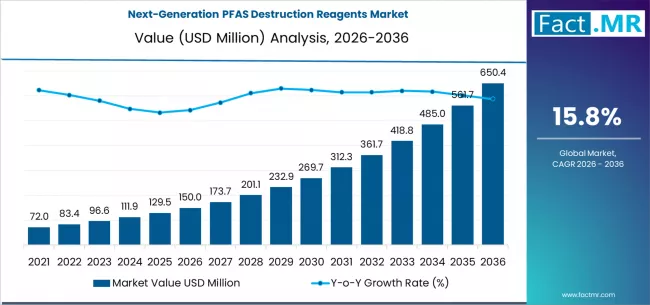

The global next-generation PFAS destruction reagents market is set for rapid expansion, fueled by tightening environmental regulations, rising public health concerns, and growing demand for effective treatment of per- and polyfluoroalkyl substances (PFAS) contamination. According to a recent analysis by Fact.MR, the market is valued at USD 150.00 million in 2026 and is projected to reach USD 650.39 million by 2036, registering a strong CAGR of 15.8% during the assessment period.

The increasing focus on eliminating “forever chemicals” from water, soil, and industrial waste streams is accelerating adoption of advanced PFAS destruction reagents across municipal, industrial, and defense-related applications.

Browse Full Report: https://www.factmr.com/report/next-generation-pfas-destruction-reagents-market

Strategic Market Drivers

Stringent Environmental Regulations Accelerate Adoption

Governments worldwide are enforcing stricter limits on PFAS discharge due to their persistence, bioaccumulation, and toxicity. Regulatory actions by environmental agencies in North America and Europe are compelling industries and municipalities to move beyond containment and adopt true PFAS destruction technologies.

Next-generation reagents enable permanent molecular breakdown of PFAS compounds, making them a preferred solution over conventional filtration or adsorption methods.

Rising Demand for Advanced Water & Wastewater Treatment

PFAS contamination in drinking water sources, groundwater, and industrial effluents is a growing global concern. Water utilities and treatment providers are increasingly investing in chemical destruction reagents that can:

- Break strong carbon–fluorine bonds

- Reduce long-term environmental liability

- Meet evolving regulatory compliance standards

This demand is especially strong in remediation projects at airports, military bases, and industrial zones.

Industrial & Defense Sector Remediation Needs

Industries such as chemicals, electronics, textiles, and firefighting foam manufacturers are major contributors to PFAS contamination. Additionally, defense installations with historical use of aqueous film-forming foams (AFFF) are driving large-scale adoption of PFAS destruction reagents for site cleanup and compliance.

Technological Advancements in Chemical Destruction Methods

Innovation in electrochemical oxidation, advanced reduction processes, plasma-based destruction, and reactive reagent formulations is significantly improving PFAS breakdown efficiency while reducing secondary waste generation. These advancements are expanding real-world applicability and scalability.

Regional Growth Highlights

North America: Regulatory Leadership and Cleanup Initiatives

North America dominates the market due to aggressive PFAS regulations, high remediation spending, and early adoption of advanced destruction technologies. The U.S. leads with large-scale cleanup programs across municipal water systems and defense facilities.

Europe: Sustainability-Driven Market Expansion

Strict EU chemical safety frameworks and sustainability mandates are accelerating demand for PFAS destruction solutions. Countries such as Germany, France, and the Nordic region are actively investing in next-generation remediation technologies.

Asia-Pacific: Emerging Industrial & Water Treatment Demand

Rapid industrialization, urbanization, and growing awareness of water contamination are driving market growth in China, Japan, South Korea, and India. Government-led clean water initiatives are further supporting adoption.

Rest of the World: Gradual Uptake with Infrastructure Growth

Latin America, the Middle East, and parts of Africa are witnessing increasing PFAS monitoring and remediation efforts, creating long-term growth opportunities for advanced reagent suppliers.

Market Segmentation Insights

By Technology Type

- Chemical Oxidation Reagents – Widely used for high PFAS destruction efficiency

- Electrochemical & Reactive Reduction Reagents – Fast-growing due to scalability

- Hybrid & Advanced Formulations – Emerging solutions combining multiple destruction pathways

By Application

- Water & Wastewater Treatment – Largest segment driven by drinking water safety

- Soil & Groundwater Remediation – Strong growth in legacy contamination sites

- Industrial Waste Treatment – Increasing regulatory compliance requirements

By End User

- Municipal Utilities

- Industrial Facilities

- Defense & Aviation Authorities

- Environmental Remediation Service Providers

Challenges Impacting Market Growth

High Treatment Costs

Advanced PFAS destruction reagents and systems involve higher upfront costs compared to conventional containment methods, which may limit adoption in cost-sensitive regions.

Technical Complexity

Optimizing reagent performance across diverse PFAS compounds and environmental conditions requires specialized expertise and system integration.

Regulatory Uncertainty in Emerging Markets

Inconsistent PFAS regulations across developing regions may slow widespread adoption despite rising contamination concerns.

Competitive Landscape

The next-generation PFAS destruction reagents market is moderately competitive, with companies focusing on:

- High-efficiency reagent formulations

- Scalable destruction technologies

- Partnerships with remediation and water treatment firms

Key Companies Profiled

- Revive Environmental

- Aquagga

- Battelle

- Cyclopure

- EPOC Enviro

- Emerging specialty chemical and remediation technology providers

Companies are investing heavily in R&D, pilot projects, and regulatory validation to strengthen market positioning.

Recent Developments

- 2024: Introduction of high-efficiency electrochemical PFAS destruction reagents for municipal water treatment

- 2023: Increased deployment of reagent-based PFAS remediation at military and airport sites

- 2022: Strategic collaborations between reagent developers and environmental engineering firms

Future Outlook: High-Growth Market for Permanent PFAS Elimination

The next decade will witness accelerated adoption of next-generation PFAS destruction reagents driven by:

- Intensifying PFAS regulations worldwide

- Expansion of clean water infrastructure

- Rising public and environmental health awareness

- Breakthroughs in chemical destruction technologies

As global stakeholders move from PFAS containment to permanent elimination, the market is positioned for strong double-digit growth through 2036, making it a critical component of the future environmental remediation ecosystem.