The U.S. cocoa liquor market is positioned for steady expansion over the next decade, driven by rising demand for premium chocolate products, growth in artisanal and craft confectionery, and accelerating adoption of clean-label, natural ingredients across the food and beverage industry.

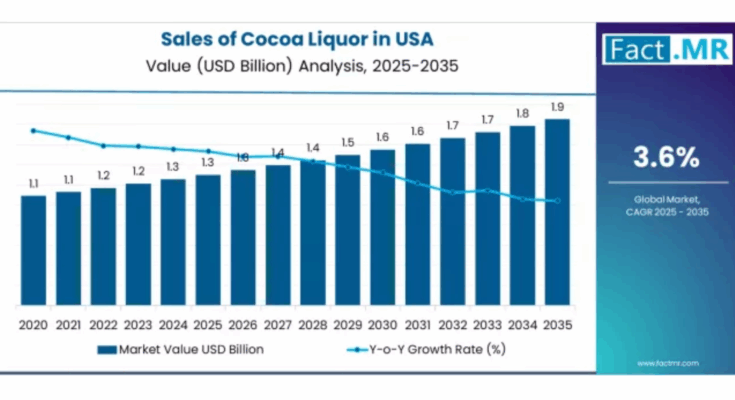

According to a new analysis by Fact.MR, the demand for cocoa liquor in the USA is projected to grow from USD 1.3 billion in 2025 to approximately USD 1.9 billion by 2035, marking an absolute increase of USD 0.6 billion during the forecast period. This reflects total growth of 46.2%, supported by a CAGR of 3.6% between 2025 and 2035.

The market’s steady expansion is underpinned by rising consumption of premium chocolates, increased usage in beverages and bakery products, and sustained innovation in gourmet and specialty cocoa-based products.

Strategic Market Drivers

Premium Chocolate Consumption Fuels Demand

Growing consumer preference for high-quality, rich-flavor chocolate continues to propel cocoa liquor usage. Premium and dark chocolate segments—recognized for their superior cocoa content and reduced sugar formulations—are witnessing rising demand in both retail and artisanal confectionery spaces.

The trend toward bean-to-bar chocolate and craft manufacturing has further boosted the market, as cocoa liquor serves as a core ingredient for flavor intensity and texture.

Browse Full Report: https://www.factmr.com/report/sales-of-cocoa-liquor-in-usa

Clean-Label & Natural Ingredient Trends Accelerate Growth

U.S. consumers increasingly seek clean-label, minimally processed, and natural products. Cocoa liquor, being an essential natural ingredient derived directly from cocoa beans, aligns well with:

- Plant-based ingredient demand

- Organic or ethically sourced product trends

- Sustainable and transparent supply chains

As the foodservice, bakery, and beverage sectors embrace natural formulations, cocoa liquor adoption continues to rise.

Expanding Use in Bakery, Beverages & Desserts

Beyond chocolate manufacturing, cocoa liquor is gaining wider use in:

- Baked goods (brownies, pastries, cookies)

- Dairy & non-dairy beverages (chocolate milk, shakes, specialty drinks)

- Desserts and frozen products

- Flavoring and specialty gourmet foods

This broadening application base remains a major growth catalyst.

Innovation and Ethical Sourcing Strengthen Market Potential

Manufacturers are increasingly focusing on:

- Traceable and ethically sourced cocoa

- Organic or fair-trade cocoa liquor

- New flavor profiles and premium blends

- Sustainable cocoa processing techniques

This enhances product appeal among environmentally and ethically conscious consumers.

Regional & Consumer Trends Supporting Growth

Rising Premiumization in Urban Markets

Major U.S. cities—New York, Los Angeles, Chicago, and San Francisco—continue to drive demand for:

- Fine chocolates

- Artisan confectionery

- Specialty cocoa-based beverages

This urban premiumization is expected to play a significant role through 2035.

Growth of Craft & Bean-to-Bar Manufacturers

The expanding ecosystem of small-batch and craft chocolate makers is increasing domestic demand for high-quality cocoa liquor.

Expansion of Foodservice & Specialty Retail

Cafés, bakeries, boutique chocolatiers, and gourmet retail stores increasingly rely on cocoa liquor as a foundational ingredient.

Market Segmentation Insights

By Product Type

- Natural Cocoa Liquor – Largest share due to broad usage in chocolate and bakery applications

- Dutch-Processed Cocoa Liquor – Growing demand owing to smoother flavor profiles and reduced acidity

By Application

- Chocolate & Confectionery – Dominant segment

- Bakery & Pastry – Rising usage in premium baked goods

- Beverages – Expanding presence in dairy, plant-based, and specialty drinks

- Ice Cream & Desserts – Strong growth driven by gourmet and indulgence trends

Challenges Impacting Market Growth

Volatility in Cocoa Bean Prices

Fluctuations in global cocoa supply—driven by climate events, crop disease, and geopolitical issues—affect cocoa liquor pricing and margins.

Sustainability Concerns

Concerns around deforestation, child labor, and farming practices push manufacturers to adopt stricter sourcing regulations and higher compliance costs.

Supply Chain Constraints

Post-harvest processing limits and logistic challenges in major cocoa-producing regions affect U.S. cocoa liquor imports.

Competitive Landscape

The U.S. cocoa liquor market features a mix of global cocoa suppliers, specialty chocolate makers, and sustainable ingredient companies focusing on high-quality cocoa sourcing.

Key Companies Profiled

- Barry Callebaut

- Cargill Inc.

- Mars Inc.

- Olam International

- The Hershey Company

- Puratos Group

- Blommer Chocolate Company

- Guittard Chocolate Company

- Nestlé S.A.

These companies invest in sustainable cocoa programs, advanced processing technologies, and premium-quality cocoa liquor production.

Recent Industry Developments

- 2024: Growth in organic and fair-trade cocoa liquor as U.S. consumers prioritize ethical sourcing.

- 2023: Specialty chocolate brands report higher adoption of single-origin cocoa liquor.

- 2022: Major beverage manufacturers incorporate cocoa liquor in plant-based and functional drink innovations.

Future Outlook: Toward Premium, Sustainable, and Ethical Cocoa Liquor Demand

The next decade will witness transformative trends in the U.S. cocoa liquor market, driven by:

- Rising premium and craft chocolate demand

- Wider applications across bakery, beverage, and dessert categories

- Expansion of fair-trade and sustainable sourcing

- Growth of plant-based and clean-label foods

- Innovation in cocoa processing and flavor development

As consumer preferences continue shifting toward natural, authentic, and ethically sourced ingredients, the U.S. cocoa liquor market is set for steady, long-term growth through 2035.