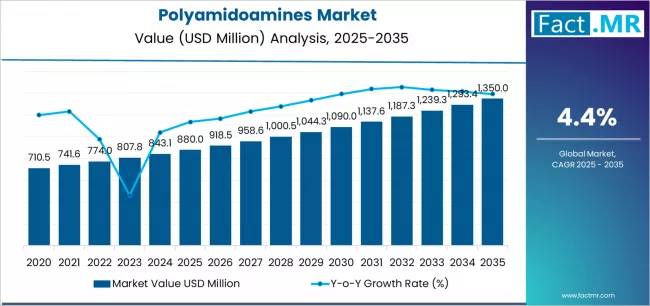

The global polyamidoamines market is projected to experience steady and sustained growth over the next decade, driven by rising demand across water treatment, industrial processing, and environmental management applications. Market valuation is expected to increase from approximately USD 880 million in 2025 to USD 1.35 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.4%.

Polyamidoamines (PAAs) are high-performance polymeric compounds recognized for their strong adhesion properties, chemical stability, and adaptability across a wide range of industrial uses. Their growing adoption reflects a broader global focus on improving process efficiency, meeting environmental regulations, and optimizing resource utilization.

Water Treatment Applications Drive Market Expansion

Water treatment continues to be the largest application segment, accounting for nearly 50% of global demand in 2025. Polyamidoamines are widely used as flocculants and coagulants to enhance sedimentation efficiency, remove suspended solids, and improve water clarity in both municipal and industrial treatment facilities.

Rising urbanization, industrial wastewater discharge, and stricter water quality regulations are compelling governments and private operators to adopt advanced chemical solutions. Polyamidoamines offer measurable efficiency gains, making them increasingly attractive for modern treatment infrastructure upgrades.

Beyond water treatment, paper and coating applications represent roughly 20% of market share, while oilfield and energy-related uses account for about 15%, highlighting the material’s versatility across industrial environments that demand precision chemistry and durability.

Product Type Insights: Linear Polyamidoamines Lead

By product type, linear polyamidoamines dominate the market, holding approximately 60% share in 2025. Their consistent molecular structure, ease of formulation, and compatibility with multiple end-use processes make them the preferred choice for large-scale industrial deployment.

Meanwhile, grafted, crosslinked, and dendritic polyamidoamines continue to gain traction in specialized applications that require enhanced mechanical strength, thermal stability, or controlled reactivity. These advanced variants support innovation in niche industrial processes and contribute to long-term market diversification.

Asia-Pacific Emerges as the Fastest-Growing Region

Regionally, Asia-Pacific is expected to be the fastest-growing market for polyamidoamines through 2035. Rapid industrial expansion, infrastructure development, and heightened environmental awareness are driving adoption across the region.

India stands out with a projected CAGR of 5.6%, supported by large-scale investments in water treatment infrastructure, industrial manufacturing growth, and government initiatives aimed at improving environmental compliance. Major urban and industrial centers are accelerating demand for advanced polymer solutions.

China follows closely with a 5.0% CAGR, fueled by modernization of industrial facilities and stricter enforcement of wastewater treatment standards. Mature markets such as the United States (4.0% CAGR) and Germany (3.8% CAGR) continue to demonstrate steady growth driven by technology upgrades and sustainability initiatives.

Challenges Highlight the Need for Innovation

Despite positive growth prospects, the polyamidoamines market faces several structural challenges. Production requires precise reaction control, specialized equipment, and skilled technical expertise, which can limit scalability and increase operational costs.

Additionally, volatility in raw material supply—particularly for acrylamide-based inputs—creates pricing pressure and supply chain risks. Regulatory scrutiny surrounding chemical manufacturing and wastewater discharge further necessitates continuous compliance investments.

However, these challenges are balanced by strong performance advantages. Polyamidoamines can deliver 35% to 55% improvements in treatment efficiency compared to conventional alternatives, reinforcing their value proposition for cost-conscious and regulation-driven industries.

Competitive Landscape and Strategic Positioning

The market remains moderately consolidated, with leading global chemical manufacturers holding a significant share. Key players compete through broad product portfolios, strong technical support, and long-standing relationships with municipal and industrial clients.

Other participants focus on regional expansion, customized formulations, and integrated service offerings to differentiate themselves. Innovation in polymer chemistry, automation, and application-specific solutions continues to shape competitive dynamics.

Strategic Outlook

Industry stakeholders are increasingly prioritizing:

- Investment in research and development to enhance polymer performance and sustainability

- Regional manufacturing expansion to reduce supply chain dependency

- Public-private collaboration for water infrastructure modernization

- Customized solutions tailored to local regulatory and industrial requirements

These strategies are expected to strengthen market resilience and unlock long-term growth opportunities.

Browse Full Report : https://www.factmr.com/report/polyamidoamines-market

About the Market Outlook

This market outlook provides a comprehensive analysis of growth trends, application demand, regional performance, and competitive dynamics shaping the global polyamidoamines industry through 2035. The insights support strategic decision-making for manufacturers, investors, policymakers, and industrial end users navigating an evolving chemical landscape.