The global protein ingredients market is poised for strong expansion between 2025 and 2035, driven by rising health awareness, growing interest in functional foods, demand for plant-based nutrition, and widespread adoption of protein-enriched products. As consumers prioritize wellness, muscle health, and balanced diets, protein ingredients have become essential components across food, beverage, and supplement applications.

Quick Stats (2025-2035)

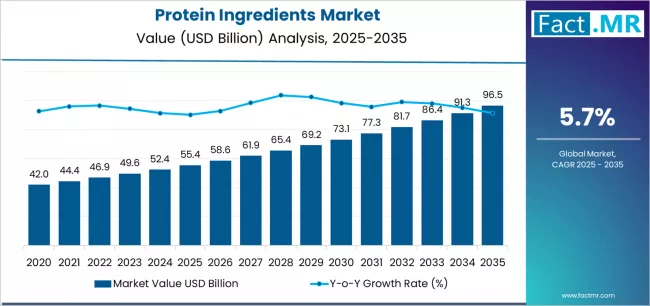

Global Market Value 2025: USD 55.4 billion

Forecast Market Value 2035: USD 96.5 billion

Absolute Growth (2025-2035): USD 41.1 billion

Forecast CAGR (2025-2035): ~5.7%

Leading Product Type (2025): Animal/Dairy Protein (~68.6% share)

Top Application (2025): Food & Beverages (~59.4% share)

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=12404

Key Market Drivers

1. Rising Focus on Health & Wellness

Increasing awareness of the role of protein in muscle maintenance, metabolism, immunity, and weight management.

Expanding consumption of protein-rich snacks, shakes, dairy alternatives, and fortified foods.

Post-pandemic lifestyle changes driving demand for nutrient-dense functional foods.

2. Rapid Growth of Plant-Based Proteins

Rising vegan, vegetarian, and flexitarian populations.

Environmental sustainability influencing consumer choices.

Improved taste, solubility, and texture of plant protein isolates supporting market growth.

Expansion of plant-based dairy and meat alternatives using soy, pea, wheat, and pulse proteins.

3. Expansion of Sports Nutrition

Growing fitness participation across all age groups.

High demand for whey, casein, and plant protein powders, bars, energy drinks, and RTD shakes.

Manufacturers launching innovative protein blends for better digestion and performance.

4. Innovation in Protein Extraction & Processing

Advanced technologies improving purity and functional properties of protein concentrates, isolates, and hydrolysates.

Development of customized proteins for beverages, bakery, dairy alternatives, and clinical nutrition.

5. Increasing Demand in Emerging Markets

Rising disposable incomes and urbanization accelerating adoption of fortified foods.

Changing dietary habits in Asia-Pacific, Africa, and Latin America creating new market opportunities.

Market Structure & Segment Insights

By Product Type

Animal/Dairy Proteins

Dominates global market share.

Includes whey, casein, egg proteins.

Preferred for complete amino-acid profile and high bioavailability.

Widely used in sports nutrition, clinical nutrition, and fortified beverages.

Plant-Based Proteins

Fastest-growing segment globally.

Includes soy, pea, wheat, oat, rice, and other pulse proteins.

Increasing adoption in dairy alternatives, smoothies, plant-based meats, and bakery applications.

By Application / End Use

1. Food & Beverages

Largest application segment.

Utilized in dairy alternatives, cereal products, baking mixes, beverages, and infant nutrition.

2. Sports Nutrition & Supplements

Strongest growth driven by athletes, fitness enthusiasts, and lifestyle consumers.

Widely used in powders, bars, shakes, and meal replacements.

3. Bakery & Snacks

Growing use of protein enrichment to enhance nutritional profiles.

Consumers prefer high-protein cookies, bread, and snacks.

4. Dairy Alternatives & Plant-Based Products

Huge demand for plant proteins in milk substitutes, yogurt alternatives, and meat analogs.

Key Challenges

1. Raw Material Price Volatility

Fluctuations in dairy, soy, and pea prices impact cost stability.

Weather-related supply issues also affect plant-based protein production.

2. Taste & Texture Limitations (Plant Proteins)

Off-flavors, grittiness, and beany taste in certain plant proteins.

Requires advanced formulation and processing for improved sensory profiles.

3. Regulatory & Clean-Label Requirements

Strong demand for natural, minimally processed, and allergen-free protein ingredients.

Manufacturers required to maintain transparency and clean-label compliance.

4. Sustainability & Supply Chain Complexity

Maintaining sustainable sourcing for dairy and plant inputs is becoming essential.

Ethical and environmental concerns influence purchasing decisions.

Major Opportunities Ahead

1. Expansion of Plant-Based Protein Innovation

Development of chickpea, lupin, fava bean, and oat proteins.

Clean-label, allergen-free protein launches to meet consumer preferences.

2. Growth in Functional & Fortified Foods

Fortified beverages, cereals, and snacks becoming mainstream.

Consumers prefer convenient high-protein formats for daily nutrition.

3. Technological Advancements

Enzymatic hydrolysis and precision fermentation improving digestibility and solubility.

Customized proteins for clinical and senior nutrition products.

4. Emerging Market Penetration

Significant demand potential in Asia-Pacific and Latin America.

Manufacturers expanding distribution networks and localized production.

Outlook (2025-2035)

The protein ingredients market is expected to grow steadily from USD 55.4 billion in 2025 to approximately USD 96.5 billion by 2035, driven by rising health consciousness, the booming sports nutrition category, and accelerating demand for plant-based foods. Animal proteins will maintain dominance due to nutritional superiority, while plant-based proteins will capture larger shares as sustainability becomes a global priority.

Brands that focus on innovation, clean-label formulations, and sustainable sourcing will lead the market. The strong rise of functional foods and dietary supplements ensures long-term demand stability, making protein ingredients one of the most resilient and expanding segments in the global food industry.

Browse Full Report: https://www.factmr.com/report/protein-ingredients-market