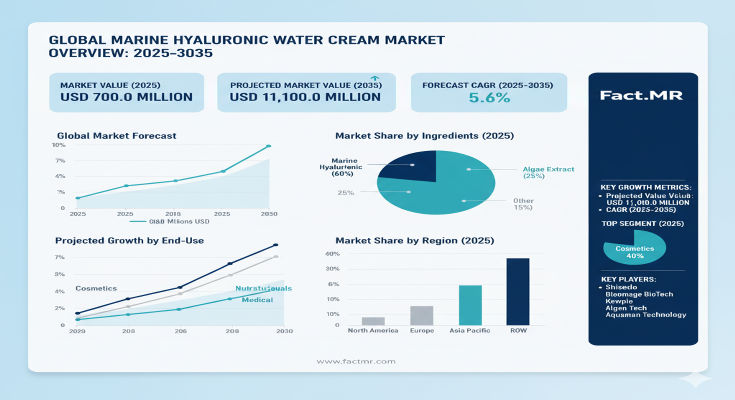

As skincare enthusiasts chase the fountain of youth through ocean-inspired purity, the marine hyaluronic water cream market is making waves with lightweight, deeply hydrating solutions that promise 50-70% superior skin moisture retention. A new report from Fact.MR forecasts the global market, valued at US$ 640.0 million in 2025, to expand to US$ 1,100.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.6%. This nearly 1.7-fold growth—delivering an absolute dollar opportunity of US$ 460.0 million—highlights the sector’s vitality, with 45.7% of expansion (US$ 210.0 million) in the first half (2025-2030) and 54.3% (US$ 250.0 million) accelerating thereafter, driven by surging demand for premium, marine-derived anti-aging actives.

With dry skin formulations leading for their advanced hydration tech, marine hyaluronic water creams are evolving into clean-beauty staples, blending sustainability with efficacy. Marine hyaluronic water creams are revolutionizing hydration with ocean-sourced innovation, and their 5.6% CAGR signals a splash of opportunity in the premium skincare arena, . From India’s urban beauty boom to Europe’s formulation finesse, this market is empowering brands to deliver lightweight luxury that resonates with wellness-savvy consumers.

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=8720

Key Drivers: Premium Skincare Demand and Extraction Advancements

The market’s buoyant trajectory is fueled by a confluence of beauty trends and technological strides. At the forefront is the escalating pursuit of premium skincare solutions, where marine hyaluronic creams excel in providing lightweight, non-greasy hydration that penetrates deeply, aligning with anti-aging and daily moisture needs amid rising environmental stressors. Investments in advanced marine-derived formulations are accelerating, with annual hydration improvements of 25-35% in key segments, bolstered by government initiatives promoting cosmetic technologies and clean-label standards.

Extraction innovations, including enzymatic processes from sustainable sources, are slashing complexities and enhancing bioavailability, making these creams accessible for mass premiumization. “The demand for advanced marine-derived formulations and anti-aging hydration-focused products” is a core driver, per Fact.MR, amplified by collaborations in beauty retail. Challenges like manufacturing intricacies may temper pace, but R&D investments are yielding scalable breakthroughs.

Segmentation Insights: Dry Skin and Retail Channels Lead

Fact.MR’s detailed segmentation uncovers high-moisture niches. By skin type, dry skin dominates with a 40.0% share in 2025, offering cutting-edge hydration for parched complexions, followed by oily (30.0%), combination (20.0%), and sensitive (10.0%) variants tailored for balanced care.

Channel-wise, retail commands 60.0% share, thriving on in-store trials and accessibility, while online surges at 35.0% for e-commerce convenience, and professional (5.0%) caters to spa and clinical settings. As a cream-centric market, forms emphasize water-light textures for seamless absorption.

Regional Dynamics: India’s Urban Surge Challenges Europe’s Precision

Asia-Pacific is the growth tide, with India at a robust 6.0% CAGR, propelled by beauty expansions in Mumbai and Delhi, where urban consumers drive 30-40% uptake in premium hydration. China follows at 5.8% CAGR, leveraging Shanghai’s innovation hubs for global exports.

Europe maintains elegance, valued at US$ 200.0 million in 2025 and projected to reach US$ 340.0 million by 2035 at 5.4% CAGR. France leads with 23.4% share in 2025 (rising to 23.8%), innovating luxury in Paris with 50% efficacy gains; Germany (18.8% to 19.1%) excels in clinical formulations; the UK emphasizes retail integrations.

North America advances steadily, led by the USA at 4.6% CAGR, anchored by wellness retail in coastal cities. South Korea (5.4% CAGR) capitalizes on K-beauty with 25% annual utilization spikes, and Japan (5.0%) refines precision in Tokyo.

Latin America, Middle East & Africa, and other regions unlock via emerging clean-beauty trends.

Recent Developments: Formulation Partnerships and Retail Expansions

The water cream wave is cresting with creativity. In 2024, AmorePacific scaled enzymatic extraction for Laneige creams in South Korea, boosting hydration yields by 30% for global launches. Shiseido partnered with European retailers for Innisfree hybrids, achieving 15% shelf gains in Paris. L’Oréal invested in Indian facilities, aligning with clean-label mandates and capturing 20% market share in Delhi. These moves, including AI-optimized textures, signal a 2025 surge in hybrid marine-synthetic blends.

Key Players Insights: Beauty Giants Crafting Hydration Empires

A vibrant field of 15-20 players sees top firms like Shiseido Company Limited (leading share) commanding 25-35% through skincare prowess and marine expertise:

-

Shiseido Company Limited: Premium dry skin innovator, dominating Asia with precision formulations.

-

AmorePacific Corporation: K-beauty leader via Laneige and Innisfree, expanding retail globally.

-

L’Oréal S.A.: Versatile processor for oily/combination, emphasizing Biotherm marine lines.

-

La Mer (Estée Lauder Companies Inc.): Luxury sensitive skin specialist.

-

The Face Shop (LG Household & Health Care Ltd.): Affordable retail focus.

-

Missha (Able C&C Co. Ltd.): Online disruptor for combination care.

-

Nature Republic Co. Ltd.: Sustainable sourcing expert.

-

Hanyul (AmorePacific Corporation): Herbal-marine hybrids.

-

Marine Elements Co. Ltd.: Niche pharma integrations.

-

DHC Corporation, The Saem Co. Ltd., H2O+ Beauty Inc.: Regional challengers in Japan and U.S.

Strategies include M&A for extraction tech and certifications for eco-claims.

Challenges and Opportunities: Formulation Hurdles vs. Premium Tides

Complex manufacturing and validation costs—up 15-20%—challenge scalability, alongside performance variances for diverse skin types.

Yet, opportunities flow: dry skin unlocks US$ 440.0 million by 2035, retail dominance US$ 660.0 million, and Asia-Pacific US$ 300+ million. Anti-aging tech adds US$ 150 million—waves for innovative brands.

Browse Full Report: https://www.factmr.com/report/marine-hyaluronic-water-cream-market

Future Outlook: A $1.1 Billion Splash of Marine Moisture

By 2035, Fact.MR envisions marine hyaluronic water creams as a US$ 1.1 billion essential, with retail at 65% share and Asia-Pacific leading the flow. The 5.6% CAGR will prioritize hybrid textures and personalization. For beauty buccaneers, the current is clear: blend innovation to cream success.