The global neural interface PLA & PHA soft materials market is poised for a decade of strong growth as advances in neurotechnology converge with innovations in biodegradable polymers. Driven by the rapid evolution of brain–computer interfaces (BCIs), neuroprosthetics, and implantable neural devices, soft materials based on polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are becoming foundational to next-generation neural interfaces.

Market Size and Growth Outlook (2026–2036)

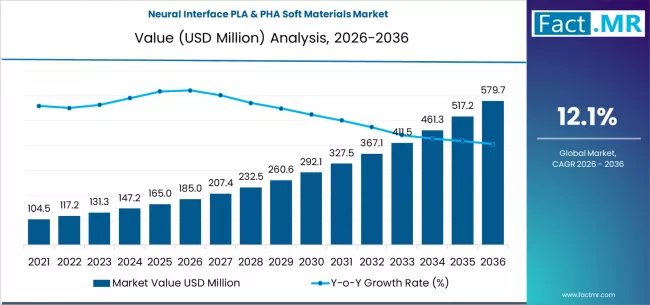

The market is projected to grow from approximately USD 207 million in 2026 to around USD 650 million by 2036, representing a robust compound annual growth rate (CAGR) of roughly 12% over the ten-year period. This growth significantly outpaces many traditional medical material segments and reflects a structural shift away from rigid, permanent neural implants toward soft, tissue-compliant, and biodegradable solutions. PLA and PHA polymers are uniquely positioned to meet this demand due to their tunable mechanical properties, controlled degradation profiles, and established biocompatibility in implantable medical applications.

Key Demand Drivers

The most powerful driver of market growth is the expanding global neurotechnology and BCI ecosystem. Rising prevalence of neurological disorders, aging populations, and advances in neural signal processing are propelling demand for implantable neural devices. As BCIs move from experimental devices to scalable clinical and commercial products, material selection has become a strategic differentiator.

PLA and PHA soft materials address several critical challenges in neural implants:

-

Reduced foreign body response compared to rigid silicon or metal electrodes

-

Enhanced conformability to delicate neural tissue

-

Lower long-term inflammation and scarring risks

-

Potential for bioresorption, eliminating the need for secondary surgical removal

Sustainability is also an increasingly important consideration. PLA and PHA are bio-based, biodegradable polymers, aligning with healthcare and regulatory trends favoring environmentally responsible materials. Advances in polymer engineering are further driving cost reductions, making next-generation PLA and PHA formulations increasingly competitive with conventional polymers.

Segment Analysis: Interfaces and Applications

By interface type, cortical neural interfaces represent the largest market segment, accounting for approximately 38% of total demand. These devices require ultra-soft, flexible substrates that maintain stable contact with the brain surface while minimizing tissue damage.

From an application standpoint, neuroprosthetics lead the market with an estimated 34% share, supported by investments in devices designed to restore motor function, sensory perception, and communication in patients with paralysis, spinal cord injuries, or neurodegenerative disorders. Other high-growth applications include deep brain stimulation, peripheral nerve interfaces, and next-generation bioresorbable electrode arrays.

Regional Market Dynamics

North America currently dominates the neural interface PLA & PHA market due to strong R&D funding, early clinical adoption of BCIs, and the presence of leading neurotechnology companies and academic research centers. The United States benefits from regulatory frameworks that facilitate clinical trials and accelerate commercialization timelines.

Meanwhile, the Asia–Pacific region is expected to record the fastest growth over the next decade. Countries such as China, Japan, and South Korea are investing heavily in domestic neurotechnology initiatives and supply chains for advanced biomaterials. Rapid industrialization, government-backed innovation programs, and growing clinical adoption of neural interfaces are driving strong regional demand.

Competitive Landscape

The competitive landscape is diverse, spanning biomaterials manufacturers, specialty polymer suppliers, and vertically integrated neurotechnology firms. While PLA and PHA resin producers benefit from scale and material expertise, value is increasingly shifting toward companies that can deliver application-specific formulations optimized for neural interfaces. This includes ultra-low modulus substrates, conductive polymer composites, and 3D-printable biomaterials.

Leading neurotechnology players are pushing performance boundaries in implantable neural systems, indirectly driving innovation in soft materials capable of supporting higher electrode densities and longer implantation lifetimes. Strategic partnerships among polymer suppliers, contract manufacturers, and device developers are becoming more common as companies seek to shorten development cycles and secure reliable supply chains for medical-grade PLA and PHA.

Browse Full Report : https://www.factmr.com/report/neural-interface-pla-pha-soft-materials-market

Future Growth Outlook

Looking toward 2036, the neural interface PLA & PHA soft materials market is expected to transition from a niche enabling technology to a core materials platform for neurotechnology. Continued clinical validation, scaling of BCI manufacturing, and advances in polymer modification—such as conductive blends and bioactive coatings—will further expand the range of addressable applications.

The global polymeric biomaterials market is projected to reach significant valuations in the early 2030s, with neural interface applications representing a small but strategically important high-growth segment. These products will continue to command premium pricing, benefit from strong intellectual property protections, and maintain long product life cycles. For stakeholders across the value chain, PLA and PHA soft materials not only offer strong growth potential but also serve as critical enablers of the next generation of human–machine integration.