The pyrogen testing market — entailing tests to detect fever-causing contaminants (pyrogens / endotoxins) in pharmaceuticals, biologics, vaccines, and medical devices — is on a strong growth trajectory over the next decade. As production of biologics, sterile injectables, vaccines, and medical devices expands globally, demand for rigorous quality control and regulatory-compliant testing is rising. At the same time, advances in testing technology — including animal-free, in vitro assays — and increasing regulatory stringency are further catalyzing market growth. This makes pyrogen testing increasingly central to manufacturing, safety assurance, and product release workflows in the life-sciences and medical industries.

Quick Stats (2025–2035)

-

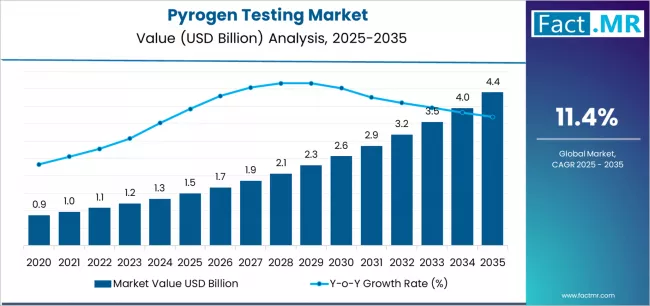

2025 Estimated Global Market Value: ≈ USD 1.5 billion

-

2030 Forecast (near-term): ≈ USD 2.49 billion

-

2035 Long-Term Forecast: Estimated to exceed USD 4.5 billion — given growth projections and expanding biologics & device demand

-

Typical Forecast CAGR (2025–2035): ~ 11-12%

-

Dominant Test Type (2025): LAL (Limulus Amebocyte Lysate) / endotoxin assays (largest share)

-

Fastest-Growing Test Type: In-vitro pyrogen tests (e.g., Monocyte Activation Test, recombinant assays)

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=10200

Key Market Drivers

1. Expansion of Biologics, Vaccines & Injectable Drug Production

-

Growing global demand for biologic drugs, monoclonal antibodies, vaccines, and sterile injectables requires stringent pyrogen and endotoxin testing to ensure product safety.

-

As pipelines expand — including biosimilars, gene- and cell-therapies — frequency of batch testing, lot release assays, and validation routines increase.

2. Strict Regulatory Requirements & Safety Standards

-

Regulatory agencies and pharmacopeias mandate pyrogen and endotoxin testing for injectable drugs, biologics, and medical devices that contact sterile fluids.

-

Compliance demands drive manufacturers and contract labs to adopt validated testing protocols, boosting demand for testing kits, reagents, instruments and services.

3. Growth of Medical Devices & Implantable / Sterile Products

-

Expanding production of sterile medical devices — syringes, catheters, IV sets, implants — increases need for pyrogen testing to avoid dangerous reactions.

-

As medical device manufacturing grows globally, more facilities need access to reliable pyrogen/endotoxin testing solutions.

4. Shift Toward Animal-Free and In-Vitro Testing Methods

-

Ethical concerns and regulatory encouragement are driving adoption of non-animal-based pyrogen tests (e.g. recombinant-factor assays, Monocyte Activation Test).

-

In-vitro methods offer advantages: faster results, reproducibility, easier standardization — making them attractive alternatives to traditional animal-based tests.

5. Outsourcing & Rising QA/QC Infrastructure in Emerging Markets

-

Pharmaceutical, biotech and device manufacturers increasingly outsource QC, including pyrogen testing, to specialized labs to manage costs and compliance.

-

Expansion of testing lab infrastructure globally, especially in Asia-Pacific, supports broader access and adoption.

Market Structure & Segment Insights

By Product & Service Type

-

Consumables & Reagents / Kits: Represent the largest segment due to recurring need for reagents for each batch/lot tested. Frequent testing of injectables and devices ensures steady demand.

-

Instruments & Equipment: Growing as labs and manufacturers invest in automated, high-throughput testing platforms, especially for in-vitro and endotoxin assays.

-

Testing Services: Contract research organizations (CROs) and third-party labs offering pyrogen testing services capture demand from firms lacking in-house capabilities.

By Test Type

-

LAL / Endotoxin Tests: Currently dominant due to established regulatory acceptance and broad applicability for bacterial endotoxin detection.

-

In-Vitro Pyrogen Tests (e.g., MAT, recombinant assays): Fastest-growing segment, gaining ground due to ethical, regulatory, and operational advantages over animal-based tests.

-

Rabbit / Animal-based Pyrogen Tests: Declining gradually as in-vitro alternatives gain acceptance; still used where required or in transitional contexts.

By End User / Industry

-

Pharmaceutical & Biopharmaceutical Manufacturers: Lead demand — for biologics, vaccines, sterile injectables, and routine batch/lot testing.

-

Medical Device Manufacturers: Significant demand due to requirement for pyrogen testing on devices that contact sterile fluids (catheters, implants, IV sets, etc.).

-

Contract Testing Laboratories / CROs: Serve outsourced testing needs of pharma, biotech, device manufacturers — especially useful for small and mid-sized companies.

-

Research Institutions & Biomanufacturing Facilities: Increasingly adopt pyrogen testing to support R&D pipelines, clinical batches, and pre-clinical safety studies.

By Geography

-

North America: Largest share historically, due to mature biotech & pharma sectors, strong regulatory frameworks, and high volume of biologics/vaccine production.

-

Asia-Pacific: Fastest growth expected — driven by rapid expansion of pharma/biotech manufacturing, vaccine production, and regulatory harmonization in emerging economies.

-

Europe, Latin America, Rest of the World: Growing mixed demand across regions as global manufacturing and outsourcing spreads.

Challenges & Market Restraints

-

High Cost of Equipment, Kits & Maintenance: Advanced instruments, reagents, and validation protocols are expensive — may limit adoption among smaller labs or startups.

-

Regulatory & Validation Burden: Laboratories and manufacturers must meet strict validation, documentation, and compliance requirements — increasing operational complexity and time to market.

-

Shift from Animal-Based to In-Vitro Testing Requires Transition & Investment: While ethically preferred, in-vitro methods often require revalidation and adoption of new standards, which may slow migration.

-

Supply Chain & Raw Material Constraints: Availability of critical reagents or specialized kits can affect testing throughput — especially in high-volume manufacturing settings.

-

Small Lab Barriers: For small or regional labs — cost, technical complexity, and regulatory burden can deter establishment of in-house pyrogen testing capability.

Opportunities & Strategic Directions

1. Adoption of Automated & High-Throughput Testing Platforms

-

Automation reduces manual labor, increases throughput, and ensures consistency — attractive to large vaccine and biologic manufacturers.

-

High-throughput capacity supports mass production and batch testing cycles, especially useful for vaccine rollouts or large-scale sterile manufacturing.

2. Expansion in Biologics, Vaccines & Cell/Gene Therapy Production

-

Growth in biologics, biosimilars, gene / cell therapies, vaccines, and injectable products is likely to generate sustained long-term demand for pyrogen testing solutions.

-

Manufacturers will value reliable, scalable, and regulatory-compliant testing pipelines.

3. Outsourcing to Contract Testing Labs (CROs)

-

CROs and specialized QC labs can capture demand from small to mid-size manufacturers, reducing their CAPEX burden while ensuring compliance.

-

Offering turnkey testing, documentation, and validation services improves access in emerging markets.

4. Growth in Medical Device and Implantable Device Manufacturing

-

Expanding production of sterile devices, implants, consumables — all require pyrogen/endotoxin testing prior to release — expanding end-use demand.

5. Development & Adoption of Ethical, Animal-Free Testing Alternatives

-

In-vitro pyrogen assays, recombinant factor C (rFC) methods, and other non-animal alternatives will likely dominate future testing protocols due to regulatory and ethical pressure.

-

These methods, combined with automation, can decrease cost per test and turnaround time — making pyrogen testing more accessible.

Outlook

The pyrogen testing market is set for robust growth from an estimated USD ~1.5 billion in 2025 to well over USD 4.5 billion by 2035, driven by rising biologics and vaccine production, stricter regulatory compliance, expanding medical-device manufacturing, and technological evolution toward in-vitro, automated testing.

As the healthcare, biotech, and sterile manufacturing sectors grow globally, demand for reliable, high-throughput and compliant pyrogen detection solutions will only increase. Companies that offer validated, scalable, cost-effective, and ethically-aligned testing products — including reagents, kits, instruments, and contract services — stand to gain the greatest market share.

In the coming decade, pyrogen testing is poised to evolve from a compliance checkbox to a core quality and safety foundation for modern pharmaceuticals, biologics, vaccines, and medical devices — ensuring safer products and enabling global scaling of sterile production.

Browse Full Report: https://www.factmr.com/report/pyrogen-testing-market