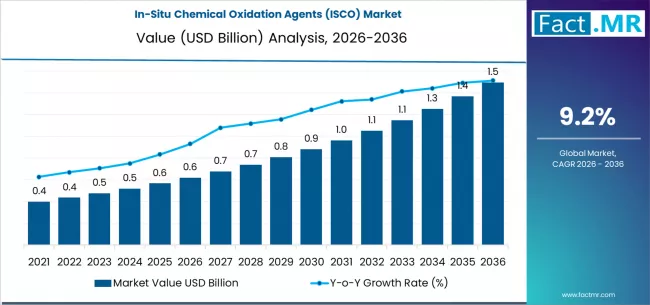

The global market for in-situ chemical oxidation (ISCO) agents is poised for transformative growth between 2026 and 2036, driven by increasing environmental remediation needs, regulatory pressures, and technological innovations. Market forecasts indicate that the global ISCO agents market, valued at USD 677 million in 2026, is expected to reach over USD 1.6 billion by 2036, reflecting a compound annual growth rate (CAGR) of approximately 9%. This growth is supported by rising demand for efficient soil and groundwater remediation solutions and the adoption of next-generation oxidants capable of treating complex contaminant profiles.

Market Segmentation and Growth Drivers

ISCO agents are predominantly segmented into hydrogen peroxide-based agents, permanganates, persulfates, and hybrid or catalyst-enhanced formulations. Hydrogen peroxide and Fenton’s reagents currently account for ~35% of total market demand, owing to their effectiveness against petroleum hydrocarbons and chlorinated solvents. Permanganates and persulfates account for 25–30% of the market, with next-generation activated persulfates gaining momentum due to their enhanced stability and ability to treat dense non-aqueous phase liquids (DNAPLs).

Over the next decade, catalyzed ISCO formulations are projected to grow at a CAGR of 10–11%, outpacing traditional oxidants. Controlled-release oxidants and stabilized formulations are expected to capture 15–20% of market share by 2036, driven by improved reaction kinetics, reduced oxidant consumption, and longer subsurface activity. These innovations are particularly impactful in heterogeneous or challenging geological conditions, reducing total remediation lifecycle costs by up to 30% compared to conventional methods.

Technological Innovations Driving Adoption

Innovation is a key driver for ISCO adoption, with focus areas including:

-

Controlled-release and stabilized oxidants: Enable oxidants to persist longer in the subsurface, expanding the radius of influence. Field studies indicate that stabilized oxidants can extend active treatment periods by 50–70%, reducing injection frequency.

-

Catalyst-enhanced oxidation systems: Use iron or chelated metals to accelerate reaction kinetics. These formulations have demonstrated 20–40% faster contaminant degradation rates in comparative trials.

-

Digital remediation and monitoring: Integration of real-time monitoring and adaptive injection strategies is improving remediation predictability. Sites using data-driven approaches report 15–25% higher contaminant removal efficiency compared to traditional applications.

These innovations are shifting the market toward performance-based solutions, where chemical efficacy, site closure speed, and regulatory compliance define competitive advantage, rather than just volume sales.

Regulatory Impact on Market Expansion

Regulatory frameworks are directly influencing ISCO adoption globally. In North America and Europe, groundwater contamination remediation is increasingly mandated, with ISCO being a preferred solution due to minimal excavation and reduced surface disruption. Groundwater remediation constitutes ~60% of the ISCO agents market, driven by stricter environmental standards for drinking water and aquifer protection.

Emerging contaminants, including PFAS compounds, are shaping regulatory policies. While ISCO is not universally effective against all emerging pollutants, integrated remediation strategies that combine ISCO with supplementary treatments are gaining traction. Forecasts suggest that regulatory-driven projects could account for up to 40% of total market revenue by 2036, highlighting the role of policy as a growth multiplier.

Regional Market Dynamics

-

North America: Largest market, accounting for ~45% of global revenue in 2026, supported by brownfield redevelopment programs and legacy site remediation initiatives.

-

Asia-Pacific: Fastest-growing region, projected CAGR of 11–12%, driven by industrialization, urbanization, and increasing environmental oversight in China, India, and Southeast Asia.

-

Europe: Moderate growth, CAGR of 8–9%, fueled by sustainability-focused policies, stricter soil and groundwater standards, and adoption of low-impact remediation technologies.

-

Rest of the World: Gradual adoption in Latin America, the Middle East, and Africa, with total contribution expected to reach ~10–12% of global revenue by 2036.

Competitive Landscape and Strategic Trends

The ISCO market is highly competitive, with companies increasingly positioning themselves as solution providers rather than chemical vendors. Leading players are investing in research, proprietary formulations, technical support, and digital monitoring services. Key market strategies include:

-

Development of high-efficiency, stabilized oxidants

-

Integration of digital site assessment tools

-

Expansion into multi-contaminant and complex geology sites

-

Strategic partnerships and acquisitions to expand geographic presence and technology portfolio

Next-generation ISCO suppliers are differentiating themselves through performance validation, regulatory acceptance, and technical support, with premium formulations commanding 20–35% higher pricing than conventional products.

Revenue Forecast and Market Implications

By 2036, total market revenue is projected to surpass USD 1.6 billion, driven by:

-

Increased demand for advanced formulations capable of handling complex contaminants

-

Rising adoption in brownfield redevelopment and industrial site remediation

-

Growth in performance-based contracts, where vendors are compensated based on site closure efficiency and long-term results

-

Expansion in high-growth regions such as Asia-Pacific and North America

Advanced ISCO technologies are expected to reduce overall remediation timelines by 15–25%, lower long-term monitoring costs by 10–20%, and increase overall project efficiency. This positions ISCO agents not only as a remediation chemical but as a strategic investment in sustainable environmental infrastructure.

Browse Full Report : https://www.factmr.com/report/in-situ-chemical-oxidation-agents-isco-market

Conclusion

The next decade represents a pivotal period for the ISCO agents market. With projected doubling of market size and increasing adoption of next-generation oxidants, ISCO technologies are set to transition from conventional chemical applications to integrated, data-driven environmental solutions. Stakeholders who invest in innovation, regulatory alignment, and performance-oriented services will capture the most value, reinforcing the role of ISCO agents as a cornerstone of global environmental remediation strategies through 2036.