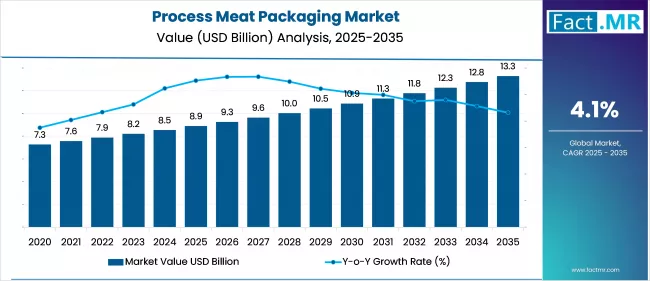

The global processed meat packaging market is expected to witness robust growth over the next decade as demand for convenience, food safety, and extended shelf life solutions continues to rise across food supply chains. In 2025, the processed meat packaging market is valued at USD 48.7 billion, and it is projected to reach USD 70.2 billion by 2035, representing an absolute increase of USD 21.5 billion during the forecast period. This growth corresponds to a compound annual growth rate (CAGR) of approximately 3.6% between 2025 and 2035, driven by increased consumption of processed meat products, expansion of organized retail, and strengthening food quality regulations globally.

Processed meat packaging includes a variety of materials and technologies designed to protect, preserve, and extend the shelf life of products such as sausages, ham, bacon, and ready-to-eat meals. Packaging solutions help maintain product freshness, prevent contamination, enhance convenience, and support branding and consumer communication.

Quick Market Snapshot (2025–2035)

-

Market Value (2025): USD 48.7 billion

-

Market Forecast Value (2035): USD 70.2 billion

-

Market Forecast CAGR: 3.6%

-

Leading Packaging Type: Modified Atmosphere Packaging (MAP)

-

Primary End Users: Processed Meat Manufacturers, Retail Chains, Foodservice Providers

-

Key Growth Regions: North America, Europe, Asia Pacific

-

Primary Drivers: Rising processed meat consumption, demand for improved food safety and shelf life, growth of refrigerated retail formats

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=6631

Market Overview

Processed meat packaging is critical to ensuring product integrity from production through distribution and consumption. Packaging formats include modified atmosphere packaging (MAP), vacuum packaging, shrink films, trays, pouches, and ready-to-eat containers that support product quality and visual appeal. Among these, modified atmosphere packaging is widely adopted for its ability to reduce oxidation, inhibit microbial growth, and extend the freshness of meat products.

The growth of organized retail formats, including supermarkets and hypermarkets with well-developed chilled and frozen sections, has further strengthened the demand for innovative packaging solutions that meet consumer expectations for convenience, traceability, and food safety.

Key Demand Drivers

Increased Consumption of Processed Meat Products

Global consumption of processed meat continues to rise due to urbanization, busier lifestyles, and consumer preference for ready-to-eat and easy-to-prepare foods. This trend drives demand for packaging that ensures product preservation and convenience.

Food Safety and Quality Regulations

Stricter food safety regulations globally require effective packaging to prevent contamination, maintain hygienic conditions, and comply with labeling standards. Enhanced packaging solutions help processors and retailers meet compliance requirements while maintaining product freshness.

Expansion of Refrigerated Retail and E-Commerce Channels

Growing refrigerated retail infrastructure and the rise of online grocery shopping have heightened the importance of durable, secure, and transport-friendly packaging solutions. These channels demand packaging that supports cold chain integrity and extended shelf life.

Innovation in Sustainable Packaging

Environmental awareness and regulatory pressure have increased interest in sustainable and recyclable packaging materials. Manufacturers are innovating with biodegradable films, recyclable trays, and eco-friendly pouches that reduce environmental impact while preserving product quality.

Market Segmentation Insights

By Packaging Type

-

Modified Atmosphere Packaging (MAP): Dominant for freshness and extended shelf life

-

Vacuum Packaging: Widely used for oxidative protection and enhanced storage life

-

Shrink Films and Trays: Common in retail presentation and convenience formats

-

Flexible Pouches: Growing segment due to lightweight and cost advantages

-

Ready-to-Eat Containers: Used in value-added processed meat offerings

By Material

-

Plastic Films and Polymers: Leading material category due to versatility and protection

-

Rigid Packaging (Trays and Containers): Preferred for premium and presentation cases

-

Paper and Fiber-Based Materials: Emerging sustainable options

-

Multi-Layer Laminates: Offer barrier protection and structural performance

By End User

-

Processed Meat Manufacturers: Major adopters of advanced packaging technologies

-

Retail Chains and Supermarkets: Key drivers due to demand for display-ready packaging

-

Foodservice Operators: Use packaging optimized for transport and convenience

Regional Demand Dynamics

North America

North America holds a significant share of the processed meat packaging market due to high processed meat consumption, extensive cold chain infrastructure, and strong regulatory frameworks for food safety. Retail expansion and consumer preference for convenience foods further bolster regional demand.

Europe

Europe is a key market with steady demand supported by established processed meat consumption patterns, robust retail systems, and increasing adoption of sustainable packaging solutions. Regulations emphasizing environmental sustainability also influence packaging innovations.

Asia Pacific

Asia Pacific is expected to register rapid growth, fueled by rising disposable incomes, urbanization, increasing retail modernization, and higher consumption of packaged and processed foods. Investment in cold chain logistics and distribution networks supports broader market expansion.

Competitive Landscape

The processed meat packaging market features a mix of global and regional packaging manufacturers, specialty material suppliers, and converters. Companies are focusing on product innovation, sustainability, and customized solutions to meet the diverse requirements of processed meat producers and retailers. Developments in high-barrier films, recyclable materials, and intelligent packaging technologies (such as freshness indicators and QR code traceability) are shaping competitive dynamics.

Partnerships with food processors, investments in packaging automation, and enhancements in supply chain support services are key strategies adopted by market players to strengthen their positions.

Future Outlook

The processed meat packaging market is expected to sustain steady growth through 2035 as processed meat consumption rises, food safety concerns intensify, and demand for convenient and high-quality products increases. Technological advancements in packaging materials, barrier solutions, and sustainable options will continue to influence market direction. As consumers and regulators prioritize food safety and environmental performance, processed meat packaging solutions that combine durability, sustainability, and convenience will drive industry innovation and adoption worldwide.

Browse Full Report: https://www.factmr.com/report/process-meat-packaging-market