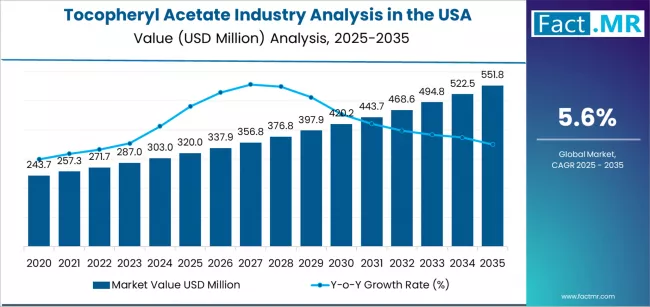

The United States tocopheryl acetate industry is poised for robust expansion over the next decade, driven by rising consumer preference for antioxidant-rich ingredients, the boom in clean beauty formulations, and escalating applications across dietary supplements and fortified foods. According to a new analysis by Fact.MR, the demand for tocopheryl acetate in the USA is projected to grow from USD 320.0 million in 2025 to approximately USD 555.0 million by 2035, reflecting a CAGR of 5.6% and marking an absolute increase of USD 235.0 million during the forecast period.

A leading derivative of Vitamin E, tocopheryl acetate is widely used for its antioxidant, moisturizing, and skin-repairing properties. The ingredient’s versatile applicability across skincare, cosmetics, pharmaceuticals, and nutrition is strengthening long-term market prospects.

Strategic Market Drivers

Clean Beauty and Skin Wellness Propel Consumption

Growing awareness of skin health, pollution defense, and photo-protection is driving consumer demand for Vitamin E derivatives in the United States. Tocopheryl acetate’s stability, compatibility with active ingredients, and proven anti-aging benefits make it a staple in moisturizers, serums, sunscreens, and restorative skincare formulations.

The Cosmetic/Personal Care grade segment is projected to account for 54.0% of overall U.S. demand in 2025, highlighting the ingredient’s dominant role in beauty and dermatology applications.

Nutraceutical Growth Enhances Market Uptake

The burgeoning nutraceuticals industry—powered by preventive wellness, immunity-boosting preferences, and lifestyle-driven supplement adoption—is contributing significantly to tocopheryl acetate demand. Its incorporation in multivitamins, energy supplements, and functional foods is expanding across U.S. retail and e-commerce platforms.

Browse Full Report: https://www.factmr.com/report/united-states-tocopheryl-acetate-industry-analysis

Innovation, Clean Labels & Advanced Formulations Transform the Market

Product Reformulation Strengthens Market Presence

Manufacturers are increasingly using tocopheryl acetate in product formulations due to its long shelf-life, enhanced stability, and protective benefits against oxidative damage. Formulators are leveraging the ingredient for:

- Anti-aging serums

- Barrier-repair creams

- UV-protection skincare systems

- Fortified dietary supplements

- Dermatologist-approved pharmaceutical blends

E-commerce, Dermatology Brands & Private Labels Accelerate Penetration

Rising online beauty spending, dermatologist-driven skincare startups, and private-label cosmetic brands are widening product accessibility. The U.S. market is witnessing rapid launches of Vitamin E-based skincare lines with claims related to hydration, scar reduction, environmental protection, and wrinkle repair.

Regional Market Highlights

Northeast USA: Epicenter of Dermatology-Driven Innovation

The presence of leading cosmeceutical laboratories and premium skincare brands supports strong demand. Rising consumer interest in anti-inflammatory and anti-pollution skincare is fueling tocopheryl acetate usage.

West Coast: Clean Beauty & Sustainable Formulations Lead the Way

California and Washington continue to drive natural beauty trends, with a strong emphasis on clean-label, vegan, and cruelty-free cosmetic formulations.

Southern & Midwestern States: Expanding Nutraceutical Consumption

Affordable supplement brands, growing middle-class health awareness, and expanding retail penetration contribute to rising tocopheryl acetate demand in dietary applications.

Market Segmentation Insights

By Grade

- Cosmetic/Personal Care Grade – Largest segment led by demand for moisturization, anti-aging, and skin-repair solutions.

- Pharmaceutical Grade – Growing use in dermatology treatments and topical formulations.

- Food & Nutrition Grade – Expanding share with fortified foods and vitamin supplements.

By Application

- Skincare & Cosmetics – Sunscreens, serums, moisturizers, anti-aging creams

- Dietary Supplements – Capsules, multivitamins, immunity boosters

- Pharmaceuticals – Topical ointments, dermatology preparations

- Food Fortification – Beverages, breakfast cereals, nutritional foods

By Distribution Channel

- Specialty Beauty Stores – Dominant for premium formulations

- Pharmacies – Strong share for cosmeceuticals and dermo-cosmetics

- Online Retail – Fastest growing due to D2C beauty brands

- Mass Retail & Hypermarkets – Broad consumer reach

Challenges Impacting Market Growth

- Stringent Regulatory Compliance for cosmetic and nutraceutical ingredients

- Price Volatility in key raw materials and Vitamin E feedstock

- Competition from Natural Vitamin E (Mixed Tocopherols)

- Increased Demand for Transparency in ingredient sourcing & purity

Competitive Landscape

The U.S. tocopheryl acetate market is moderately consolidated, with manufacturers focusing on purity enhancement, stabilization techniques, and application-specific product offerings.

Key Companies Profiled

- BASF SE

- DSM Nutritional Products

- ADM

- Zhejiang Medicine Co.

- Wilmar BioEthanol

- Hoffmann-La Roche Ltd.

- Eva Pharma

- Vitaquest International

- Ashland Inc.

- Symrise AG

Companies are prioritizing high-purity grades, clean-label formulations, non-GMO sourcing, and improved solubility technologies to compete effectively.

Recent Developments

- 2024: Surge in Vitamin E-based serums and moisturizers launched by U.S. dermatologist-backed brands.

- 2023: Expanded use of tocopheryl acetate in vegan-certified and cruelty-free skincare formulations.

- 2022: Nutraceutical manufacturers introduced new Vitamin E-fortified supplements targeting immunity and metabolic health.

Future Outlook: A Decade of Clean Beauty and Wellness Innovation

The U.S. tocopheryl acetate industry is set to benefit from accelerating beauty-tech innovation, science-backed dermatology solutions, and personalized nutrition trends. As consumers prioritize antioxidant protection and cleaner ingredient profiles, the role of tocopheryl acetate will continue to expand.

Brands that focus on sustainable sourcing, advanced formulations, regulatory compliance, and multifunctional product benefits will emerge as market leaders through 2035.