensure safety, consistency, and regulatory compliance.

• Increased Outsourcing, Contract Manufacturing & Biomanufacturing Infrastructure Build-Out

The trend of outsourcing R&D, drug discovery, and manufacturing to contract research organizations (CROs) and contract development & manufacturing organizations (CDMOs) is accelerating. As companies outsource more of their biologics production and cell therapy manufacturing, demand for scalable, high-quality supplements increases accordingly.

In addition, major players and suppliers are investing heavily to expand manufacturing capacity, secure supply chains, and ensure quality compliance. This includes establishing GMP-grade supplement production, expanding facility footprint, and strengthening raw-material sourcing.

Market Structure — Segments & Share

• By Product Type

In 2024, protein-based and recombinant supplements dominated the U.S. market, holding the largest share of roughly 42.5–45%.

However, chemically defined supplements are anticipated to record the fastest growth through the forecast period. This reflects growing preference for defined, reproducible, and animal-free media formulations in therapeutic manufacturing and research settings.

Other product types include serum-based and other supplement varieties — but the market clearly is tilting toward defined and recombinant solutions.

• By Application

In 2024, the biopharmaceutical manufacturing segment was the largest application area, accounting for approximately 48.7–49% of market share.

Yet, the cell & gene therapy segment is expected to grow at the fastest pace going forward — reflecting the rapid expansion of advanced therapies, clinical pipelines, and demand for tailored cell culture environments.

Other applications include drug discovery and research (academic and CROs), though their share remains smaller relative to commercial manufacturing.

• By End‑User

Pharmaceutical and biotechnology companies remain the dominant end-users, capturing the largest share (~41–45%) in 2024. These companies are at the forefront of biologics development, cell- and gene-based therapies, and large-scale manufacturing.

Meanwhile, CROs/CDMOs are among the fastest-growing user segments, as outsourcing continues to be a key strategic trend in drug development and manufacturing.

Outlook 2025–2035: What Lies Ahead

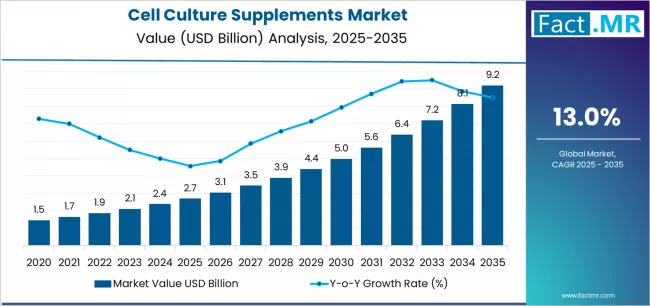

Most publicly available forecasts for the U.S. market centre around USD 2.30–2.50 billion by 2033. Broader global forecasts for the overall cell culture supplements market suggest far larger growth through 2035, with projections estimating a rise from USD 2.7 billion in 2025 to USD 9.2 billion by 2035, implying a global CAGR of ~13.0%.

For the U.S., if growth continues robustly beyond 2033 — driven by biopharmaceutical expansion, increasing cell/gene therapy approvals, and continued innovation in supplement formulations — the market could potentially mirror broader global trends, with increasing integration of advanced culture systems (3D, organoids), broader adoption of chemically defined media, and deeper penetration into emerging therapeutic and research areas.

Future growth may also be supported by:

-

Increasing regulatory emphasis on reproducibility, safety, and animal‑free manufacturing components.

-

Expansion of personalized medicine and autologous therapies demanding bespoke culture conditions.

-

Scaling-up of manufacturing infrastructure across both established pharma and newer biotech firms.

-

Growth in research and development budgets for regenerative medicine, cell therapy, organoid-based disease models, and high-throughput drug screening.

Browse Full Report : https://www.factmr.com/report/cell-culture-supplements-market

What This Means for Stakeholders

For biopharma companies: the growing reliance on advanced cell culture supplements underscores the importance of proactively adopting defined, GMP-grade, and scalable media solutions. Investing in reliable suppliers and validated supply chains will be critical as biologics and cell-based therapies scale up.

For CROs/CDMOs: rising outsourcing trends make supplement supply a strategic advantage — offering not just reagents, but turnkey media solutions tailored to specific cell lines and therapeutic modalities.

For Suppliers and Media Manufacturers: demand is shifting rapidly — from conventional supplements toward chemically defined, recombinant, and serum-free media. Suppliers that invest in R&D, regulatory compliance, and production capacity will be well-positioned.

For Investors: the sustained double-digit CAGR for the U.S. market and even higher growth globally signals attractive long-term potential, especially as cell and gene therapies continue to mature, regulatory frameworks evolve, and therapeutic pipelines expand.

For Researchers and Academic Labs: the broader accessibility and scalability of chemically defined media and advanced supplements expands possibilities in organoid research, disease modeling, drug discovery, and translational research — potentially accelerating breakthroughs in biology and medicine.

Summary

The U.S. cell culture supplements market is set for a strong upward trajectory over the coming years. From a base of roughly USD 813–835 million in 2024, the industry is projected to more than double — reaching USD 2.30–2.50 billion by 2033 — at a healthy CAGR of ~12.8–12.9%.

Driving this growth are surging biopharmaceutical and biologics demand, rapid expansion of cell and gene therapies, adoption of advanced culture technologies (3D cultures, organoids), and a decisive industry shift toward chemically defined, serum-free, and recombinant supplements for improved reproducibility, safety, and scalability.